To come up with this list, we have tested several forex brokers Singapore holding MAS licenses.

We opened a real account and deposited between €5,000 and €6,000 with each broker. We placed real trades in each popular market to get the real spreads.

We also reached out to customer support to solve issues that we had encountered. Finally, we withdrew our funds to see if there is any issue with the withdrawal process.

We handpick the best forex brokers based on our trading data and experience as a trader.

Singapore MAS Regulations for Forex Brokers

Forex brokers must be registered and authorized by the Monetary Authority of Singapore (MAS) to operate legally in Singapore. Established in 1971, MAS is Singapore’s central bank and also regulated the financial market, including retail forex brokers.

Forex brokers in Singapore need to obtain a Capital Markets Service Licence from the regulator for their operations.

MAS’s official website is www.mas.gov.sg, and we recommend investors and traders follow the regulator on Twitter, @MAS_sg, for important regulatory updates.

MAS is considered among one of the most reputed financial markets regulators due to its strict frameworks. It requires forex brokers need to keep business and client funds separate, along with several other safety measures to protect traders’ interests. It can also take disciplinary actions for compliance violations and even suspends or cancels licenses in the extreme case.

Retail forex brokers regulated by MAS can offer a maximum leverage of up to 20:1. Qualified professional investors can receive leverage up to 50:1.

However, retail forex brokerage regulations of MAS also has a few shortcomings:

- Hedging is not allowed.

- Automated forex trading is not allowed.

- MAS does not offer any compensation scheme.

Some of the key highlights of trading with MAS-regulated brokers:

| 🏦Regulator | Monetary Authority of Singapore (MAS) |

| 📊Max. Leverage | 20:1 |

| 🛡️Is It safe to trade | Yes |

| 🔒Negative Balance Protection | No |

| 💰Compensation Scheme | No |

Best Forex Brokers in Singapore

To select the best MAS-regulated forex brokers, we have tested and reviewed several forex brokers. We opened a live account, deposited real money, and placed real trades with each broker. With our test, we got a picture of the real spreads and commissions, trading platforms, deposit and withdrawal conditions, educational resources, and customer services.

- CMC Markets – Best Overall Forex Broker in Singapore

- Swissquote – Best Forex Broker for Beginners in Singapore

- OANDA – Best MT4 Broker in Singapore

- Saxo Markets – Best Forex Trading Platform in Singapore

- Plus500 – Best Forex Broker with Lowest Spread & Trading Fees in Singapore

Best Overall Forex Broker in Singapore

We picked CMC Markets as the overall best forex broker in Singapore.

CMC Markets is regulated in several jurisdictions around the globe, including Singapore, and it offers extensive forex brokerage services. Apart from forex, its offerings also include CFDs of indices, stocks, ETFs, commodities, and cryptocurrencies.

It offers some of the lowest spreads on currency pair trading and provides trading on industry-standard MT4, along with CMC’s proprietary platform. It provides some excellent trading tools for analysis and market research.

Top Forex Broker for Beginners in Singapore

We picked Swissquote as the best forex broker for beginners in Singapore.

Swissquote is a major European forex broker holding a regulatory license in Singapore as well. It is one of the top forex brokers for beginners due to its well-sourced educational resources.

Swissquote offers detailed courses on trading to both beginner and advanced traders, along with in-depth guides and webinars. The broker also provides a demo account to new traders for hands-on practice using real money.

Best MT4 Forex Trading Account Singapore

We picked OANDA as the best MT4 broker in Singapore.

OANDA is by far the best MT4 forex broker. The broker only offers trading services on MT4, meaning all services and tools are only integrated into this single platform.

Traders can also upgrade to MT4 premium services on OANDA to get access to 28 additional trading tools and indicators

Best Forex Trading Platform in Singapore

We picked Saxo Markets as the best forex trading platform in Singapore.

For only forex trading, Saxo Markets is an excellent trading platform. It offers more than 180 currency pairs for trading and lists other popular assets like cryptocurrencies and commodities. It also offers forex options with 44 forex vanilla options with maturities from one day to 12 months, along with 6 FX touch options to only professional traders

Saxo offers three tiers of accounts with attractive spreads on the higher two tiers.

Lowest Spread & Trading Fees in Singapore

We picked Plus500 as the best forex broker with the lowest spread and trading fees in Singapore.

Plus500 offers attractive spreads on the currency pairs. Its spreads usually remain much lower than the industry average with only 0.8 pips on average for EUR/USD pair, according to our tests. Plus500 does not charge any extra trading fees for opening and closing positions.

MAS Regulated Forex Brokers In Singapore List & Review

Here is a list of some of the major MAS-regulated Singapore forex brokers:

| Singapore Forex Broker | MAS Regulated | Visit Broker |

|---|---|---|

| Swissquote | Yes | Visit Swissquote |

| IG Markets | Yes | Visit IG Markets |

| CMC Markets | Yes | Visit CMC Markets |

| Plus500 | Yes | Visit Plus500 |

| Saxo Markets | Yes | Visit Saxo Markets |

| OANDA | Yes | Visit OANDA |

| City Index (StoneX) | Yes | Visit City Index |

| Interactive Brokers | Yes | Visit Interactive Brokers |

FAQ & More on Singapore Brokers

Traders usually have many questions related to generic trading-related queries. We tried to pick and answer some of the most important queries related to MAS-regulated brokers.

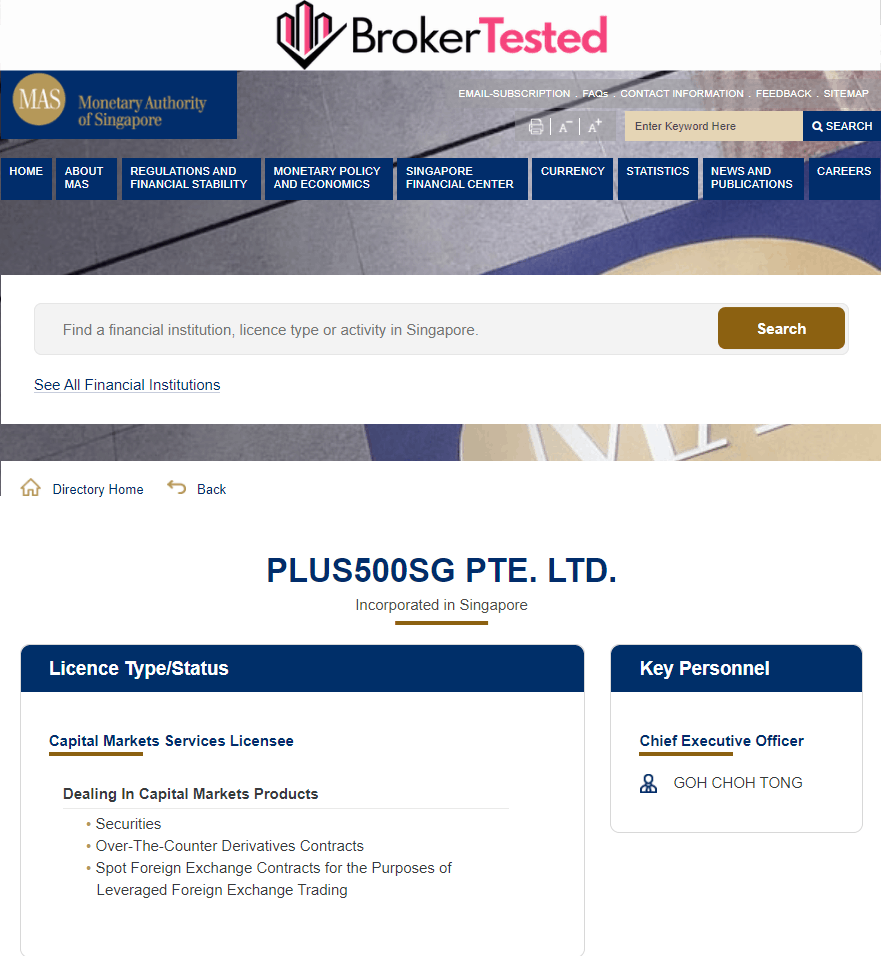

How to Verify MAS-Regulated Brokers?

MAS maintains an excellent directory of all the regulated entities under it.

Go to eservices.mas.gov.sg/fid and simply search the intended forex broker’s name in the search bar. If the broker is regulated under MAS, its name will appear and details about it can be accessed by clicking on it.

A list of all companies holding Capital Markets Services License can also be seen as a list on the directory.

Best Options Trading Platform Singapore

Forex options give buyers the right, but not an obligation, to purchase the currencies at the expiry of the contract. Forex options are available as vanilla contracts, touch options, and others.

Some regulated forex options brokers in Singapore are:

- Saxo Markets

- Swissquote

- CMC Markets

- IG Markets

MT4 Forex Trading Singapore

Developed by MetaQuotes Software, MT4 is the leading forex and CFDs trading platform. The platform allows a ton of services including automated trading and customized indicators.

Some of the top MAS-regulated forex brokers offering trading on MT4 are:

- OANDA

- Swissquote

- CMC Markets

Low Spread Forex Brokers Singapore

Forex brokers Singapore usually make money from charging spreads on buy and sell positions. But with rising competition in the market, brokers started to charge very competitive low spreads on currency pairs to attract more traders.

Some MAS-regulated forex brokers offering low spreads are:

- Plus500

- CMC Markets

- Swissquote

- Saxo Markets

True ECN Forex Brokers in Singapore

True ECN brokers offer direct market access to traders, thus charging zero spreads. However, these brokers charge commissions for opening and closing positions.

Some of the true ECN forex brokers in Singapore are:

- Saxo Markets

- IG Markets

Tax in Singapore for For Forex Trading

Taxes in Singapore for forex trading are a little different. If residents trade on the side, their income is considered tax-free. However, if tradings are full-time, the profits may be subject to tax. Strangely, the transfer method can also impact taxes. For instance, if traders withdraw their profits through international payment methods, they will not need to pay taxes.

Generally, the tax rate in Singapore ranges from 0% to 15% for the country’s residents and up to 22% for non-residents.

Traders should remember that they are responsible for submitting tax forms to the relevant financial bodies of the country. In case of tax avoidance or delay, they may face complications and fines.