For this BXB Market review, we opened a live account and deposited over $3,000.

We traded the popular instrument in each market to identify the actual spreads and placed a total of 10 trades.

We reached out to the broker’s client support team to resolve the challenges we faced.

Finally, we withdrew our funds to evaluate whether the withdrawal process was smooth.

What is BXB Market

BXB Market is an online trading platform that provides access to various financial instruments, including Forex, CFDs on cryptocurrencies, metals, stocks, commodities, and indices.

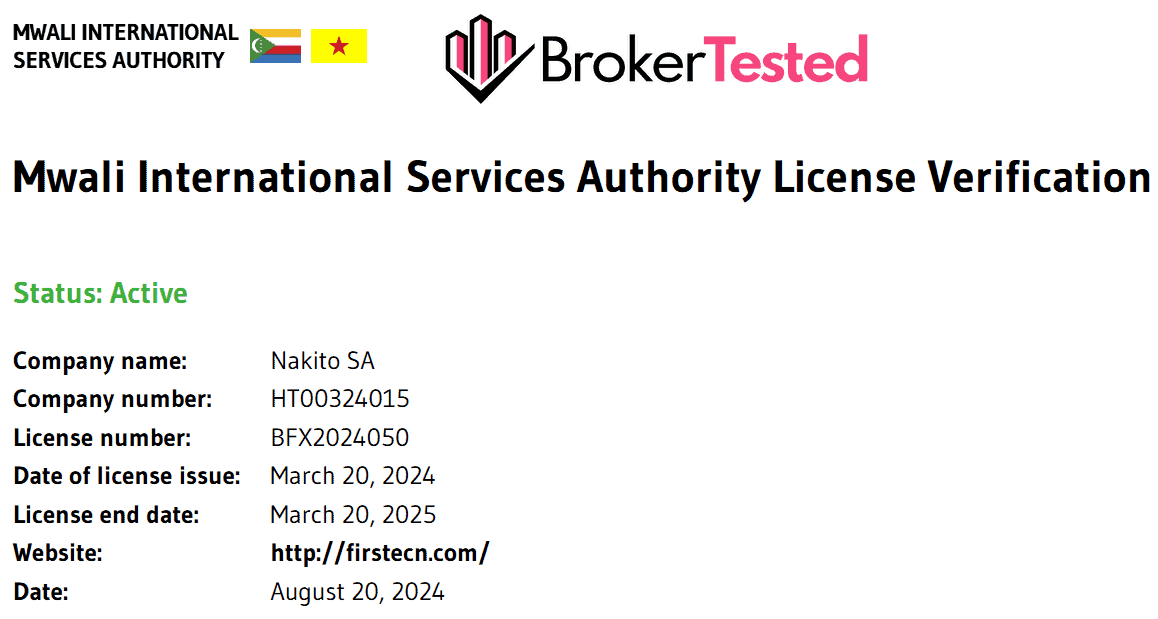

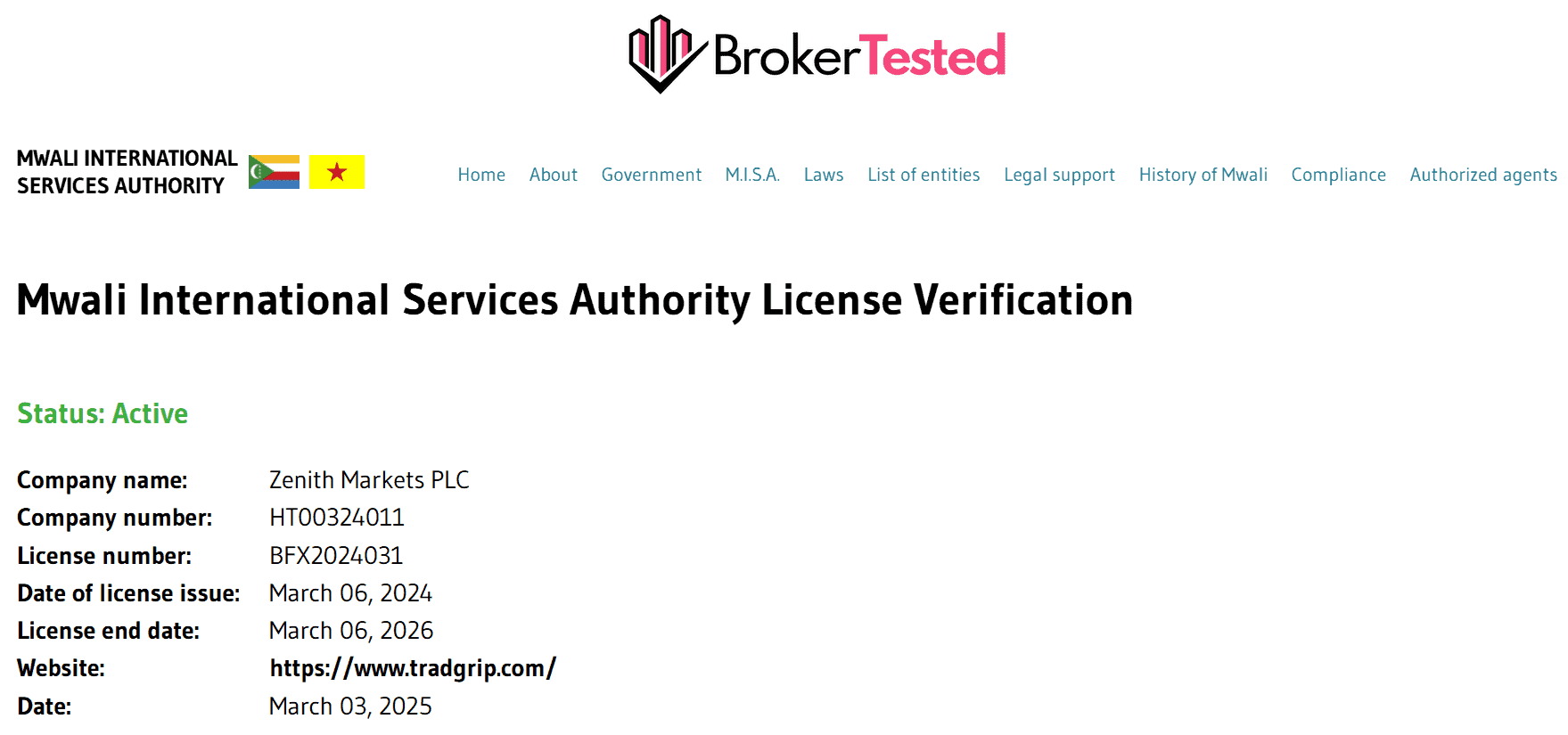

The broker is licensed under the MWALI International Services Authority (MISA) with the brokerage license number BFX2025065.

However, traders should carefully review the company’s regulatory status, as MISA is based in Comoros and may not offer the same level of investor protection as more established financial regulators.

Some of the highlights of BXB Market are:

| 🗺️ Authorized & Regulated in | Comoros |

| 🛡️ Is BXB Market safe | Yes |

| 💰 EUR/USD Spread | 1 |

| 💳 Minimum deposit | $250 |

| 💰 Withdrawal fee | Depends on the payment provider |

| 🖥️ Trading Platform | BXB Market WebTrader, Mobile App, TradingView |

| 📈 Markets offered | CFDs on Forex, cryptos, metals, stocks, commodities, and indices. |

| 📉 Number of Products | 350 |

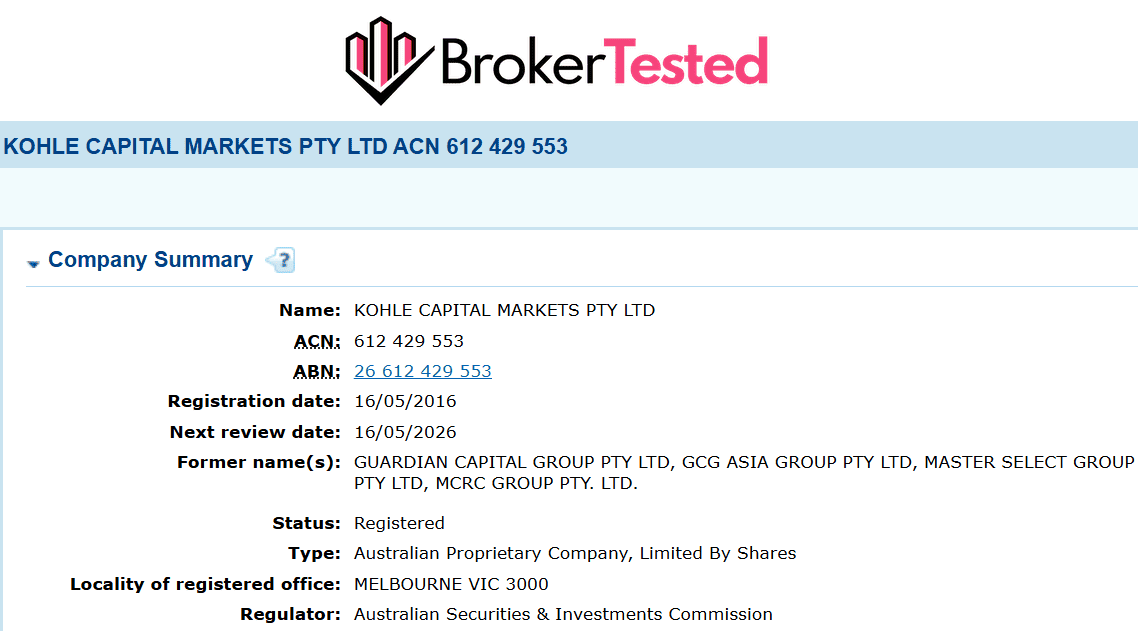

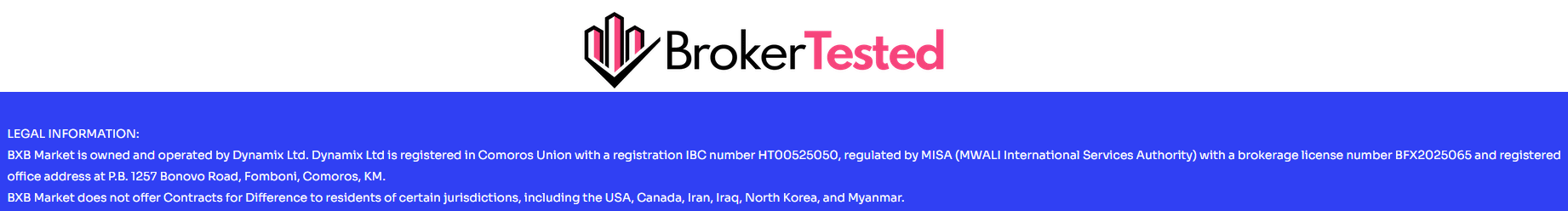

Licenses and Regulations

BXB Market is owned and operated by Dynamix Ltd, a company registered in the Comoros Union with a registration IBC number HT00525050. It holds a brokerage license from the Mwali International Services Authority (MISA) under license number BFX2025065.

While this provides the company with a formal regulatory status, MISA is considered less stringent compared to major financial regulators, meaning the level of investor protection and supervision may be more limited.

Traders should therefore review the broker’s transparency, safety policies, and conditions carefully before opening an account.

Here are the details of BXB Market’s sole license:

| Legal entity | Registered in | Regulator | License number | Accepting clients from | Compensation scheme amount |

| Dynamix Ltd | Comoros | MISA | BFX2025065 | Many countries globally | No compensation scheme |

Is BXB Market Safe

BXB Market offers basic security measures, including segregated accounts for client funds, encrypted transactions, and identity verification (KYC).

However, the MISA is an offshore regulator, so clients should be cautious and verify all details before investing.

We had a smooth experience when trading with BXB Market.

For our tests, we opened Silver account with Dynamix Ltd, which is regulated by the MISA in Comoros.

However, we recommend you conduct thorough research before opening a live account with BXB Market.

Fees and Commissions

BXB Market charges its fees via spreads, rather than fixed commissions, making its cost structure dependent on market liquidity and volatility.

Spreads on the instruments were on average with industry benchmark.

Spread Charged in our Trades

For our tests, we have chosen popular instruments in each market. We placed 3 trades for each instrument to get a picture of the average spread.

Our test is based on BXB Market Silver account. The spreads for our trades across all asset classes remained stable, with only minor variations.

Details of our trades are shown below the table.

| Markets | Instruments | 1st trade | 2nd trade | 3rd trade | Avg. Spread |

|---|---|---|---|---|---|

| Forex | EUR/USD | 1 | 0.5 | 1 | 1 |

| Indices | FTSE 100 | 1 | 1.5 | 1 | 1 |

| Stocks | Apple | 0.75 | 0.8 | 0.8 | 0.8 |

| Commodities | Gold | 3 | 3.5 | 3 | 3 |

We executed all our trades via the BXB Market iOS App on our iPhone.

Our testing finds that BXB Market’s spreads across all assets are lower than or in line with the industry average.

| Markets | Instruments | Avg. Spread Charged | Industry Avg. Spread |

|---|---|---|---|

| Forex | EUR/USD | 1 | 1.2 |

| Indices | FTSE 100 | 1 | 1.65 |

| Stocks | Apple | 0.8 | 1.75 |

| Commodities | Gold | 3 | 3.53 |

Other fees

BXB Market does not charge any deposit or withdrawal fees; however, third-party costs, such as bank transfer charges, payment processor fees, or currency conversion costs, may still apply.

Traders should check with their payment providers to understand any external fees that could affect the final transaction amount.

Account Types

BXB Market offers 3 main account types: Silver Account, Gold Account, and Platinum Account.

Details of the Account types and differences are outlined below:

| Silver | Gold | Platinum | |

|---|---|---|---|

| Trading Platforms | BXB Market WebTrader, Mobile App, TradingView | BXB Market WebTrader, Mobile App, TradingView | BXB Market WebTrader, Mobile App, TradingView |

| Account Currency | USD, EUR, GBP | USD, EUR, GBP | USD, EUR, GBP |

| Minimum Deposit | $250 | $250 | $250 |

| Commission | Zero | Zero | Zero |

| Order Execution | Market Execution | Market Execution | Market Execution |

| Spread | From 1 | From 0.5 | From 0.3 |

| Note | – | Spread Discount 50% | Spread Discount 75% |

BXB Market also offers a Demo Account, allowing beginners to practice and advanced traders to test strategies in a risk-free environment using real-time market conditions.

For our tests, we chose to open Silver Account.

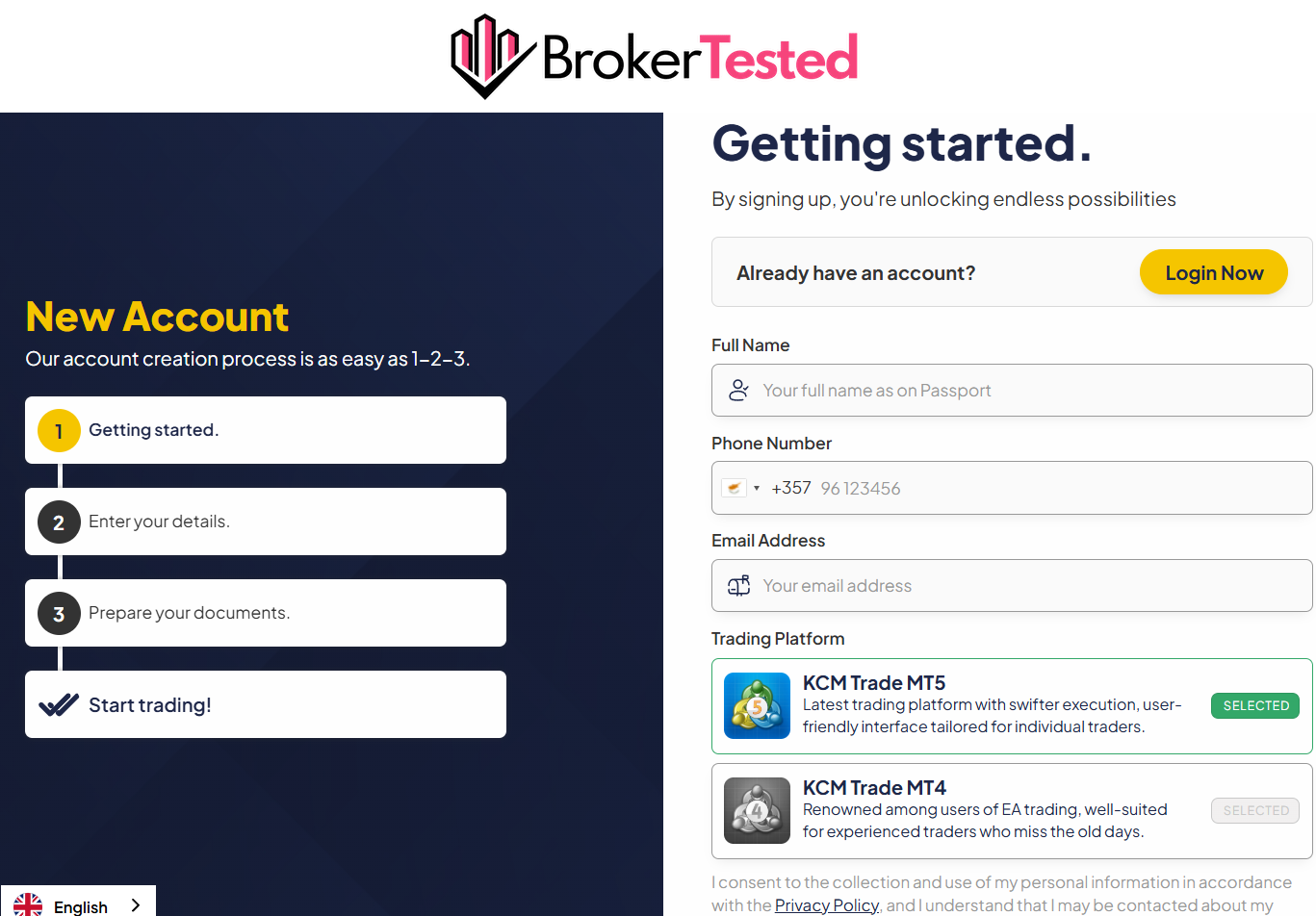

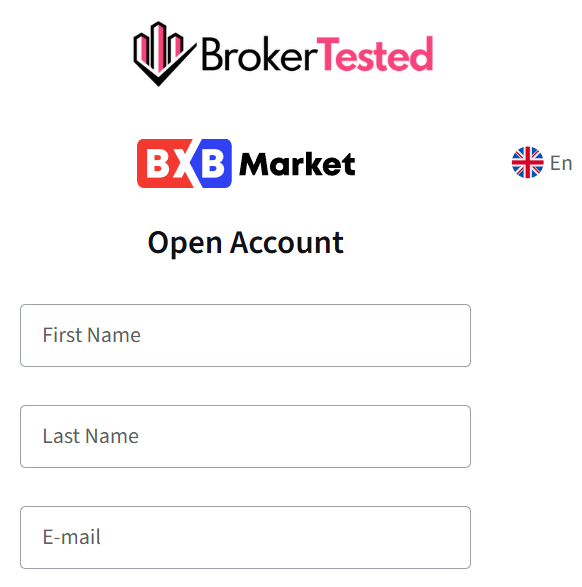

BXB Market Account Opening

BXB Market account opening was smooth and quick. We went through the entire registration process and completed it online.

The process of registration of a new BXB Market live account:

- Visit the official BXB Market website.

- Navigate to the Open Account section on the homepage.

- Fill out the registration form with your basic details, such as name, phone number, and preferred account settings.

- Choose between Silver, Gold, or Platinum accounts based on your trading experience and goals.

- Upload a government-issued ID (passport or national ID) and a recent proof of address (e.g., utility bill or bank statement).

- Choose the desired trading platform.

- Submit the form and verify your email if required.

- Once registered, download the selected trading platform or access the WebTrader directly through your browser.

- Log in using the account credentials provided.

- Once your account is approved and funded, you can access the trading platform and begin trading.

The registration process took 15 minutes only, and our account was approved in 2 working days.

We opened Silver account with Dynamix Ltd, which is regulated by the MISA in Comoros for this test.

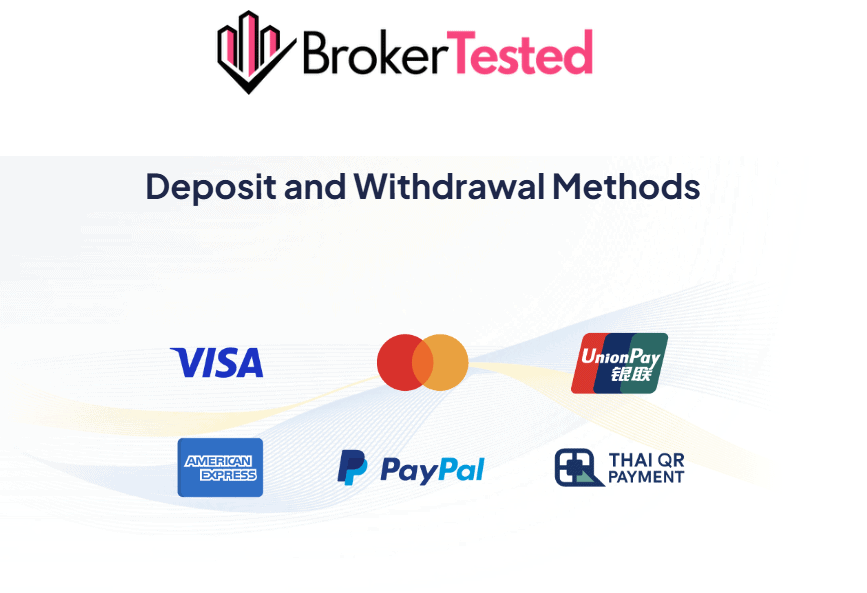

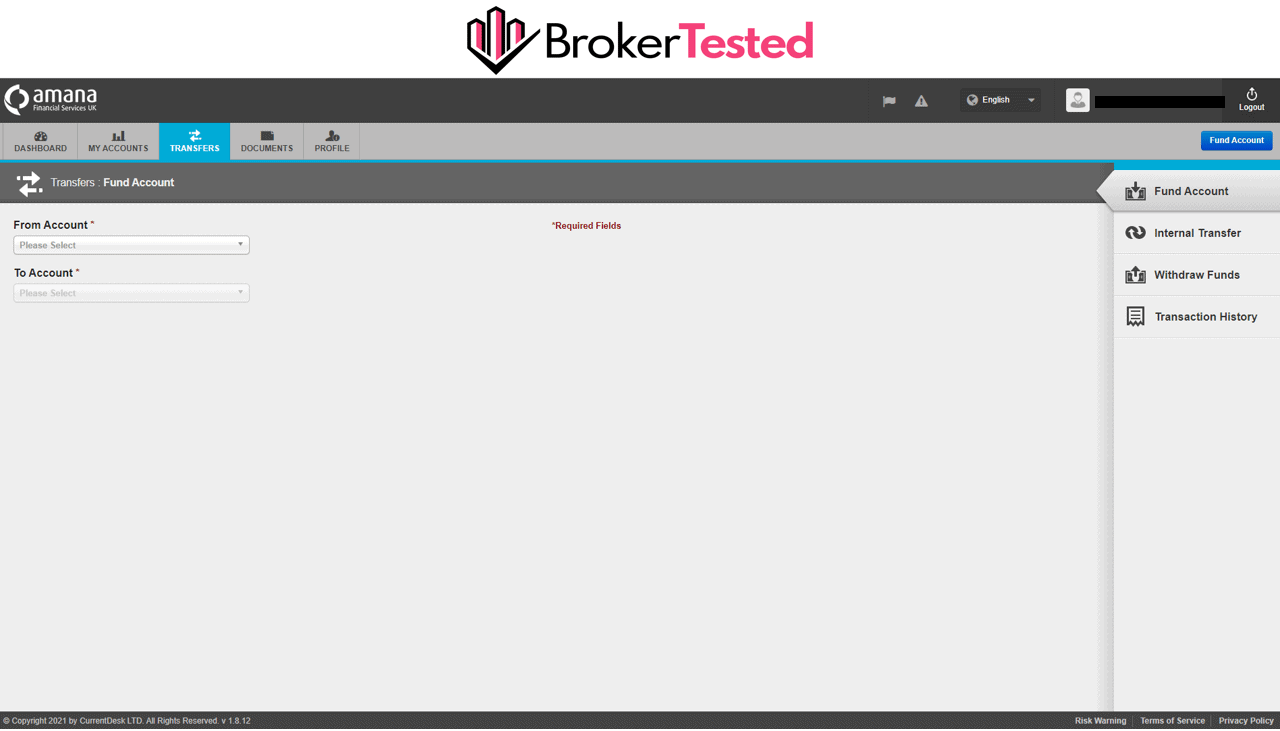

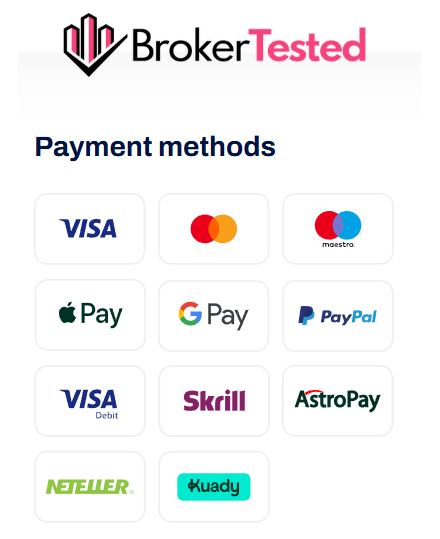

Deposit and Withdrawal

Both deposits and withdrawals on BXB Market are easy and fast. A range of funding methods is supported, and all our requests were completed without any issues.

BXB Market Minimum Deposit

The minimum deposit to open a BXB Market account is $250, which applies to all account types.

Traders only need to maintain the minimum deposit balance in their accounts.

BXB Market Deposit

BXB Market supports deposits via bank transfers, credit/debit cards, Skrill, Neteller, AstroPay, Apple Pay, Google Pay, and more.

The broker does not charge any deposit fees, and processed our deposit quickly.

BXB Market Withdrawal

BXB Market allows users to make withdrawals using the same payment methods as available for deposits.

There are no fees for withdrawal requests, however third-party fees may apply.

We did not face any challenges when withdrawing funds.

Markets and Products

BXB Market offers over 350 trading instruments across various asset classes, including CFDs on Forex, cryptos, metals, stocks, commodities, and indices.

Here’s the complete list of BXB Market’s product offering:

| Markets | Instruments |

|---|---|

| Forex | 80+ |

| Indices | 40 |

| Metals | 20 |

| Commodities | 5 |

| Cryptocurrencies | 5 |

| Stocks | 250 |

The broker offers a regular number of instruments, but it is lower than industry leaders, who offer thousands of products.

Trading Conditions

The conditions at BXB Market are quite good. Traders can execute the majority of trading strategies as the broker allows strategies like scalping, hedging, and more.

| Trading Method | Allowed |

|---|---|

| Hedging | Yes |

| Scalping | Yes |

| Change Leverage | Yes |

Leverage

BXB Market offers traders various leverage levels depending on the instrument, with a maximum of 1:200 considered high leverage.

Traders are allowed to change account leverage levels after registration

The table below shows the different leverage levels available:

| Markets | DXA Seychelles Limited |

|---|---|

| Major Currency Pairs | 200:1 |

| Commodities | 100:1 |

| Indices | 100:1 |

| Stocks | 10:1 |

| Cryptocurrencies | 10:1 |

Bonus

BXB Market’s Gold and Platinum account holders can benefit from reduced spreads and swap discounts.

Gold account holders receive a 40% swap discount and a 50% spread discount, while Platinum account holders enjoy a 60% swap discount and a 75% spread discount.

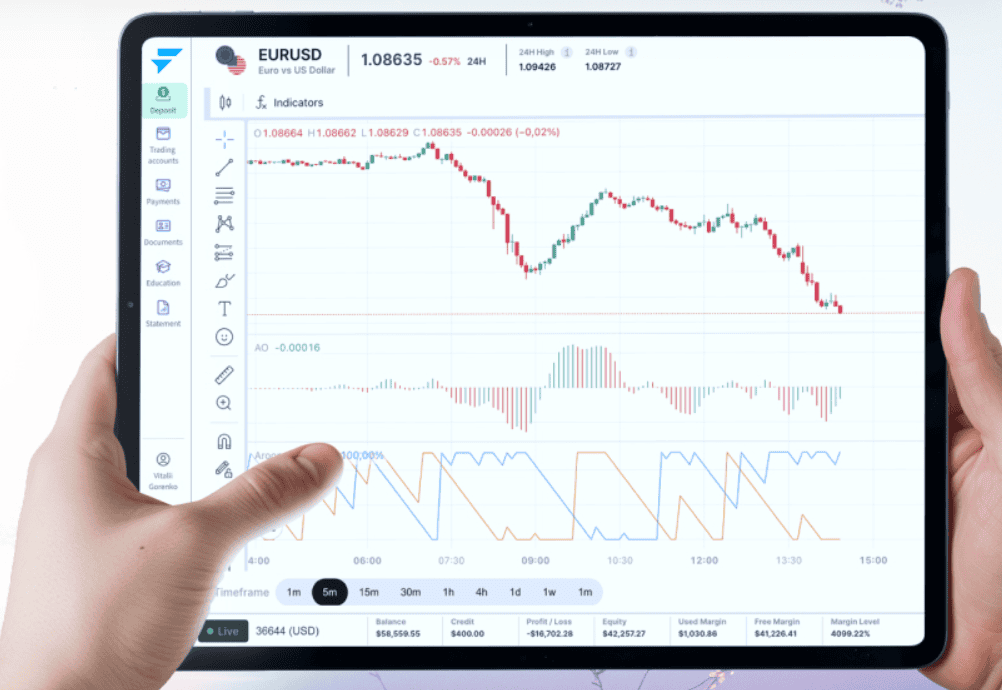

BXB Market Platform

BXB Market offers trading services on its proprietary web and mobile platforms, as well as through integration with the TradingView platform.

- BXB Market WebTrader

- BXB Market Mobile App

- TradingView

We found the platforms to be well suited to all types of traders with good charts and numerous functions

Research and Tools

BXB Market offers some research and analysis tools. For technical analysis, the broker integrates TradingView’s charting technology.

Some of the key tools offered by the broker are:

- Custom charts

- Indicators

- Economic calendar

- Trading strategies

- Real-time data

- Newsfeed

BXB Market’s research offering was quite basic in our test. There are only few extra tools provided compared to industry leaders that provide numerous tools with great research.

Education

BXB Market offers very limited educational resources: there is no clearly defined learning center on the broker’s website.

Based on our Test, BXB Market Education is limited compared to brokers with comprehensive learning materials. Beginners better look for more detailed education or Trading Courses.

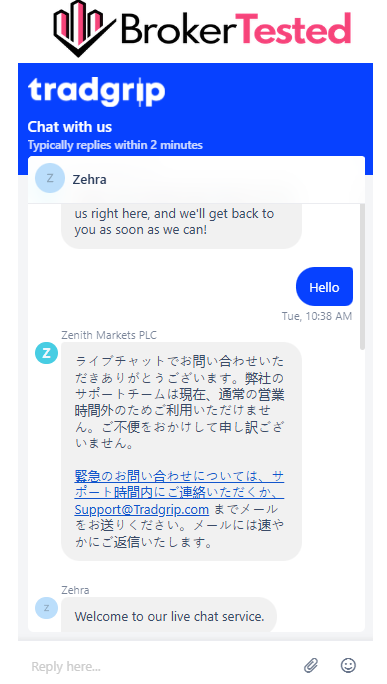

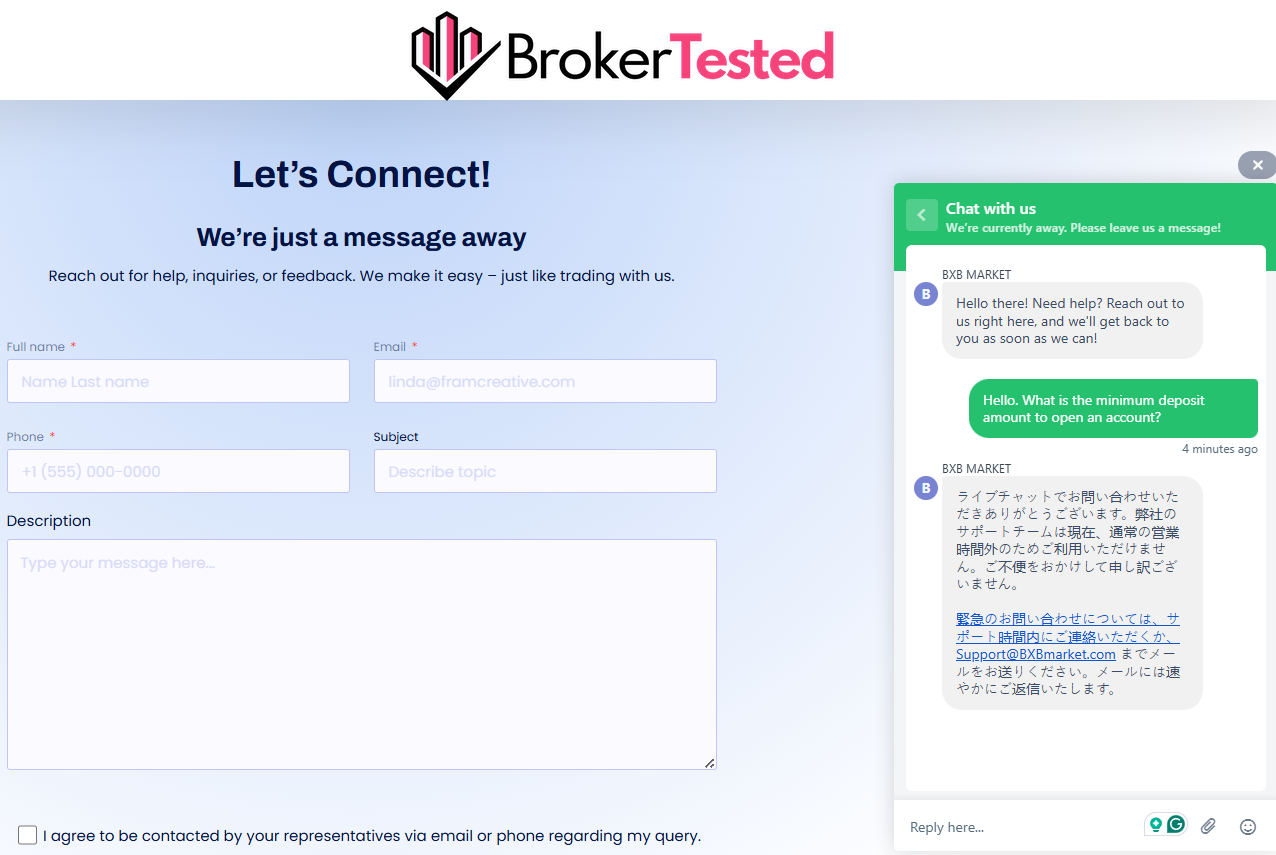

Customer Service

BXB Market provides responsive customer support.

Traders can contact the broker via:

- Live chat

- Phone

- Contact form

The support team is available 24/5, ensuring that users can receive assistance with a range of inquiries and issues.

Our experience with BXB Market customer support was good.

We first contacted the broker through live chat to ask about the minimum deposit amount, but the agent mentioned that our inquiry was submitted outside of their working hours.

We then filled out the contact form, and the response we received regarding the minimum deposit amount was clear and accurate.

| Question | Response Time | Quality of reply | |

|---|---|---|---|

| Contact form | Asked about the minimum deposit amount | 2 hours | It was direct and accurate. |

Conclusion

Our overall experience with BXB Market was smooth.

BXB Market BrokerTested Review found that the Broker delivers competitive trading conditions with a good number of currency pairs and Forex spreads below or on average industry benchmark.

Our experience with account opening, deposits, and withdrawals was also smooth and without any issues.

The only lower than industry offering we would mark Education and Research quality, also instruments range is lower than the thousands of instruments provided by Market leaders.

We recommend BXB Market to traders looking for simple, multi-asset trading environment with access to popular instruments in one platform.

We recommend BXB Market for traders who are

- International traders

- Experienced traders

- Beginners

- Run Scalping

- Hedging

- Use charting technology

- Preher flexible account types

BXB Market might not be a fit if you are

- Looking for a wider instrument range

- Prefer the cTrader/MetaTrader platforms

- Seeking comprehensive learning materials and research

- Commission-based trading

- Need a regulation by a reputable financial authority

- Prefer a broker with copy/social trading features