Best Forex Brokers in UK 2022

To come up with this list, we have tested over 19 forex brokers holding FCA licenses in the United Kingdom.

We opened a real account and deposited between $4,000 and $6,000 with each broker. We placed real trades in each popular market to get the real spreads.

We also reached out to customer support to solve issues that we had encountered. Finally, we withdrew our funds to see if there is any issue with the withdrawal process.

We handpick the best forex brokers based on our trading data and experience as a trader.

United Kingdom’s FCA Regulated Forex Brokers

Forex brokers must be registered and authorized by the Financial Conduct Authority (FCA) to operate in the United Kingdom. FCA’s official website is www.fca.org.uk, and we recommend investors and traders follow FCA on Twitter, @TheFCA, for important regulatory updates.

FCA is a reputed regulator with strict scrutiny measures, and thus brokers regulated by it are considered safe. It is very vigilant in the industry and actively warns non-compliant traders, and even fines and suspends the licenses for many violators.

FCA also offers a compensation scheme of £85,000 that protects investors’ deposits in case the broker goes bankrupt. FCA offers maximum leverage of 30:1 to retail traders, and also negative balance protection is mandatory.

Some of the key highlights of trading with FCA regulated brokers:

| 🏦Regulator | Financial Conduct Authority (FCA) |

| 📊Max. Leverage | 30:1 |

| 🛡️Is It safe to trade | Yes |

| 🔒Negative Balance Protection | Yes |

| 💰Compensation Scheme | £85,000 |

Best Forex Brokers in UK

To select the best FCA-regulated forex brokers, we have tested and reviewed over 20 forex brokers. We opened a live account, deposited real money, and placed real trades with each broker. With our test, we got a picture of the real spreads and commissions, trading platforms, deposit and withdrawal conditions, educational resources, and customer services.

- ActivTrades – Best Overall Forex Broker in the UK

- XM – Best Forex Broker for Beginners in the UK

- Capital.com – Best MT4 Broker in the UK

- FXPro – Best Forex Trading Platform in the UK

- CMC Markets – Best Forex Broker with Lowest Spread & Trading Fees in the UK

Overall Top Forex Broker UK

We picked ActivTrades as the overall best forex broker in the UK.

Founded in 2001, ActivTrades is a global forex and CFD broker regulated by FCA. It offers trading with a wide array of assets like forex, commodities, shares, cryptocurrencies, indices, and financials; the broker also provides unlimited trading strategies to its clients.

From our test, ActivTrades’s average EUR/USD spreads are 0.57 pips which is much lower than the average industry benchmark (1.16 pips). The average spread on Apple CFDs was 1.17 pips, compared to the industry average of 1.5 pips.

Additionally, ActivTrades has the benefit of platform choice by giving access to its services through MT4, MT5, and its proprietary platform. It also has comprehensive educational resources making it suitable for both beginners and experts.

Best Forex Broker for Beginners in the UK

We picked XM as the best forex broker for beginners in the UK.

XM is an FCA-regulated broker with a well-maintained reputation. The broker offers excellent educational resources, from forex guides to platform tutorials. It also offers forex webinars and seminars, which are very helpful for beginner traders.

The broker offers a good analysis of the markets as well and also provides in-house research, trading ideas, technical summaries, and much more.

Coming to trading, XM offers to trade on MT4 and MT5, two industry-standard trading platforms. It has a good range of products with no limits in trading conditions.

XM also has an excellent customer support team and they are helpful in answering queries of beginner traders.

Best MT4 Broker in the UK

We picked Capital.com as the best MT4 broker in the UK.

MT4 is the leading trading platform used for forex and CFDs trading. Though many brokers offer to trade with MT4, we have found Capital.com offering to be the best. Capital.com offers MT4 clients on desktop, web, and mobile.

Apart from MT4, Capital.com also offers trading with its proprietary trading platform, which is only available for web and mobile. As MT4 is one of the primary platforms of the broker, it will push most of the support and updates for this platform.

Capital.com offers trading services with a wide range of assets and also allows traders to run all types of strategies. With all the features and trading support, Capital.com is the no-doubt the best MT4 broker in the United Kingdom.

What is the Best Forex Trading Platform UK

We picked FXPro as the best forex trading platform in the UK.

When it comes to only forex trading, FXPro stands out in to be the best FCA-regulated platform. It offers a long list of currency pairs to traders and allows them to run all trading strategies with no limits.

FXPro also offers trading services on MT4, MT5, cTrader, and FxPro EDGE, meaning traders have a lot of options to choose the desired trading platform.

It also offers competitive spreads that linger around the industry average. The average spread for our EUR/USD pair was 1.6 pips. It also supports deposits and withdrawals with several widely used methods and has minimum non-trading fees.

Lowest Spread & Trading Fee Forex Broker in the UK

We picked CMC Markets as the best forex broker with the lowest spread and trading fees in the UK.

The average EUR/USD spread on CMC Markets is only 0.7 pips, which is very competitive in the industry. The broker also allows deposits and withdrawals with all major channels and does not charge any commission-based fees for these services.

Headquartered in London, CMC Markets is a publicly-listed broker, making it a very safe brokerage platform. It offers trading with a wide range of assets, and trading conditions are also excellent with no limit on trading strategies.

Additionally, CMC Markets is a Top UK Forex Broker with good quality educational resources, with many impressive market research tools. It also has an excellent customer support team, making it the best overall FCA-regulated forex broker in the United Kingdom.

FCA-Regulated Forex Brokers List & Review

Besides our best 5 picks above, we also put together a complete list of 20 UK forex brokers along with our review.

| UK Forex Broker | FCA Regulated | About Our Test | Our Review |

|---|---|---|---|

| eToro | Yes | Deposit Amount: Over $6,000 Total Trade: 18 trades | eToro Review |

| Plus500 | Yes | Deposit Amount: Over €6,000 Total Trade: 18 trades | Plus500 Review |

| AXI (AxiTrader) | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | AXI Review |

| XM | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | XM Review |

| Admiral Markets | Yes | Deposit Amount: Over €4,500 Total Trade: 12 trades | Admiral Markets Review |

| Pepperstone | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | Pepperstone Review |

| Markets.com | Yes | Deposit Amount: Over €4,500 Total Trade: 12 trades | Markets.com Review |

| Vantage FX | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | Vantage FX Review |

| ThinkMarkets | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | ThinkMarkets Review |

| GO Markets | Yes | Deposit Amount: Over €4,500 Total Trade: 12 trades | GO Markets Review |

| Fortrade | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | Fortrade Review |

| ICM Capital | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | ICM Capital Review |

| INFINOX | Yes | Deposit Amount: Over €4,000 Total Trade: 9 trades | INFINOX Review |

| Capital.com | Yes | Deposit Amount: Over €3,500 Total Trade: 15 trades | Capital.com Review |

| Darwinex | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | Darwinex Review |

| Amana Capital | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | Amana Capital Review |

| XTB | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | XTB Review |

| FXTM | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | FXTM Review |

| Tickmill | Yes | Deposit Amount: Over €8,000 Total Trade: 12 trades | Tickmill Review |

| Trading 212 | Yes | Deposit Amount: Over €5,500 Total Trade: 15 trades | Trading 212 Review |

FAQ & More on the UK Brokers

Traders usually have many questions related to trading generic trading-related queries. We tried to pick and answer some of the most important queries related to FCA-regulated brokers.

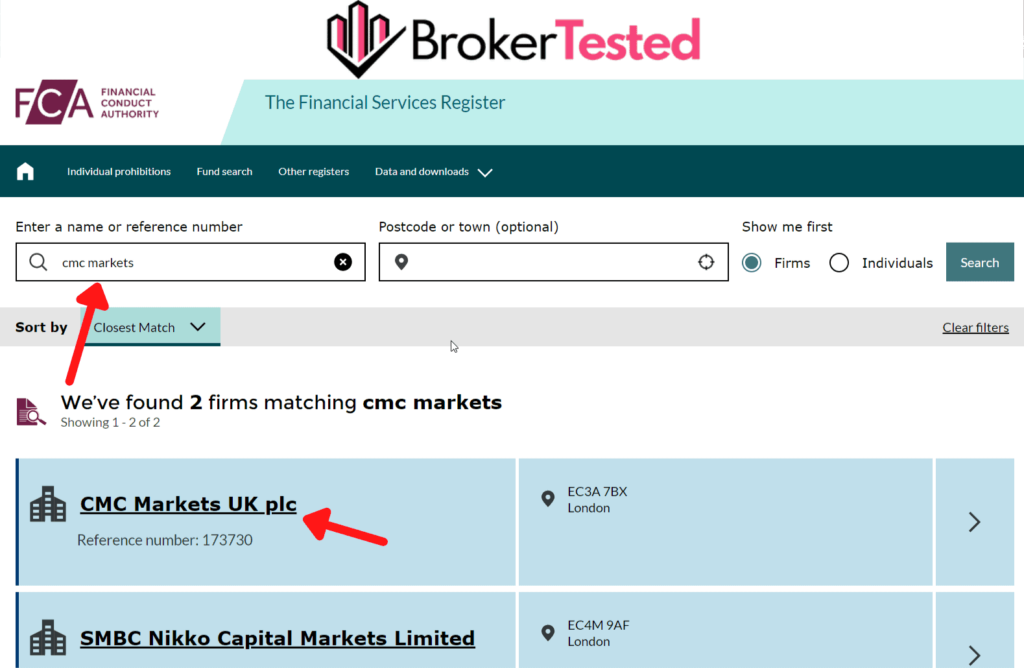

How to Verify an FCA-Regulated Broker?

The registration details of any FCA-regulated can be checked on the online registry of the regulator.

Go to https://register.fca.org.uk/s/ and type the name or reference number of the broker on the search box and the register will show the licensing details of the broker. If the broker is not licensed by the FCA, you will not see any broker listed by that name.

Compare UK Forex Brokers

All UK forex brokers can be compared using the standard trading metrics like regulatory license, products offered, spreads and fees, deposit and withdrawal options, and a few other parameters.

We have tested several FCA-regulated brokers based on these parameters and concluded that CMC Markets is the best overall forex broker in the United Kingdom.

ECN Forex Brokers in UK

ECN brokers offer traders direct market access and do not take any positions against the traders. These brokers offer raw market spreads with zero or tight spreads and usually charge a commission as trading fees.

Pepperstone is one of the FCA-regulated brokers that offer ECN accounts to traders.

Some of the best FCA-regulated ECN forex brokers are:

- Pepperstone

- FXTM

- AxiTrader

- Admiral Markets

MT4 Forex Brokers in UK

MT4 is the leading trading platform used by forex traders across the world. Despite many limitations, this legacy platform is supported by a large number of market developers with third-party plugins.

MT4 has become an industry-standard trading platform and most of the FCA-regulated brokers, including the five best brokers on our list, offer trading services on MT4.

Some of the best FCA-regulated MT4 forex brokers are:

- ActivTrades

- Tickmill

- FXTM

- XM

- FXPro

High Leverage Forex Brokers in UK

The FCA follows the ESMA’s guidelines and limits the maximum leverage offered to retail traders to 30:1. However, only qualified professional traders can receive maximum leverage of up to 500:1.

Lowest Spread Forex Broker in UK

As there are many brokers operating in the market, offering competitive spreads has become a norm. Many market makers now offer tight spreads and do not even charge additional commissions.

All the top brokers shortlisted by us offer low spreads, but brokers like ActivTrades, Capital.com, and CMC Markets stand out by offering some lowest forex spreads in the industry.

Some of the lowest spread FCA-regulated forex brokers are:

- ActivTrades

- Capital.com

- Darwinex

- CMC Markets

- Markets.com

Forex Brokers with Micro/Cent Accounts in UK

Micro/Cent account generally means the brokers calculate the trading account balance instead of dollars. These type of accounts enables traders to trade in small lots without needing massive capital investments.

Though most of the brokers do not promote themselves as micro/cent account brokers, they usually offer such services for standard retail clients. However, some brokers specifically offer micro/cent trading accounts.

Swap Free Forex Brokers in UK

Swap-free is the option of offering trading services without any fees. These accounts are considered Halal under Islamic Sharia Law as traders are not trading on commission-basis or paying any roll-over charges.

Many forex brokers are offering such swap-free accounts to attract Muslim traders who hesitate to trade with the standard accounts offered by the brokers.

Some of the FCA-regulated brokers offering swap-free accounts are:

- ActivTrades

- ICM Capital

- INFINOX

- Fortrade

- Amana Capital

- ThinkMarkets

Tax in the Uk for Forex Trading

In the UK annual gains of up to £12,300 for forex trading are considered tax-free. However, when the gains are over the mentioned amount, a tax of 10% to 20% applies to them. The good news about the UK taxes is that the income from spread betting platforms is free of taxes. This is due to the fact that in the country’s tax code spread betting is equalled to sports, horse racing, and betting.

When it comes to taxes, traders should be very careful and bear in mind that they are responsible for submitting a tax form to the relevant institution in the country.

Author of this review

By George Rossi

Author of this review

I am a well-rounded financial services professional experienced in fundamental and technical analysis, global macroeconomic research, foreign exchange and commodity markets and an independent trader.

Now I am passionate about reviewing and comparing forex brokers.

Everything you find on BrokerTested is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology