To come up with this list, we have tested more than 15 forex brokers authorized and operating in Portugal.

We opened a real account and deposited between €4,000 and €6,000 with each broker. We placed real trades in each popular market to get the real spreads.

We also reached out to customer support to solve issues that we had encountered. Finally, we withdrew our funds to see if there is any issue with the withdrawal process.

We handpick the best forex brokers in Portugal based on our trading data and experience as a trader.

CMVM Regulated Forex Brokers

Forex brokers in Portugal, a member country within the European Union, are regulated and authorized by the Portuguese Securities Market Commission, officially known as Comissão do Mercado de Valores Mobiliários (CMVM).

The regulator was established in 1991 and has full regulatory authority over all financial markets operating in Portugal, including the Portuguese stock exchange, members of the equity markets, financial services firms, and, of course, forex brokers.

CMVM’s official website is www.cmvm.pt, which is available in both Portuguese and English language. We highly recommend Portuguese investors and traders follow CMVM on Twitter, @CMVM_pt, for updates on regulations.

CMVM is an entirely independent organization and operates with the collected membership fees and proceeds collected as penalties from non-compliant firms. This also prompts the regulator to actively monitor regulated entities for any lapses in compliance.

Portugal is a member of the European Economic Area (EEA), meaning brokers regulated by any of the regulators in the EEA jurisdiction can operate in the country. CMVM itself is MiFID II compliant, meaning any CMVM-regulated broker can operate in any other European Union member country.

Forex brokers authorized by CMVM can offer a maximum leverage level of 30:1 and have to provide mandatory negative balance protection. CMVM also provides a compensation scheme of up to €20,000.

Some of the key highlights of trading with CMVM-regulated brokers:

| 🏦Regulator | Comissão do Mercado de Valores Mobiliários (CMVM) |

| 📊Max. Leverage | 30:1 |

| 🛡️Is It safe to trade? | Yes |

| 🔒Negative Balance Protection | Yes |

| 💰Compensation Scheme | Yes (€20,000) |

Best Forex Brokers in Portugal

To select the best regulated forex brokers operating in Portugal, we have tested and reviewed several forex brokers. We opened a live account, deposited real money, and placed real trades with each broker. With our test, we got a picture of the real spreads and commissions, trading platforms, deposit and withdrawal conditions, educational resources, and customer services.

- XTB – Best Overall Forex Broker in Portugal

- XM – Best Forex Broker for Beginners in Portugal

- INFINOX – Best MT4 Forex Broker in Portugal

- FxPro – Best Forex Trading Platform in Portugal

- AvaTrade – Best Forex Broker with Lowest Spread & Trading Fees in Portugal

Best Overall Forex Broker in Portugal

We picked XTB as the overall best forex broker in Portugal.

XTB is one of the very few forex brokers regulated by CMVM in Portugal. The broker is headquartered in Poland and is also licensed in the UK, Poland, Spain, France, Turkey, Cyprus, Germany, and a few other countries: 11 in total.

XTB is also a publicly listed company in Poland and thus has to report business financials quarterly, making it an extremely safe trading platform.

The broker lists more than 2,100 trading instruments, including currency pairs and CFDs of indices, stocks, commodities, ETFs, and cryptocurrencies. It also has minimum non-trading fees, and the spreads charged on traders are much below the industry average. XTB offers trading services on the industry-standard MT4 and proprietary xStation platform.

Best Forex Broker for Beginners in Portugal

We picked XM as the best forex broker for beginners in Portugal.

XM is an excellent forex broker for beginners because of its wide spectrum of trading services and a vast library of educational resources. The broker provides in-depth guides and well-explained videos on trading markets and strategies.

XM was founded in 2009 and is licensed in the UK, Cyprus, Australia, UAE and Belize. Its offerings include trading pairs of forex and CFDs of indices, stocks and commodities, listing around 1,336 trading pairs. It provides services on MT4 and MT5 platform, with spreads around the industry average across asset classes.

Best MT4 Broker in Portugal

We picked INFINOX as the best MT4 broker in Portugal.

INFINOX is another forex broker that is licensed and regulated by the Portuguese CMVM. The broker is also regulated in the United Kingdom, South Africa, Bahamas and Mauritius.

INFINOX provides services trading services on both the MT4 and MT5 platforms. It supports forex and CFDs of indices, metals and commodities on MT4, while MT5 supports additional equities. The broker offers excellent indicators and charting tools to analyze the listed 90 trading instruments.

Best Forex Trading Platform in Portugal

We picked FxPro as the best forex trading platform in Portugal.

FxPro is well-known for its forex trading services though the platform also lists CFDs of indices, stocks, commodities and cryptocurrencies. It lists around 234 trading instruments and offers trading on MT4, MT5, cTrader, and proprietary FxPro EDGE platforms.

The broker trading with 70 currency pairs and puts no restrictions on trading strategies, meaning both hedging and scalping are allowed.

FxPro operates in Portugal with its license from the Cyprus regulator and is also regulated in the United Kingdom, South Africa and the Bahamas.

Best Forex Broker with Lowest Spread & Trading Fees in Portugal

We picked AvaTrade as the best forex broker with the lowest spread & trading fees in Portugal.

AvaTrade is an Ireland-headquartered forex and CFDs broker. It lists around 796 instruments of currency pairs and CFDs of indices, stocks, commodities, bonds, cryptocurrencies and ETFs. The broker is also exceptional when it comes to fees, both trading and non-trading.

According to our tests, AvaTrade charges an average spread of 0.87 pips on the EUR/USD pair, while the industry standard lingers around 1.6 pips. The spreads on most of the other asset classes are also much lower than the industry average. It also has minimum non-trading as there are no deposit or withdrawal fees of anykind.

CMVM-Regulated Forex Brokers List & Review

Here is a list of the regulated forex brokers operating in Portugal, which we have tested by opening real accounts, depositing real money, executing trades, and then withdrawing all funds.

| Forex Broker | EU Regulated | About Our Test | Our Review |

|---|---|---|---|

| FBS | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | FBS Review |

| GO Markets | Yes | Deposit Amount: Over €4,500 Total Trade: 12 trades | GO Markets Review |

| Fortrade | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | Fortrade Review |

| RoboMarkets (RoboForex) | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | RoboMarkets Review |

| IC Markets | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | IC Markets Review |

| FXTM | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | FXTM Review |

| Capital.com | Yes | Deposit Amount: Over €3,500 Total Trade: 15 trades | Capital.com Review |

| FxPro | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | FxPro Review |

| Pepperstone | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | Pepperstone Review |

| Amana Capital | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | Amana Capital Review |

| FxPro | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | FxPro Review |

| XTB | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | XTB Review |

| eToro | Yes | Deposit Amount: Over $6,000 Total Trade: 18 trades | eToro Review |

| Tickmill | Yes | Deposit Amount: Over $8,000 Total Trade: 12 trades | Tickmill Review |

| Plus500 | Yes | Deposit Amount: Over €6,000 Total Trade: 18 trades | Plus500 Review |

FAQ & More on Portugal Brokers

Traders usually have many questions related to trading generic trading-related queries. We tried to pick and answer some of the most important queries related to CMVM-regulated brokers.

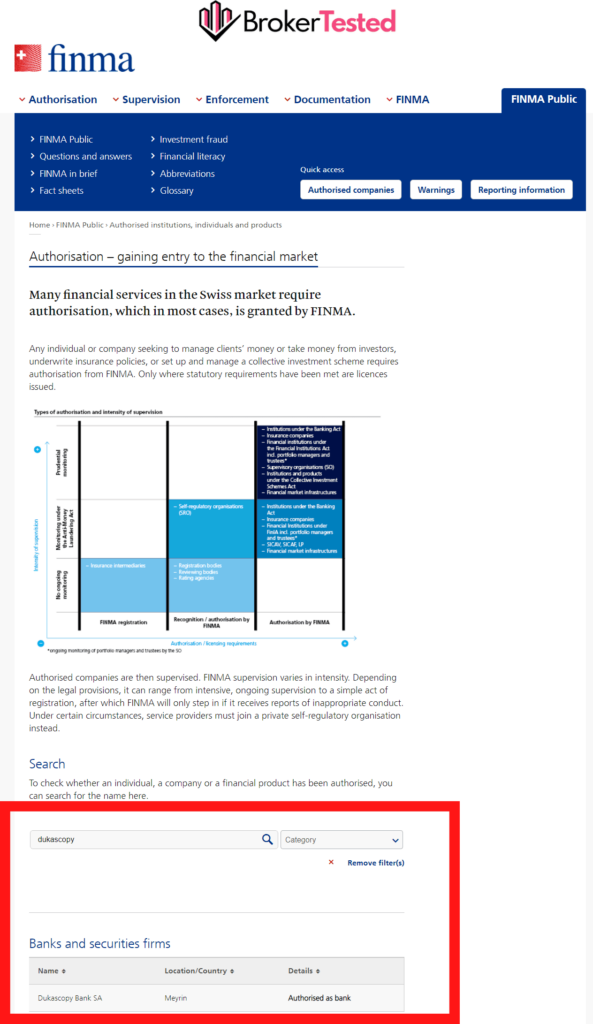

How to Verify CMVM-Regulated Brokers?

Similar to any other reputed financial market regulator, CMVM maintains a database of all the authorized brokers and other financial services authorized to operate in Portugal. In fact, it has one of the most user-friendly UI to search the database.

To find any regulated broker, go to this link and choose any of the categories of authorized firms. It categorizes financial services firms based on their licensing terms: if they are directly regulated by CMVM, if they are passporting licenses from other EEA members or if they are operating under some temporary licensing regime, among others.

ECN Brokers in Portugal

ECN brokers provide connection to an automated bridging network, thus directly connecting buyers and sellers. These brokers offer raw spreads and charges commission on trades. Some of the ECN brokers operating in Portugal are:

- FXTM

- RoboMarkets (RoboForex)

- GKFX

MT4 Portuguese Forex Brokers

MT4 is the trading platform developed by MetaQuotes Software and is very popular for trading Forex and CFDs worldwide. Most of the popular brokers provide services on MT4. Some of the MT4 forex brokers operating in Portugal are:

- Admiral Markets

- FxPro

- XM

- Tickmill

Low Spread Forex Brokers in Portugal

Charging spreads are the primary way for most brokers to make money. While many brokers keep their spreads tight, many offer wide spreads. Some of the brokers operating in Portugal with low spreads and fees are:

- IC Markets

- Capital.com

- Pepperstone

High Leverage Forex Brokers in Portugal

Portugal’s CMVM aligns its regulations with the ESMA-recommended MiFID II. These regulations limit forex brokers Portuguese forex brokers to offer leverage of only up to 30:1.

Tax in Portugal for Forex Trading

Forex trading is taxable in the country. Commonly, the profits from forex trading are seen as general income and are taxed the same way. The income tax ranges from 14.5% to 48%. Capital gains in Portugal are taxed at 28%.

Traders from Portugal should remember that they are responsible for filing tax forms to the relevant institution of the country. If they fail to perform their obligations in time, they will later face fines and penalties.