To complete this list, we have searched for forex brokers, offering swap free accounts, and tested them.

First, we opened real accounts with each of the brokers and deposited between $4,000 and $8,000 with each of them. Then, to get the real spreads, we placed real trades in each popular market.

To find solutions to the problems we had encountered, we contacted the customer support team. Finally, to find out whether any withdrawal issues might occur, we withdrew our funds.

Based on our trading experience and data, we handpicked the best forex brokers with swap-free accounts.

What is Swap or Rollover Interest?

Rollover is the forex trading strategy under which traders hold their open positions overnight. Swap or rollover rate is the interest they have to pay or earn for carrying forward their open positions overnight.

The swap rate is basically the difference of the interest rates set by the central bank of the two currencies in the trading pair. The type of open position, long or short, will determine which currency interest rate should be substracted from which one.

Swap benefit or swap charges completely depend on interest rate differentials.

For example, in the case of a long position on the EUR/USD pair, the swap rate can be calculated by subtracting the US dollar interest rate from the euro interest rate.

Most of the forex trading platforms will display the rollover rate of all currency pairs. Else, traders can use third-party platforms to check the rollover rates.

What is Swap Free Forex Trading Account?

Swap free accounts enable forex traders to take overnight positions on currency pairs without any possibility of earning or paying interest.

Traders pay the brokers a specific commission to hold positions overnight. This is swap, which can be positive or negative, depending on the ongoing price of the traded asset.

Forex Swap Free Accounts are available to traders in the case the broker offers accounts free of swaps and any kind of adjustments.

No Swap Forex Account Brokers

To select the best swap free forex brokers, we tested and reviewed several forex brokers. We opened live accounts and deposited real money with each of them. We also placed real trades in popular markets to get the real picture of the spread and commission, trading platform, deposits and withdrawals conditions, education, and customer service.

- Pepperstone – Best Overall Swap-Free Forex Broker

- AvaTrade– Best Swap-Free Broker for Beginners

- Dukascopy – Best Swap-Free High Leverage Forex Broker

- Amana Capital – Best MT4 Swap-Free Forex Broker

- Go Markets – Best Swap-Free Forex Broker with Low Spread and Fees

Best Overall Swap-Free Forex Broker

We have picked Pepperstone as the best overall swap-free forex broker.

Pepperstone is a versatile broker with excellent services. It offers a total of 158 trading instruments in markets across forex, indices, stocks, commodities, and cryptocurrencies. The trading platforms offered by the broker are MT4, MT5, and cTrader.

It primarily offers two account types (excluding the swap-free account) to retail traders and supports an array of base currencies. Additionally, it offers raw market spreads with minimum trading and non-trading fees.

Best Swap-Free Broker for Beginners

We have picked AvaTrade as the best swap-free broker for beginners.

AvaTrade is an excellent forex broker when it comes to beginner-friendly services. It offers good educational resources to train new brokers about the forex market and trading techniques. It even offers a demo account to the traders that allow them to execute trades and learn without risking their real money.

AvaTrade has no limits in trading strategies and also offers copy trading services, which allows novice traders to copy the exact strategy and positions of experts to potentially earn profits when learning about trading.

Best Swap-Free High Leverage Forex Broker

We have picked Dukascopy as the best swap-free high leverage broker.

When it comes to offering high leverage, there are only a few well-regulated brokers: Dukascopy is one of them. The broker is regulated by FINMA that offers leverage of up to 100:1 on major currency pairs.

Dukascopy offers trading with forex, stocks, indices, commodities, and cryptocurrencies, and lists a total of 750 instruments. It offers services on two platforms: MT4 and JForex. It also has some of the lowest spreads in the industry as our tests found that the average spread on the EUR/USD pair is only 0.8 pips.

Best MT4 Swap-Free Forex Broker

We have picked Amana Capital as the best MT4 swap-free forex broker.

Amana Capital holds multiple regulatory licenses and operates globally. It is considered an excellent broker for those Muslim traders who want to trade on MT4 with a swap-free account. Like many other brokers, it offers trading services on MT4. Yet, it also offers the latest MT5 platform.

The primary trading platform of the trader is MT4, thus most of its additional tools and features are included on this platform. MT4 is available to the clients on web, desktop and mobile devices.

Amana Capital is regulated in the UK, Cyprus, UAE, Lebanon, Malaysia, and Mauritius. It offers services with forex, and CFDs of indices, stocks, commodities, and cryptocurrencies.

Best Swap-Free Forex Broker with Low Spread and Fees

We have picked Go Markets as the best swap-free forex broker with low spread and fees.

Go Markets stands out when it comes to the top forex and CFDs brokers. It offers over 378 trading instruments. Among them are forex pairs and CFDs of indices, metals, commodities, and shares.

GO Markets is one of the best zero spread brokers. Traders can choose from three main account types: Standard, GO Plus+, and Pro. For Standard accounts spread is from 1 pip, yet it does not have any commission. On the contrary, GO Plus+ and Pro accounts have spread from zero with an added commission for each transaction.

Swap-Free Forex Brokers List

Apart from the shortlisted brokers, here is a complete list of forex brokers that offer swap-free accounts, which we have tested and reviewed.

| Forex Broker | Swap-Free Account | Test Details | Broker Review |

|---|---|---|---|

| FxPro | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | FxPro Review |

| Admiral Markets | Yes | Deposit Amount: Over €4,500 Total Trade: 12 trades | Admiral Markets Review |

| BlackBull Markets | Yes | Deposit Amount: Over €4,000 Total Trade: 12 trades | Visit BlackBull Markets |

| GO Markets | Yes | Deposit Amount: Over €4,500 Total Trade: 12 trades | Go Markets Review |

| ActivTrades | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | ActivTrades Review |

| XM | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | XM Review |

| FXTM | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | FXTM Review |

| ICM Capital | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | ICM Capital Review |

| Tickmill | Yes | Deposit Amount: Over $8,000 Total Trade: 12 trades | Tickmill Review |

| XTB | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | XTB Review |

| RoboMarkets (RoboForex) | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | RoboMarkets (RoboForex) Review |

| Pepperstone | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | Pepperstone Review |

| FBS | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | FBS Review |

| GKFX | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | GKFX Review |

| Darwinex | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | Darwinex Review |

| IC Markets | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | IC Markets Review |

| ThinkMarkets | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | ThinkMarkets Review |

| FP Markets | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | FP Markets Review |

| Amana Capital | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | Amana Capital Review |

| AvaTrade | Yes | Deposit Amount: Over €4,000 Total Trade: 21 trades | AvaTrade Review |

| Vantage FX | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | Vantage FX Review |

| INFINOX | Yes | Deposit Amount: Over €4,000 Total Trade: 9 trades | INFINOX Review |

FAQ and More on Swap-Free Brokers

When it comes to generic trading-related queries, traders often seem to have many questions. We chose some of the most important queries related to swap-free forex brokers and tried to give accurate answers to them.

Swap-Free Forex Broker in Australia

Many Australian forex brokers, which are regulated by the Australian Securities and Investments Commission (ASIC), offer swap-free Islamic forex trading accounts. Some of the leading Aussie brokers offering swap-free accounts are:

- IC Markets

- ThinkMarkets

- vantage FX

MT4 Swap-Free Forex Brokers

MT4 platform dominates the forex and CFDs trading and most of the brokers offer trading services on this platform. Some of the reputed MT4 forex brokers offering swap-free accounts are:

- AxiTrader

- XM

- Amana Capital

Swap-Free Forex Brokers with High Leverage

There are only a few well-regulated forex brokers offering high leverage on currency pairs. Some of the FINMA or FMA regulated forex brokers offering swap-free accounts are:

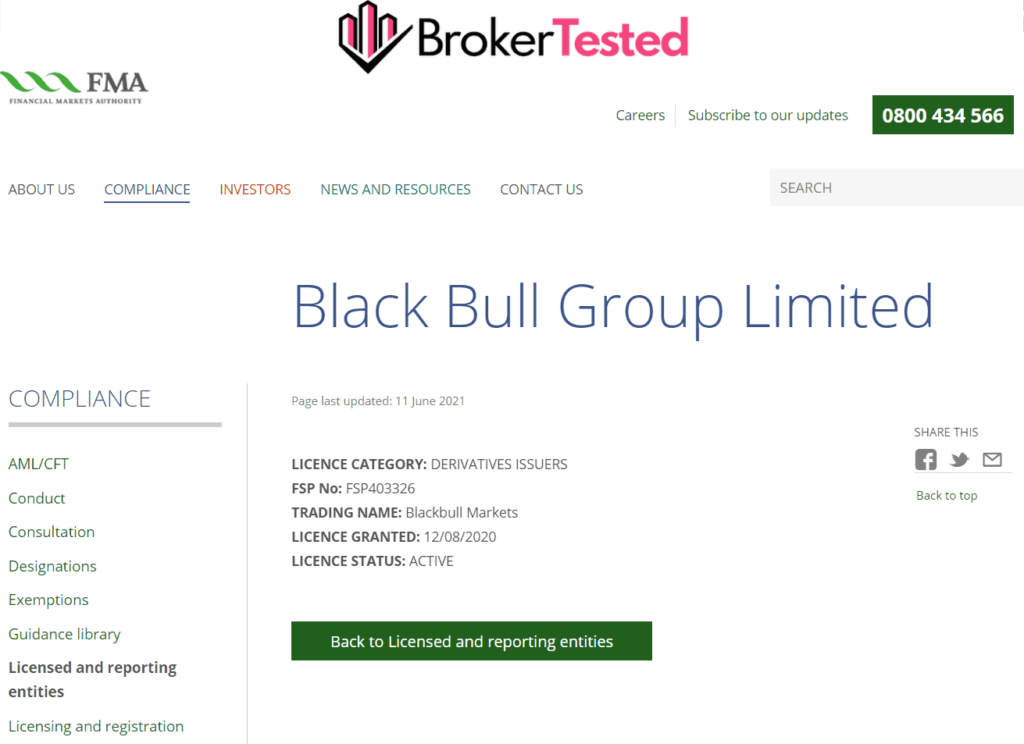

- BlackBull Markets

- Dukascopy

- Swissquote

- Saxo Markets

Swap-Free Forex Broker USA

OANDA is one of the best swap-free forex brokers in the USA. Their swap-free accounts allow the traders to take a position on over 26 instruments. Maximum trade size is 10 million. Moreover, the broker does not charge commission fees. OANDA allows hedging, scalping and EAs.