Admirals Review 2025

For this Admirals review, we opened a live account and deposited over €4,5oo.

We traded the popular instrument in each market to determine the actual spreads and placed 12 trades in total.

We contacted the broker’s customer support team to resolve the challenges we faced.

Finally, we withdrew our funds to determine if the withdrawal process was smooth.

What is Admirals

Admirals is a global Forex and CFDs broker founded in 2001 whose parent company is Admirals Group AS, based in Estonia.

The broker is licensed in Australia, the United Kingdom, Cyprus, Kenya, and Jordan. As a part of its global expansion strategy, Admirals has also acquired South African license in 2022.

Admirals offers thousands of instruments to traders in the following categories, Forex pairs, indices, stocks, commodities, bonds, ETFs, and cryptocurrencies.

The broker offers a diverse product range consisting of more than 8,000 tradable instruments compared to its competitors.

Here’s a summary of Admirals’ main features:

| 🗺️ Authorised & Regulated in | UK, Cyprus, Kenya, Australia, Jordan, South Africa |

| 🛡️ Is Admirals safe | Yes |

| 💰 EUR/USD Spread | 0.6 |

| 💳 Minimum deposit | US$1 |

| 💰 Withdrawal fee | $0 |

| 🖥️ Trading Platform | MT4, MT5 |

| 📈 Markets offered | Forex, Indices, Stocks, Commodities, Bonds, ETFs, Cryptocurrencies |

| 📉 Number of Products | 8,000+ |

Licenses and Regulations

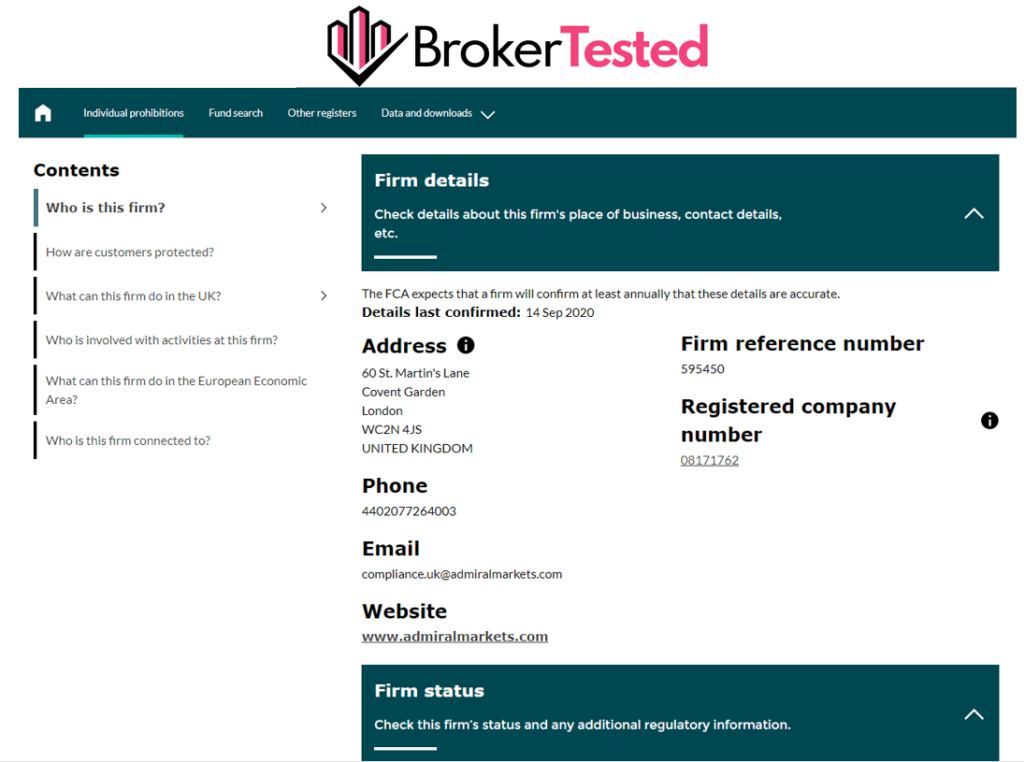

Admirals is licensed by 6 regulators globally, including the top-tier UK Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Jordan Securities Commission (JSC), the Capital Markets Authority (CMA) in Kenya, and South Africa’s Financial Sector Conduct Authority (FSCA).

Here’s a full list of the licenses held by Admirals’ subsidiaries:

| Legal entity | Registered in | Regulator | License Number | Accepting Clients From | Compensation Scheme Amount |

|---|---|---|---|---|---|

| Admiral Markets UK Limited | United Kingdom | Financial Conduct Authority (FCA) | 595450 | Globally many countries | £85,000 |

| Admiral Markets Cyprus Limited | Cyprus | Cyprus Securities & Exchange Commission (CySEC) | 201/13 | EU | €20,000 |

| Admiral Markets Pty Limited | Australia | Australian Financial Services License (AFSL) | 410681 | Globally many countries | No compensation scheme |

| Admirals KE Ltd | Kenya | the Capital Markets Authority (CMA) | PVT-JZUG57PL | Kenya | No compensation scheme |

| Admiral Markets AS Jordan Ltd | Jordan | the Jordan Securities Commission (JSC) | 57026 | Jordan | No compensation scheme |

| Admiral Markets SA PTY Limited | South Africa | Financial Sector Conduct Authority (FSCA) | 620981 | South Africa | No compensation scheme |

Is Admirals Safe

Yes, Admirals is safe to trade. The broker is regulated by the top-tier ASIC and the UK’s FCA, which have strict rules and enforcement procedures. The broker is also licensed by Cyprus’ CySEC, Jordan’s JSC, Kenya’s CMA, and South Africa’s (FSCA).

The UK’s FCA guarantees investors’ compensation of up to £85,000 if the broker goes bankrupt, while the CySEC guarantees investors’ compensation of up to €20,000 if the broker becomes insolvent.

Traders have to be registered under the relevant entity to qualify for compensation if a broker declares bankruptcy.

We did not encounter any major challenges when trading with Admirals.

For this review, we opened a Trade.MT5 account with Admirals UK Limited, licensed by the UK’s Financial Conduct Authority (FCA). We deposited money into the account, placed trades, and finally withdrew our funds.

We recommend that you open your account with the UK or Cyprus entities since they are the only ones that offer deposit protection to traders if either is available to you.

The FCA offers deposit protection of up to £85,000 if the broker becomes insolvent, while the CySEC offers deposit protection of up to €20,000.

Fees and Commissions

Admirals charges very low fees for trading the main instruments on offer: Forex pairs, indices, stocks, and commodities.

The broker’s average spreads for the popular instruments in each market were much lower than industry averages.

Some account types have very low spreads combined with a commission, while other account types have no commissions, but feature wider spreads.

Spread Charged in our Trades

In our tests, we traded the most popular instrument in each market. We placed 3 trades per instrument to get an accurate estimate of the average spread. We tested Admirals’ Trade.MT5 account, which charges a spread on all instruments. The spreads were quite low, as shown in the table below.

| Markets | Instruments | 1st trade | 2nd trade | 3rd trade | Avg. Spread |

|---|---|---|---|---|---|

| Forex | EUR/USD | 0.8 | 0.45 | 0.45 | 0.6 |

| Indices | FTSE 100 | 0.8 | 0.8 | 0.8 | 0.8 |

| Stocks | Apple | 0.8 | 0.75 | 0.7 | 0.8 |

| Commodities | Gold | 3 | 3.15 | 2.59 | 2.9 |

We executed all our trades via the mobile trading app MetaTrader 5 on our iPhone.

A deeper comparison of the spreads charged in our trades revealed that they were well below industry benchmarks. None of Admirals’ average spreads was above industry averages.

| Markets | Instruments | Avg. Spread Charged | Industry Avg. Spread |

|---|---|---|---|

| Forex | EUR/USD | 0.6 | 1.16 |

| Indices | FTSE 100 | 0.8 | 1.65 |

| Stocks | Apple | 0.8 | 1.75 |

| Commodities | Gold | 2.9 | 3.53 |

Other fees

The broker charges a monthly inactivity fee of €10, if there are no new or running transactions on an account for 24 months. The broker does not charge deposit and withdrawal fees.

Admirals Account Types

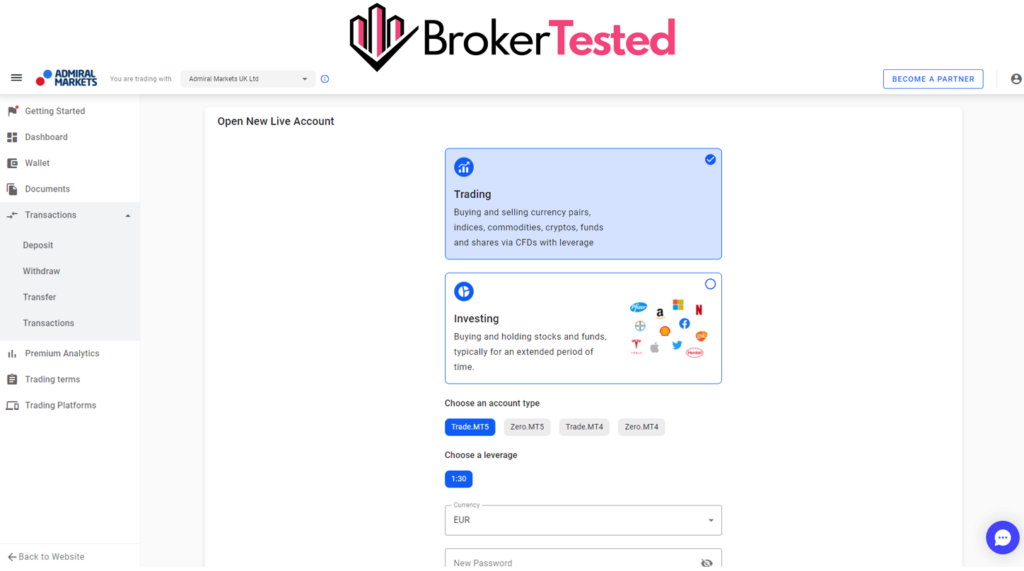

Admirals offers 5 account types with slightly different features. The accounts are known as the Trade.MT4, Zero.MT4, Trade.MT5, Invest.MT5, and Zero.MT5 accounts.

See the differences below:

| Trade.MT4 | Zero.MT4 | Trade.MT5 | Invest.MT5 | Zero.MT5 | |

|---|---|---|---|---|---|

| Trading Platform | MetaTrader 4 | MetaTrader 4 | MetaTrader 5 | MetaTrader 5 | MetaTrader 5 |

| Base Currency Options | EUR/ USD/ GBP/ CHF/ BGN/ CZK/ HRK/ HUF/ PLN/ RON | EUR / USD / GBP / CHF / BGN / CZK / HRK / HUF / PLN / RON | EUR / USD / GBP / CHF / BGN / CZK / HRK / HUF / PLN / RON | EUR / USD / GBP / CHF / BGN / CZK / HRK / HUF / PLN / RON | EUR / USD / GBP / CHF / BGN / CZK / HRK / HUF / PLN / RON |

| Minimum Deposit | $/€/£ 25 | $/€/£ 25 | $/€/£ 25 | $/€/£ 1 | $/€/£ 25 |

| Commission | *See note below | $1.8-$3.0 per lot | None | $2 per lot | $1.8-$3.0 per lot |

| Order Execution | Market Execution | Market Execution | Market Execution | Exchange Execution | Market Execution |

| Spread | From 0.5 | From 0 | From 0.5 | From 0 | From 0 |

| Note | Commisions of Trade. MT4 account: Single Share & ETF CFDs – from 0.02 USD per share, Other instruments – no commissions |

Admirals also offers swap-free Islamic Accounts (Also check Forex Swap-Free Accounts). Such accounts do not attract a swap fee for positions held overnight, but trades held for more than 3 nights attract an administration fee.

For our tests, we chose to open the Trade.MT5 Account.

Account Opening

Admirals account opening is fast and efficient. We went through the entire process and completed it digitally.

Here are the 5 steps to opening an Admirals account:

- Enter your country of residence, full name, email address, password and phone number.

- Verify your email and phone number, then choose your account type, currency, and leverage.

- Enter your date and place of birth and residential address including your city/town, street number, residence, postal/ZIP code.

- Answer a few questions about your financial position including your income and net worth as well as your investing/trading experience.

- Verify your account using either a national ID or Passport and a utility bill or bank statement.

The registration process took exactly 15 minutes, and our account was approved on the same day.

We registered our account on 25 February 2023, and it was approved on 25 February 2023.

For this test, we opened the Trade.MT5 account with Admirals UK Limited, which is UK’s FCA regulated.

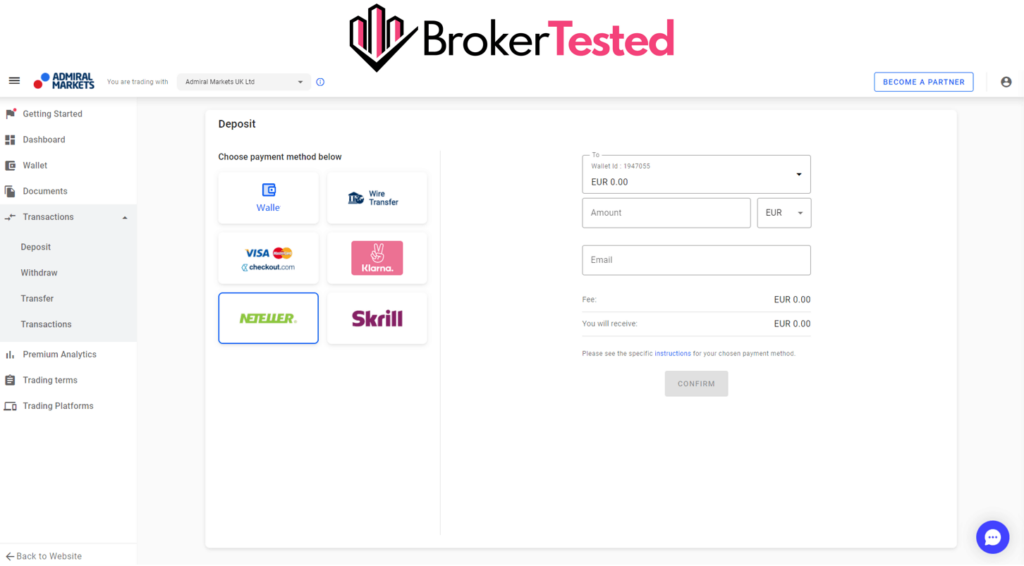

Deposit and Withdrawal

Admirals offers fast deposits and withdrawals. Traders can deposit and withdraw from their accounts using the following payment methods, bank wires, credit and debit cards, and e-wallets such as Skrill and Neteller.

Admirals Minimum Deposit

Admirals has a minimum deposit requirement of $/€/£ 25 on its Trade.MT4, Zero.MT5, Trade.MT5, and Zero.MT5 accounts, while the Invest.MT5 account has a minimum deposit of $/€/£ 1.

Deposit

Admirals’ clients can deposit funds into their trading accounts via bank transfers, debit/credit cards, and e-wallets such as Skrill, and Neteller.

The table below has the details of our deposits:

| Payment Method | Submitted Date | Funded Account Date | Funding Time | Fee |

|---|---|---|---|---|

| Credit card | 08 March 2023 | 08 March 2023 | Instant | €0.00 |

| Credit card | 08 March 2023 | 08 March 2023 | Instant | €0.00 |

| Skrill | 08 March 2023 | 08 March 2023 | 4 hours | €0.00 |

| Neteller | 08 March 2023 | 08 March 2023 | Instant | €0.00 |

Admirals does not charge deposit fees for its funding methods. Our Skrill deposit was not instant as we had to wait for 4 hours before the amount was credited to our account. Credit and debit card deposits are free and instant. We did not deposit via bank transfer.

Withdrawal

Admirals allows its clients to make withdrawals via the same payment methods available for deposits making it easy for investors to access their funds.

Admirals does not charge a fee on deposits, as well as on withdrawals, unlike most brokers who have withdrawal fees.

| Payment Method | Submitted Date | Funds Released Date | Funds Arrived Date | Withdrawal Time | Fee |

|---|---|---|---|---|---|

| Credit card | 09 March 2023 | 09 March 2023 | 10 March 2023 | 1 day | zero |

| Skrill | 08 March 2023 | 08 March 2023 | 08 March 2023 | 1 hour | zero |

| Neteller | 08 March 2023 | 09 March 2023 | 09 March 2023 | 1 day | zero |

We did not encounter any difficulties during the withdrawal process, which was quite smooth.

Markets and Products

Admirals offers a wide selection of tradable instruments in the Forex, indices, stocks, commodities, bonds, ETFs, and cryptocurrencies markets.

Here’s the complete list of Admirals’ product offerings:

| Markets | Instruments |

|---|---|

| Forex | 50 |

| Indices | 43 |

| Stocks | 3352 |

| Commodities | 28 |

| Cryptocurrencies | 32 |

The broker offers a significant amount of stocks CFDs to its clients.

Trading Conditions

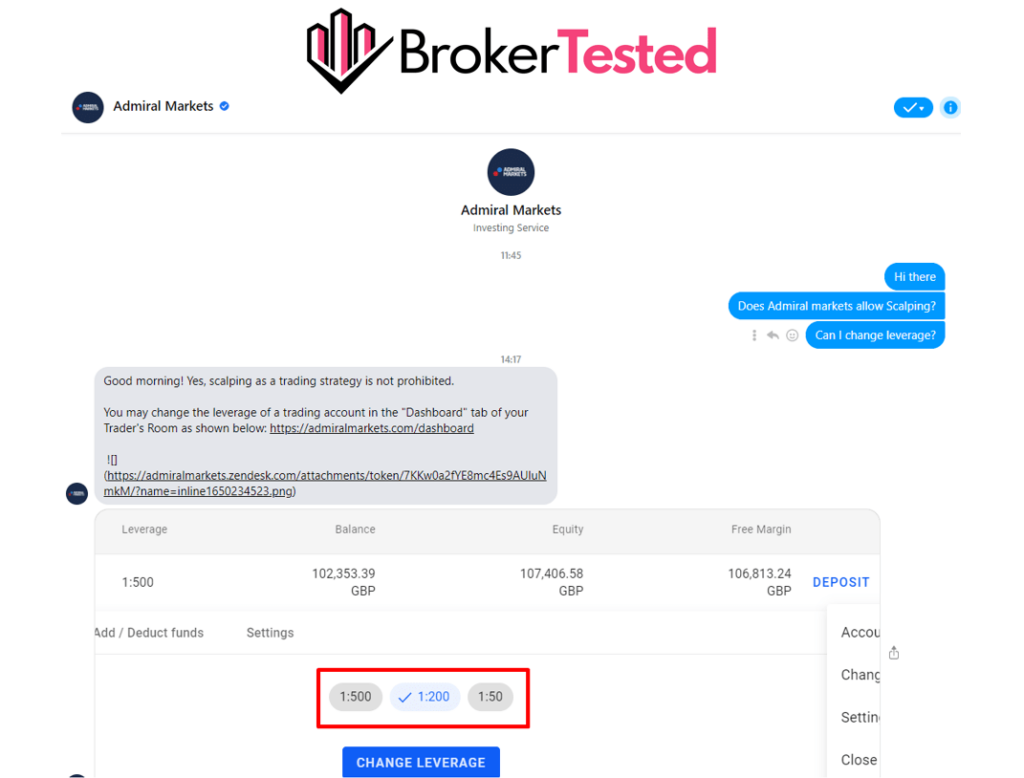

The trading conditions at Admirals are great. Traders can execute most trading strategies given that the broker allows high-risk strategies such as hedging and scalping.

There are no time limits for how long you can keep your hedging positions open. Admirals also allows traders to use Expert Advisors (EAs) for automated trading.

| Trading Method | Allowed |

|---|---|

| Hedging | Yes* |

| Scalping | Yes |

| Change Leverage | Yes |

*The broker allows hedging strategies on all account types except for the Invest.MT5 account.

Leverage

Admirals clients have access to different leverage levels based on the entity under which their account is registered.

Traders can also change their account’s leverage levels after registration.

The table below shows the various leverage levels available to clients:

| Markets | Admiral Markets UK Limited | Admiral Markets Cyprus Limited | Admirals KE Ltd | Admiral Markets AS Jordan Ltd | Admiral Markets Pty Limited | Admirals SA (PTY) Ltd |

|---|---|---|---|---|---|---|

| Major currency pairs | 30:1 | 30:1 | 400:1 | 500:1 | 500:1 | 500:1 |

| Non-major currency pairs | 20:1 | 20:1 | 400:1 | 500:1 | 500:1 | 100:1 |

| Gold | 20:1 | 20:1 | 400:1 | 500:1 | 500:1 | 10:1 |

| Other Commodities (except gold) | 10:1 | 10:1 | 400:1 | 500:1 | 500:1 | 500:1 |

| Indices | 5:1 | 5:1 | 200:1 | 500:1 | 500:1 | 100:1 |

| Stocks | 5:1 | 5:1 | 100:1 | 100:1 | 20:1 | 100:1 |

| Cryptocurrencies | N/A | N/A | N/A | 100:1 | 5:1 | 100:1 |

Bonus

Admirals does not offer bonuses to its clients (See No Deposit Bonus Forex for finding brokers that offer bonuses).

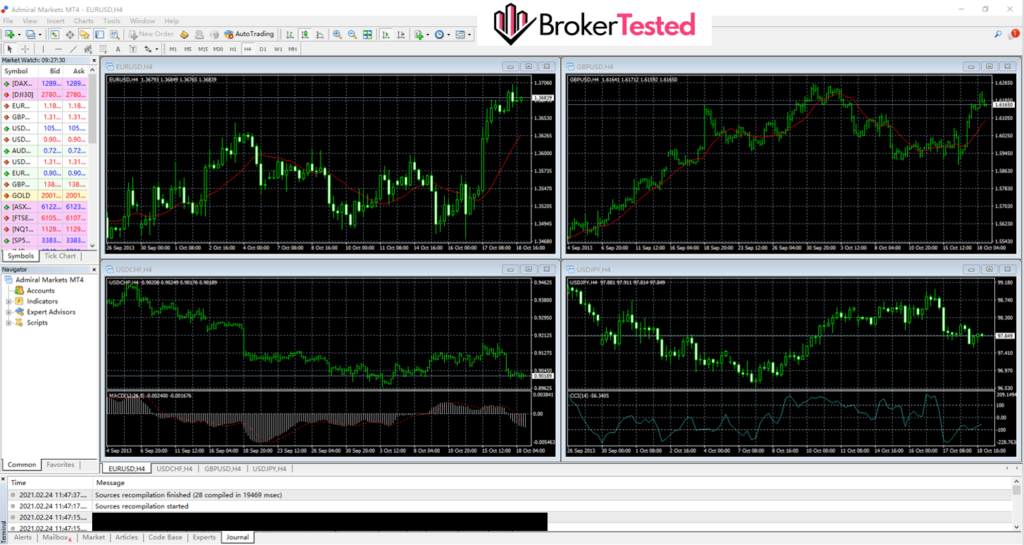

Trading Platform

Admirals offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms to its clients. Clients can trade via the broker’s website and the mobile and desktop MT4 and MT5 applications. The broker does not have a proprietary trading platform.

Traders who prefer the MetaTrader platform can choose between the MT4 and MT5 platforms. However, traders who prefer to trade on proprietary platforms have to find an alternative broker.

We found the MT5 platform to be satisfactory for traders who prefer to trade on a modern platform, while the MT4 platform is outdated.

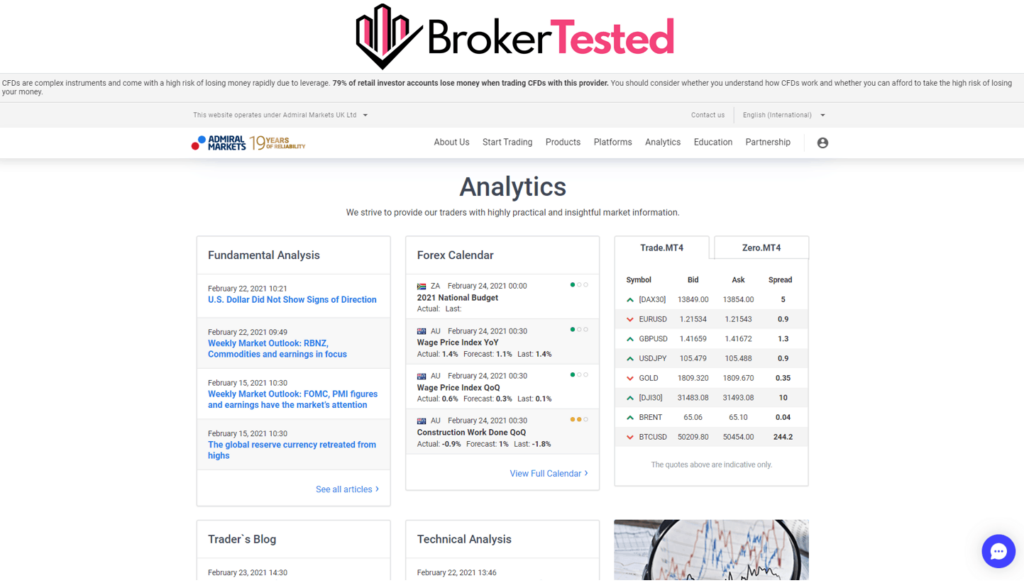

Research and Tools

Admirals provides market research via the in-built features on the MetaTrader platforms. Clients can access premium research from Trading Central via the MetaTrader Supreme Edition, an available add-in on the platforms.

The broker has a Premium Analytics section, which gives its clients access to the Dow Jones News calendar, signals from Trading Central, and sentiment trackers from Acuity Trading. All these are freely available to their clients.

Admirals also has a Trader’s Blog where it publishes fundamental and technical analysis articles covering significant market moves several times each month. The broker also has a Forex Calendar and a Trading Calculator.

The broker also produces a weekly trading podcast that discusses past and coming fundamental events and provides market analysis and trading strategies.

Education

Admirals has a great beginners course titled Forex 101 that consists of nine in-depth lessons that acquaint new traders with the Forex markets’ dynamics. Traders have to sign up for a free demo account to gain access to lessons 4-9; the first three lessons are freely available.

The broker also hosts free weekly educational webinars that build on the course content. The course also focuses on risk management as a key pillar of trading, which is commendable.

Admirals also provides several detailed articles and tutorials that cover various trading topics. Traders also have access to a complete guide to the Forex markets called Zero-to-Hero.

Customer Service

Admirals’ customer support team was very helpful and gave us direct and accurate answers to our questions. We first contacted the support team via live chat and received a prompt and accurate answer to our question.

You can reach the Admirals customer service team via email and live chat. Our live chat query reached the customer support team within 2 minutes, which was quite impressive.

Our second query was submitted to the customer support team via email. We received a clear, detailed and accurate answer within an hour. We were impressed by the fast response time.

Here are the results of our test below:

| Question | Response Time | Quality of reply | |

|---|---|---|---|

| Live chat | Why do you need further approval when we deposit funds into our trading wallet? | We reached a support agent within 2 minutes. | It was direct, detailed, and accurate. |

| Why are we barred from trading BTCUSD in our Trade? MT5 account? | We received feedback within an hour. | It was accurate and detailed. |

Conclusion

Finally, we had a smooth experience with Admirals starting from the account opening, to the deposit, trading and withdrawal processes.

Admirals has high execution speeds and very low spreads on all instruments. Additionally, the broker does not charge fees for its deposit and withdrawal methods.

Traders should also avoid depositing funds into their trading wallets, which requires approval from the broker’s finance department. We encourage traders to deposit funds directly into their trading accounts, which is instant.

We recommend Admirals to all types of traders, from beginners to experienced professionals. This is a truly safe broker, given that it does not have an offshore license. The UK and Australian entities accept clients from all countries globally. Hence, clients from every country are truly protected.

We recommend Admirals for traders who are

- Experienced traders

- Beginners

- Run Scalping

- Hedging

- EAs trading

- Trading through MT4 / MT5

- Looking for a wide range of instruments

Admirals might not be a fit if you are

- Real Stock / Futures Trading

- Commission-based trading

- Prefer other platforms rather than MetaTrader

Author of this review

By George Rossi

Author of this review

I am a well-rounded financial services professional experienced in fundamental and technical analysis, global macroeconomic research, foreign exchange and commodity markets and an independent trader.

Now I am passionate about reviewing and comparing forex brokers.

Everything you find on BrokerTested is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology