Amana Capital Review 2023

For this Amana Capital review, we have opened a standard account with the broker and deposited over €5,000.

We traded the popular instrument in each market to get the real spreads and placed a total of 12 trades.

We also reached out to customer support to solve the issues we faced.

Finally, we withdrew our funds to see if there are any issues with the withdrawal process.

What is Amana Capital?

Amana Capital is well-known forex and contracts for difference (CFDs) broker with offices in Dubai, London, Limassol, and Beirut.

The broker was founded in 2010 and operates globally. It is regulated in countries like the United Kingdom, the United Arab Emirates, Cyprus, Malaysia, and Mauritius.

The offerings of Amana Capital include trading with forex, indices, commodities, cryptocurrencies, and shares CFDs.

Some of the highlights of Amana Capital are:

| 🗺️ Authorised & Regulated in | UK, Cyprus, UAE, Lebanon, Malaysia, Mauritius |

| 🛡️ Is Amana Capital safe | Yes |

| 💰 EUR/USD Spread | 1.43 |

| 💳 Minimum deposit | US$50 |

| 💰 Withdrawal fee | US$0 (with many exceptions) |

| 🖥️ Trading Platform | MT4, MT5 |

| 📈 Markets offered | Forex, Indices, Stocks, Commodities, Cryptocurrencies |

| 📉 Number of Products | 392 (depends on the jurisdiction) |

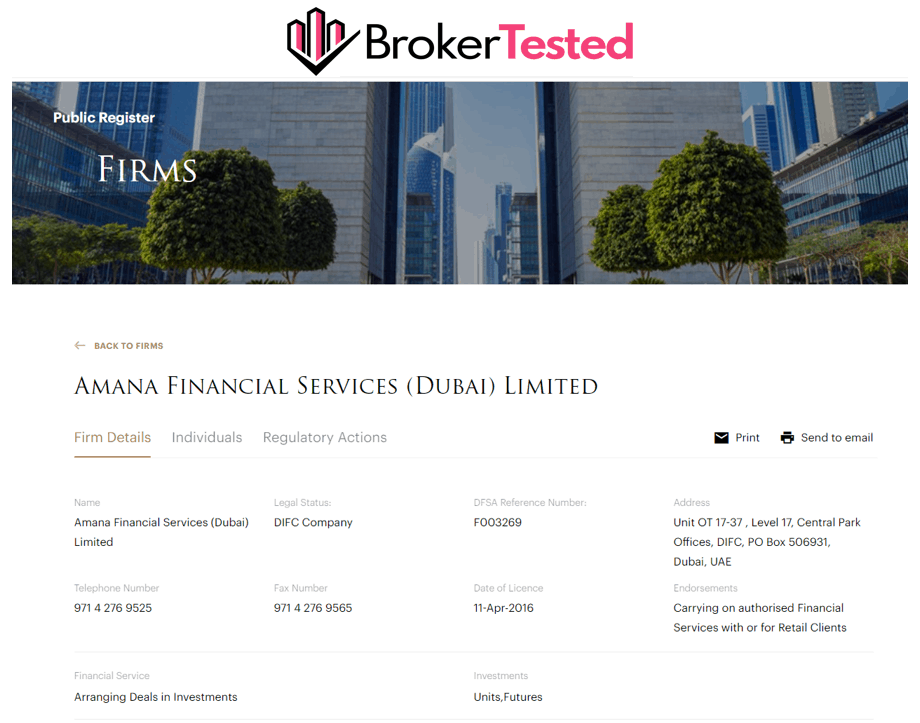

Is Amana Capital Regulated

Amana Capital holds licenses from 6 regulators.

The broker is regulated in the UK, the UAE, Cyprus, Lebanon, Malaysia, and Mauritius. The UK’s FCA and the UAE’s DFSA are considered as two of the top global financial regulators.

The full list of Amana Capital licenses is below:

| Legal entity | Registered in | Regulator | License number | Accepting clients from | Compensation scheme amount |

|---|---|---|---|---|---|

| Amana Financial Services UK Limited | United Kingdom | Financial Conduct Authority (FCA) | 605070 | United Kingdom, Global | £85,000 |

| Amana Financial Services (Dubai) Limited | United Arab Emirates | Dubai Financial Services Authority (DFSA) | F003269 | Middle East | No compensation scheme |

| Amana Capital Ltd | Cyprus | Cyprus Securities and Exchange Commission (CySEC) | 155/11 | European Union | €20,000 |

| Amana Capital SAL | Lebanon | Lebanese Capital Markets Authority (CMA) | 26 | NA | No compensation scheme |

| AFS Global | Malaysia | Labuan Financial Services Authority (LFSA) | MB/18/0025 | Global | No compensation scheme |

| ACG International Limited | Mauritius | Financial Services Commission – Mauritius (FSC) | C118023192 | Global | No compensation scheme |

Amana Capital is not accepting accounts through Amana Capital SAL anymore due to the banking crisis in Lebanon and the very tough rules of the central bank of Lebanon.

Is Amana Capital Safe?

Yes, Amana Capital is a safe broker.

The broker is well-regulated with a total of 6 licenses. It is also overseen by the UK’s FCA and the UAE’s DFSA, two well-reputed financial market regulators.

The FCA and the CySEC also offer compensation schemes of £85,000 and €20,000, respectively, to protect clients’ funds.

Amana Capital UK

For our tests, we opened an MT5 Amana Classic account with Amana Financial Services UK Limited, which is regulated by Financial Conduct Authority (FCA) in the UK.

We recommend you open an account with the UK or the UAE unit if their services are available in your jurisdiction.

Fees and Commissions

Amana Capital’s trading fees are mostly built into spreads. The broker charges commission on share CFDs trading and for all asset classes on its top-tier accounts.

Spreads for forex and stocks on our trades were much below the average industry benchmark.

Spread Charged in Our Trades

For our tests, we have chosen popular instruments in each market. We placed 3 trades for each instrument to get a picture of the average spread.

Our test is based on Amana Capital’s Amana Classic account. Spreads for our trades remained stable with minor deflections for all asset classes.

Details of our trades are shown below the table.

| Markets | Instruments | 1st trade | 2nd trade | 3rd trade | Avg. spread |

|---|---|---|---|---|---|

| Forex | EUR/USD | 1.45 | 1.45 | 1.4 | 1.43 |

| Indices | FTSE 100 | 1.8 | 1.8 | 1.8 | 1.8 |

| Stocks | Apple | 0.45 | 0.4 | 0.4 | 0.42 |

| Commodities | Gold | 4.55 | 4.15 | 4.35 | 4.35 |

Our testing finds that spreads on forex and share CFDs are lower than the industry average. Spreads on indices and commodities are, however, on the higher side.

| Markets | Instruments | Avg. spread charged in our trades | Industry avg. spread |

|---|---|---|---|

| Forex | EUR/USD | 1.43 | 1.16 |

| Indices | FTSE 100 | 1.8 | 1.65 |

| Stocks | Apple | 0.42 | 1.75 |

| Commodities | Gold | 4.35 | 3.53 |

Other Fees

Amana Capital charges deposit and withdrawal fees on most of the methods. It does not have any account maintenance or inactivity fees.

Withdrawal and deposit fees on Amana Capital are detailed below:

| Deposit fee | Withdrawal fee | |

|---|---|---|

| Wire Transfer | £6 | None |

| Amana Prepaid Cards | $3 | 1.5% |

| Credit/debit card (Visa, Mastercard, Maestro) | 1.5% | None |

| Debit Card (Union Pay) | None | 0.5% |

| Neteller | 3.9% + $0.29 | 2% Capped at $30 |

| Skrill | 3.9% + $0.29 | 1% |

| E Pay | None | None |

| Perfect Money, Payeer, AdvCash | 5% | None |

| WebMoney | 2.8% | 2.8% |

| Moneta | 4.95% | 4.9% |

| Qiwi | 6.5% | 2% |

| Fast Bank Transfer | 2.5% or €1 or €2 | None |

| FasaPay | Free | 0.5% capped at $5 |

Account Types

Amana Capital offers four account types: Amana Classic, Amana Active, Shares Account, and Amana Elite.

Amana Active account is eligible to clients with a minimum funding of $25,000 and $100 million of volume per calendar month.

Details of all Amana Capital accounts are:

| Amana Classic | Amana Active | Shares Account | Amana Elite | |

|---|---|---|---|---|

| Trading Platforms | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 | MetaTrader 5 | MetaTrader 5 |

| Account Currency | USD, GBP, EUR | USD, GBP, EUR | USD, EUR | USD, GBP, EUR |

| Minimum deposit | $50 | $25,000 | NA | $250,000 |

| Commission | 0 Commission on FX,0 Commission on Cash CFDs,$10 / lot on Futures CFDs,0.02$ / Share on Share CFDs (min 15$/tx) | $30 per 1M on FX, $0 on Cash CFDs, $5 per lot on Future CFDs | 0.02$ / Share ($15 minimum/transaction) | Raw spread + 4 to 6 $ commission round trip |

| Order execution | Market Execution | Market Execution | Instant Execution | Market Execution |

| Spread | From 1.4 | From 0.1 | From 0 | From 0 |

Amana Capital also offers swap-free Islamic accounts, joint accounts, and corporate accounts.

Account Opening

Our overall experience of opening a new account with Amana Capital was smooth and fast.

We opened a MetaTrader 5 Amana Classic account for our tests under the FCA-regulated entity.

The process of registration of a new Amana Capital account:

- Fill the initial registration form with details like account type, first name, last name, email, mobile number, and the preferred Amana entity.

- Click on the link sent to the registered email to proceed with the registration process.

- Enter trading platform, base currency, nationality, passport number (optional), date of birth, address, employment type, and educational level.

- Answer questionnaires on trading knowledge and experience.

- Provide details on the source of funds, intended initial investment, funding method, estimated annual income, estimated net worth, TIN number.

We submitted the following documents to verify our Amana Capital account:

- Copy of national identification (both front and back)

- Copy of our bank statement

The registration process took around 14 minutes. Our account was verified on the same working day, within 6 hours.

Our account was registered on March 25, 2023, and approved on the same day.

Our overall account opening experience was smooth and without any issues from registration to verification.

Deposit and Withdrawal

Both deposits and withdrawals on Amana Capital are easy and fast. All our funding and withdrawal requests were completed without any issues.

However, the broker charges high deposit and withdrawal fees on most of the methods.

Minimum Deposit

The minimum deposit on Amana Capital varies with the account types.

- Amana Classic account: $50

- Amana Active account: $25,000

- Shares account: None

- Amana Elite account: $250,000

Traders only need to maintain the minimum deposit balance on their accounts.

Deposit

Amana Capital supports deposits with bank transfers, credit and debit cards, online wallets like Neteller and Skrill, and many other popular regional methods.

The broker charges heavy fees on deposits.

The deposit methods also depend on the account jurisdiction.

We tested the deposit process on Amana Capital using a credit card, Neteller, and Skrill.

Details of our fund deposits are shown in the below table.

| Payment Method | Submitted Date | Funded Account Date | Funding Time | Fee |

|---|---|---|---|---|

| Credit card | 2023-03-31 | 2023-03-31 | 1 hour | 1.5% |

| Neteller | 2023-03-31 | 2023-03-31 | 5 minutes | 3.9% + $0.29 |

| Skrill | 2023-03-31 | 2023-03-31 | 6 minutes | 3.9% + $0.29 |

Amana Capital Withdrawal

Amana Capital allows withdrawals with bank transfers, credit and debit cards, online wallets like Neteller and Skrill, and many other popular regional methods, same as the deposit methods.

Though a few key withdrawal methods are free, the broker charges fees for most of the methods.

Overall, our experience with the Amana Capital withdrawal process was positive, except for the fees.

Details of our withdrawal requests are in the table below.

| Payment Method | Submitted Date | Fund Released Date | Fund Arrived Date | Withdrawal Time | Fee |

|---|---|---|---|---|---|

| Credit card | 2023-04-01 | 2023-04-01 | 2023-04-02 | 1 working day | zero |

| Neteller | 2023-04-01 | 2023-04-01 | 2023-04-01 | 4 hous | 2% |

| Skrill | 2023-04-01 | 2023-04-01 | 2023-04-01 | 2 hours | 1% |

Markets and Products

Amana Capital offers CFDs trading services with forex, indices, stocks, commodities, and cryptocurrencies instruments.

The complete list of Amana Capital’s offerings are:

| Markets | Instruments |

|---|---|

| Forex | 64 |

| Indices | 20 |

| Stocks and ETFs | 286 |

| Commodities | 18 |

| Cryptocurrency | 4 |

The markets and the number of offered instruments will depend on the account jurisdiction.

Trading Conditions

Amana Capital offers excellent trading conditions, allowing both hedging and scalping strategies. Traders can change leverage levels as well.

| Trading Method | Allowed |

|---|---|

| Hedging | Yes |

| Scalping | Yes |

| Change Leverage | Yes |

Leverage

Leverages offered by Amana Capital on various asset class are standard, as per the regulatory requirements, and are detailed below:

| Markets | Amana Financial Services UK Limited | Amana Capital Ltd | Amana Financial Services (Dubai) Limited | AFS Global | ACG International Limited |

|---|---|---|---|---|---|

| Major Currency Pairs | 30:1 | 30:1 | 400:1 | 500:1 | 2000:1 |

| Non-Major Currency Pairs | 20:1 | 20:1 | 400:1 | 100:1 | 500:1 |

| Gold | 20:1 | 20:1 | 200:1 | 100:1 | 500:1 |

| Other Commodities (except Gold) | 10:1 | 10:1 | 50:1 | 100:1 | 200:1 |

| Indices | 5:1 | 5:1 | 200:1 | 100:1 | 2000:1 |

| Stocks | 5:1 | 5:1 | 10:1 | 10:1 | 10:1 |

| Cryptocurrencies | NA | 2:1 | 20:1 | 2:1 | 100:1 |

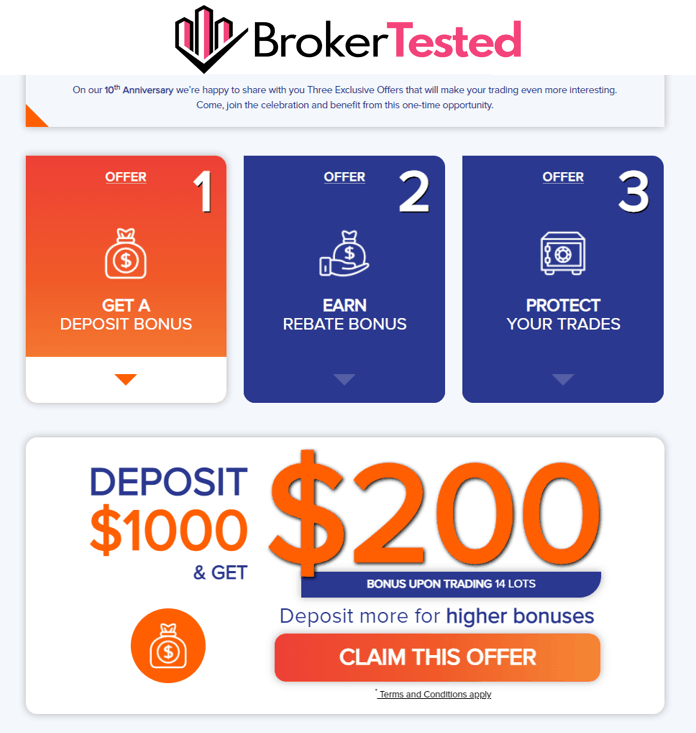

Bonus

Amana Capital offers three promotional offers to traders under its Malaysia-regulated entity (Read about no deposit bonus Malaysia).

- Bonus of $200 on deposits of $1,000

| Maximum payout | $1000 |

| Minimum deposit | $1000 |

| Available instrument | All CFDs (excluding CFDs on shares, cryptocurrencies and cash indices), forex, precious metals, and commodity futures |

Requirements for the bonus:

| Deposit | Bonus | Minimum lots required |

|---|---|---|

| $1,000 | $200 | 14 |

| $2,000 | $400 | 28 |

| $3,000 | $600 | 42 |

| $4,000 | $800 | 56 |

| $5,000 | $1,000 | 70 |

2. Rebate Bonus

| Maximum payout | $1000 |

| Minimum deposit | $1000 |

| Available instrument | All CFDs (excluding CFDs on shares, cryptocurrencies and cash indices), forex, precious metals, and commodity futures |

Details on the rebate:

| Consecutive trading days | 30 days (Tier 1) | 60 days (Tier 2) | 90+ days (Tier 3) |

|---|---|---|---|

| Rebates per lot | $1 per lot | $1.5 per lot | $2 per lot |

| Max cap payout | $500 | $750 | $1,000 |

Amana Capital clients are entitled to a rebate bonus once and it is applicable to all tiers.

3. 50% money back on lossing trades

Amana Capital clients are entitled to receive a 50% of their losses, up to $1,000, for the first month of trading, which starts from the date of the initial deposit.

Copy Trading

Amana Capital offers copy trading services with ZuluTrade, which is a third-party platform.

Trading Platform

Amana Capital offers MetaTrader 4 and MetaTrader 5 platforms to the traders. These are industry standard third-party platforms developed by the company MetaQuotes Software.

Both these platforms are available on the web, desktop, and mobile.

We executed all our trades on MetaTrader 5 platform.

Research and Tools

Amana Capital offers some excellent market research and analysis tools.

Tools offered by the broker include:

- Impressive charting tools

- Market research using RiskPulse

- Trading signals using Autochartist and Trade Captain

- Economic calendar

- Forex VPS

- Newsfeed

Education

Amana Capital offers decent educational resources.

The broker’s educational materials include:

- Guides on forex trading, CFDs, and cryptocurrencies

- Webinars

- Demo account

Customer Service

Amana Capital has excellent customer support.

Traders can contact the broker via:

- Live chat

- Phone

The support staff is available only on weekdays.

Our experience with Amana Capital customer support was very good.

The support staff on both live chat and email was quick enough to answer our query accurately and in detail.

| Question | Response Time | Quality of reply | |

|---|---|---|---|

| Live Chat | Asked questions on withdrawal priority | 1 minute | Clear and accurate |

| Asked several questions on the trading account, spread, leverage, and their entities | 2 hours | Clear and accurate |

The broker also has a detailed FAQ section for frequently faced issues.

Conclusion

Our overall experience with Amana Capital was positive.

The broker offers attractive spreads on forex and stock CFDs with fast execution.

Account opening, deposits, and withdrawals are also smooth and fast on Amana Capital. However, we did not like the fees on deposits and withdrawals. We recommend traders to use credit cards for deposits and withdrawals as the fees with this are the lowest.

Our experience with customer support was again excellent as the responses were fast, clear, and detailed.

We recommend Amana Capital to forex traders who run EA and follow strategies like scalping and hedging.

We recommend Amana Capital for traders who are

- Experienced traders

- Run Scalping

- Hedging

- EAs trading

- Trading through MT4

Amana Capital might not be a fit if you are

- Real Stock / Futures Trading

- Commission based trading

- Prefer other platforms rather than MetaTrader

Author of this review

By George Rossi

Author of this review

I am a well-rounded financial services professional experienced in fundamental and technical analysis, global macroeconomic research, foreign exchange and commodity markets and an independent trader.

Now I am passionate about reviewing and comparing forex brokers.

Everything you find on BrokerTested is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology