Darwinex Review 2025

For this Darwinex review, we opened a live account and deposited over €5,000.

We traded the popular instrument in each market to determine the actual spreads and placed 12 trades in total.

We reached out to the broker’s customer service team to resolve the issues we faced.

Finally, we withdrew our funds to assess if the withdrawal process was smooth.

What is Darwinex

Darwinex is a global Forex and CFDs broker founded in 2012 as Tradeslide Trading Tech, a provider of trading technologies. Two years later, the company rebranded to Darwinex, an FCA-regulated Forex and CFD broker.

The broker is licensed in the United Kingdom by the Financial Conduct Authority (FCA). In July 2023, Darwinex obtained Spain’s CNMV license as a part of its post-Brexit part.

Darwinex offers hundreds of instruments to traders in the following categories, Forex pairs, indices, stocks, and commodities.

The broker offers 287 tradable instruments, which is not a lot compared to some of its peers.

Here’s a summary of Darwinex’s main features:

| 🗺️ Authorised & Regulated in | UK, Spain |

| 🛡️ Is Darwinex safe | Yes |

| 💰 EUR/USD Spread | 0.32 |

| 💳 Minimum deposit | US$500 |

| 💰 Withdrawal fee | 1.2% for Card, 3.5€/£ for Trustly Bank Transfer, 1.2% for Skrill |

| 🖥️ Trading Platform | MT4, MT5 |

| 📈 Markets offered | Forex, Indices, Stocks, Commodities, |

| 📉 Number of Products | 287 |

Licenses and Regulations

Darwinex is licensed by two global regulators: the tier-1 UK Financial Conduct Authority (FCA) and tier-2 Spain’s Comisión Nacional del Mercado de Valores (CNMV).

Here are the details of Darwinex’s sole UK license.

| Legal entity | Registered in | Regulator | License Number | Accepting Clients From | Compensation Scheme Amount |

|---|---|---|---|---|---|

| Tradeslide Trading Tech Limited | United Kingdom | Financial Conduct Authority (FCA) | 586466 | Globally many countries | £85,000 |

| Spain | Comisión Nacional del Mercado de Valores (CNMV) | 311 | Spain | €20,000 |

Is Darwinex Safe

Yes, Darwinex is safe to trade. The broker is regulated by the top-tier UK Financial Conduct Authority (FCA), which has strict rules and enforcement procedures.

The UK’s FCA guarantees investors’ deposit compensation of up to £85,000 if the broker declares bankruptcy. The broker has gone a step further to get free supplementary insurance covering eligible clients for up to £1,000,000. Spain’s CNMV in its turn guarantees deposit compensation of €20,000 in case the client goes insolvent.

For this review, we opened an MT5 Standard CFD account and an Mt5 standard stock account with Tradeslide Trading Tech Limited, regulated by the UK’s Financial Conduct Authority (FCA). We deposited funds into the account, placed trades, and finally withdrew our funds.

Fees and Commissions

Darwinex charges low fees for trading most of the main instruments on offer, including Forex pairs, indices, and commodities.

However, the broker’s average spreads for trading stocks were much higher than the industry benchmark.

The broker charges low spreads because it charges a commission on all trades, making its fees much higher than other brokers.

Spread Charged in our Trades

For our tests, we traded the most popular instrument in each market. We executed 3 trades for each instrument to get an accurate estimate of the average spread. We tested Darwinex’s MT5 Standard CFD and stock accounts, which charges a spread and commission on all instruments.

| Markets | Instruments | 1st trade | 2nd trade | 3rd trade | Avg. Spread |

|---|---|---|---|---|---|

| Forex | EUR/USD | 0.3 | 0.3 | 0.35 | 0.32 |

| Indices | FTSE 100 | 0.7 | 0.7 | 0.7 | 0.70 |

| Stocks | Apple | 3.5 | 1.5 | 1.5 | 2.17 |

| Commodities | Gold | 1.1 | 1.4 | 1.5 | 1.33 |

We executed all our trades via the MetaTrader 5 mobile app on our iPhone.

A deeper analysis of the spreads charged in our trades revealed that most of the spreads were lower than industry averages. But the broker’s fees were higher because of the additional commissions charged on each trade.

| Markets | Instruments | Avg. Spread Charged | Industry Avg. Spread |

|---|---|---|---|

| Forex | EUR/USD | 0.32 | 1.16 |

| Indices | FTSE 100 | 0.70 | 1.65 |

| Stocks | Apple | 2.17 | 1.75 |

| Commodities | Gold | 1.33 | 3.53 |

Other fees

Darwinex does not charge other non-trading fees. However, investors pay a 1.2% annual commission on invested equity for using the broker’s copy-trading feature known as a DARWIN. Investors pay a 20% performance fee if they make money with a Darwin strategy, with strategy providers earning 15% and Darwinex taking the remaining 5%.

Darwinex Account Types

Darwinex offers only 1 account type. The account is known as the standard account and is offered on the MetaTrader 4 and MetaTrader 5 platforms.

Here are its features:

| Standard Account | |

|---|---|

| Trading Platforms | MetaTrader 4 & 5 |

| Account Currency | EUR/ GBP/ USD |

| Minimum Deposit | $500 |

| Commission | 2.5 USD per lot |

| Order Execution | Market Execution |

| Spread | From 0 |

| Note |

Darwinex does not offer (Swap-free) Islamic Accounts.

For our tests, we opened an MT5 standard CFD account and an MT5 standard stock account with Tradeslide Trading Tech Limited, which is regulated by the UK’s Financial Conduct Authority (FCA).

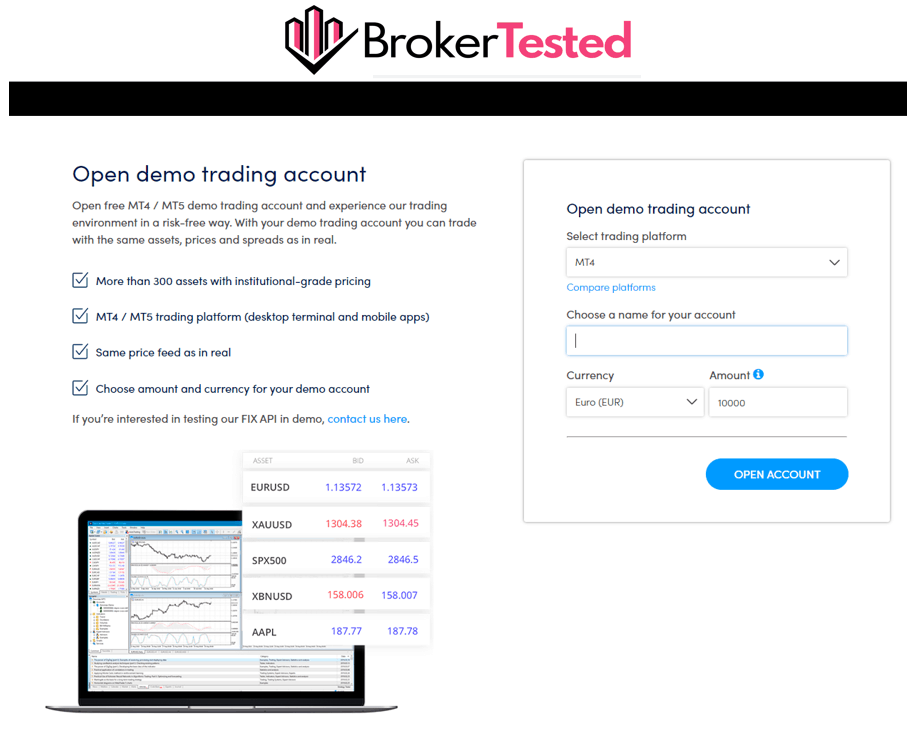

Account Opening

Darwinex account opening is fast and efficient. We completed the entire process digitally within 10 minutes.

Here are the 5 steps to opening a Darwinex account:

- Select your trading platform, choose a name for your account, your account currency and deposit amount.

- Enter your username, email and password and choose whether to open an individual or corporate live account.

- Provide your title, full name, date of birth, nationality, country of birth, phone number and residential address, including postcode, City/Town, State/Province, and Country of Residence.

- Enter your tax details, current employment status, the value of your savings and liquid investments, and how much you plan to invest.

- Do you have an account with another broker and how frequently did you trade in the past 3 years?

The registration process took only 10 minutes, and our trading account was approved in one working day.

We registered the account on 26 March 2023, and it was approved on 29 March 2023.

For this test, we opened the MT5 standard CFD account and an MT5 standard stock account.

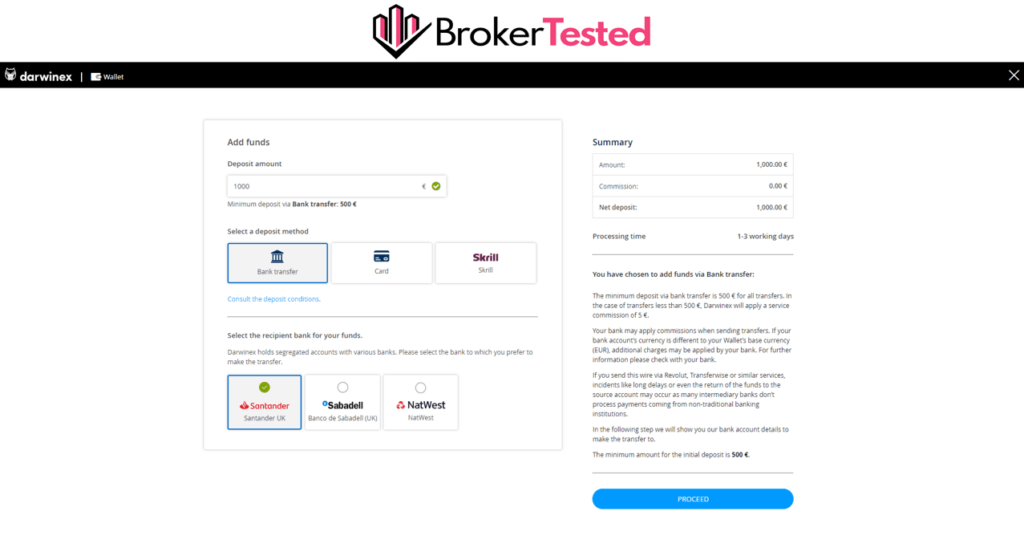

Deposit and Withdrawal

Darwinex offers fast deposits and withdrawals. Traders can use bank transfers, credit and debit cards, and e-wallets such as Skrill and Trustly to deposit and withdraw funds from their accounts.

However, Darwinex charges a 0.5% fee on Skrill deposits and is one of the few brokers that charge a fee on deposits.

Darwinex Minimum Deposit

Darwinex has a minimum deposit requirement of $/€/£ 500 on its live accounts. Traders should make the next deposits in multiples of 100, as the broker will reject other figures.

Deposit

Darwinex’s clients can deposit funds into their trading accounts via bank transfers, debit/credit cards, and e-wallets such as Skrill and Trustly.

Skrill deposits attract a 0.5% fee.

The table below shows the details of our deposits:

| Payment Method | Submitted Date | Funded Account Date | Funding Time | Fee | Bank Fee |

|---|---|---|---|---|---|

| Credit Card | 01 April 2023 | 01 April 2023 | Instant | €0.00 | Zero |

| Skrill | 01 April 2023 | 01 April 2023 | Instant | 0.5% | Zero |

Darwinex processes debit/credit card deposits instantly, while Trustly payments are processed in 1 day. Bank transfers may take up to 3 days to appear in your trading account.

Withdrawal

Darwinex does not charge a fee on withdrawals but passes on all associated costs to its clients. Therefore, traders end up paying varying fees on their withdrawals, which was unexpected.

Most brokers charge a fixed fee on withdrawals instead of passing on the merchant fees to their clients.

Hence, each withdrawal at Darwinex attracts a different fee based on the amount withdrawn and the percentage fees charged by the payments company.

Darwinex allows traders to make withdrawals using the same payment methods available for deposits.

| Payment Method | Submitted Date | Funds Released Date | Funds Arrived Date | Withdrawal Time | Fee | Note |

|---|---|---|---|---|---|---|

| Credit card | 01 April 2023 | 01 April 2023 | 03 April 2023 | 2 working days | 1% | 32.41 EUR fee was charged |

| Credit Card | 04 April 2023 | 05 April 2023 | 06 April 2023 | 2 working days | 3.30% | 2 EUR fee was charged |

| Skrill | 04 April 2023 | 05 April 2023 | 05 April 2023 | 1 working day | 1% | 16.41 EUR fee was charged |

We did not encounter any difficulties during the withdrawal process and received our funds within a maximum of two working days.

Markets and Products

Darwinex offers a variety of tradable instruments in the Forex, indices, stocks, and commodities markets.

Here’s the complete list of Darwinex’s product offerings:

| Markets | Instruments |

|---|---|

| Forex | 40 |

| Indices | 10 |

| Stocks | 233 |

| Commodities | 4 |

| Cryptocurrencies | 0 |

The broker offers a limited number of instruments to its clients compared to the leading brokers.

Trading Conditions

The trading conditions at Darwinex are good. Traders can execute most trading strategies since the broker allows high-risk strategies such as hedging and scalping.

Traders can keep their hedging positions open for as long as they want. Darwinex also allows traders to use Expert Advisors (EAs).

| Trading Method | Allowed |

|---|---|

| Hedging | Yes |

| Scalping | Yes |

| Change Leverage | No |

Traders cannot change their account’s leverage level after opening the account.

Darwinex Leverage

Darwinex clients have access to standard leverage levels in line with the European Securities and Markets Authority (ESMA) regulations regarding leverage levels offered to retail traders based in the EU.

However, professional traders can access higher trading leverage levels, but they lose out on ESMA protections.

The table below shows the different leverage levels available to clients:

| Markets | Tradeslide Trading Tech Ltd |

|---|---|

| Major currency pairs | 30:1 |

| Non-major currency pairs | 20:1 |

| Gold | 20:1 |

| Other Commodities (except gold) | 10:1 |

| Indices | 5:1 |

| Stocks | 5:1 |

| Cryptocurrencies | N/A |

Bonus

Darwinex does not offer a bonus program to its clients.

Trading Platform

Darwinex offers traders a proprietary FIX API trading platform developed by Darwinex Labs ( its Quant team) that is specifically used for copy trading. The API software is used for copy-trading DARWIN assets on the broker’s proprietary marketplace known as the DARWIN exchange.

Investors can use the DARWIN API to buy and sell winning strategies created by professional traders and hosted on the DARWIN exchange.

Darwinex MT4 MT5

The broker also offers the MetaTrader 4 and 5 platforms for traders who want to trade their independent strategies. The MT4 platform offers traders a wide range of analytical tools and indicators, while the MT5 has additional features that deliver a better trading experience.

Darwinex further offers tools for automated trading in the form of auxiliary libraries that can be added to the MetaTrader and DARWIN platforms. These tools include ZeroMQ to MetaTrader and Zorro to MetaTrader bridging solutions.

Traders who prefer to copy the strategies developed by professionals will be at home on the DARWIN proprietary marketplace, while self-directed traders have to use the MT4 and MT5 platforms.

We found the MT5 platform to be great for traders who prefer to trade the popular MetaTrader platforms.

Research and Tools

Darwinex provides its clients who use its copy-trading platforms excellent research tools to sift through the over 2000 strategies (Darwins) and find the ones that fit their investor profile.

Traders can use the broker’s marketplace to research the performance rankings of each Darwin based on criteria such as the Darwinex score (D-score) to identify the best-performing strategies.

Darwinex provides little in the form of traditional market research for self-directed traders except for occasional news articles on its blog.

The broker also offers a community forum where traders can discuss trending topics and learn from each other.

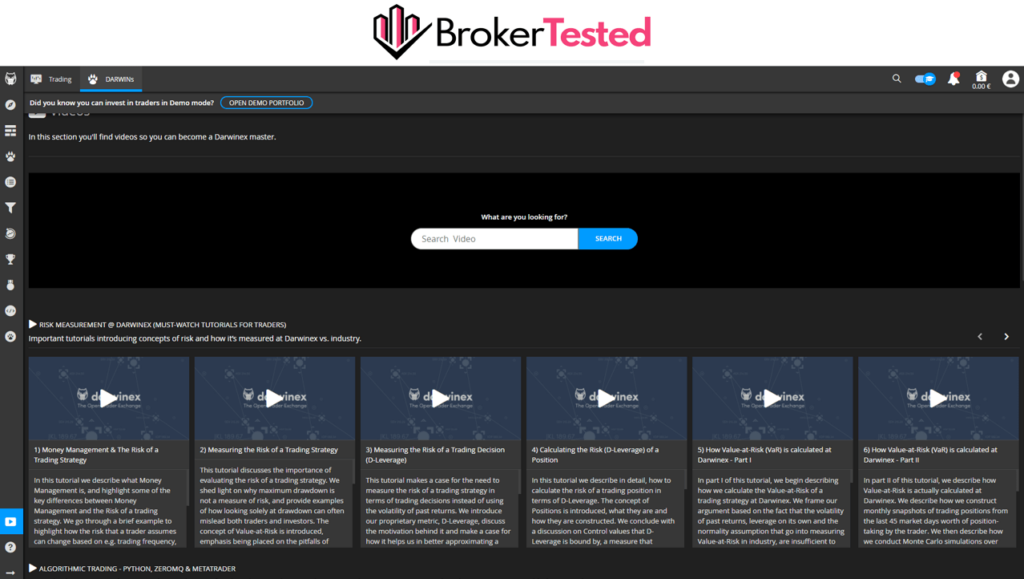

Education

Darwinex offers minimal education in the form of training videos and tutorials. These are found within its proprietary trading platform.

Customer Service

Darwinex’s customer service team was helpful and gave us direct answers to our questions. However, the broker does not offer support via live chat, unlike most brokers.

You can reach Darwinex’s customer service team via email. The customer service team answered our email query within 10 hours, which was okay.

Here are the results of our test below:

| Question | Response Time | Quality of reply | |

|---|---|---|---|

| Live chat | N/A | N/A | N/A |

| We asked for general information about our account (minimum deposit, available currencies, execution type) bonus offers, leverage changes, hedging and scalping | We received feedback within 10 hours. | The first reply was a link to their website containing the account information. We then asked about the minimum deposit, available currencies and order execution types and got a detailed answer. |

Conclusion

In summary, we had a positive experience with Darwinex starting from the account opening to the deposit, trading and withdrawal processes.

We had to open an MT5 standard CFD account and an MT5 stock account to get access to Forex pairs and stock CFDs, which were limited in number. The broker charges low fees on Forex, indices and commodities trades, while its fees for stock trades were higher than industry averages.

Darwinex offers instant deposits and a user-friendly client portal. However, Skrill deposits attract a 0.5% fee, hence, we recommend traders use credit/debit cards to deposit.

The broker passes on the fees charged by payment processors to its clients when processing withdrawals. Therefore, card withdrawals attract a 1.2% fee, Trustly bank transfers attract a €/£3.5 fee, while Skrill withdrawals attract a 1.2% fee.

Darwinex does not offer support via live chat, which is inconvenient when one needs a quick reply to a query. The broker’s email responses were not as fast as some of its peers.

We recommend Darwinex to traders who want to copy strategies developed by other successful traders. Traders who run scalping, hedging and automated strategies will also feel at home with this broker.

We recommend Darwinex for traders who are

- Experienced traders

- Run Scalping

- Hedging

- EAs trading

- Copy Trading

- Trading through MT4

Darwinex might not be a fit if you are

- Beginners

- Real Stock / Futures Trading

- Commission based trading

- Looking for a wide instrument range

- Prefer other platforms rather than MT4

Author of this review

By George Rossi

Author of this review

I am a well-rounded financial services professional experienced in fundamental and technical analysis, global macroeconomic research, foreign exchange and commodity markets and an independent trader.

Now I am passionate about reviewing and comparing forex brokers.

Everything you find on BrokerTested is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology