To come up with this list, we have tested more than 15 forex brokers Cyprus holding CIF licenses.

We opened a real account and deposited between €4,000 and €6,000 with each broker. We placed real trades in each popular market to get the real spreads.

We also reached out to customer support to solve issues that we had encountered. Finally, we withdrew our funds to see if there is any issue with the withdrawal process.

We handpick the best forex brokers based on our trading data and experience as a trader.

Best CySEC Brokers Regulated

Cyprus Securities and Exchange Commission (CySEC) regulates retail forex brokers in Cyprus. It issues the Cyprus Investment Firm (CIF) license to the forex brokers. CySEC-regulated forex brokers can also offer services in the European Economic Area (EEA) by using the passporting rights of their license.

Forex CySEC License Cyprus

CySEC’s official website is www.cysec.gov.cy (available both in English and Greek), and we recommend investors and traders follow the regulator on Twitter, @CySEC_official, for important regulatory updates.

- CySEC has a mixed reputation as a forex broker regulator. Despite its entry into regulating retail forex brokers from as early as 2001, the regulator failed to implement strict regulations. Many Cypriot brokers had been flagged by other European regulators for violations of compliances.

- Over the past few years, CySEC has turned much more strict and amended many of its regulatory requirements to conform with the EU and MiFID standards. The regulator now started to maintain a warning list and also imposing heavy penalties for compliance violations.

Forex brokers regulated by the CySEC can offer up to 30:1 leverage to retail traders. The regulator also offers a €20,000 compensation scheme and made negative balance protection mandatory.

CySEC-regulated forex brokers cannot offer bonuses to gain traders and push them for more deposits (Check for No Deposit Bonus Forex $200).

Some of the key highlights of trading with CySEC-regulated brokers:

| 🏦Regulator | Cyprus Securities and Exchange Commission (CySEC) |

| 📊Max. Leverage | 30:1 |

| 🛡️Is It safe to trade | Yes |

| 🔒Negative Balance Protection | Yes |

| 💰Compensation Scheme | Yes (up to €20,000) |

Best Forex Brokers in Cyprus

To select the best CySEC-regulated forex brokers, we have tested and reviewed several forex brokers. We opened a live account, deposited real money, and placed real trades with each broker. With our test, we got a picture of the real spreads and commissions, trading platforms, deposit and withdrawal conditions, educational resources, and customer services.

- XM – Best Overall Forex Broker in Cyprus

- FBS – Best Forex Broker for Beginners in Cyprus

- ICM Capital – Best MT4 Broker in Cyprus

- FxPro – Best Forex Trading Platform in Cyprus

- Capital.com – Best Forex Broker with Lowest Spread & Trading Fees in Cyprus

Best Overall Forex Broker in Cyprus

We picked XM as the overall best forex broker in Cyprus.

XM is regulated in multiple jurisdictions, including Cyprus. It is a versatile forex broker offering extensive services to retail forex traders. It offers trading with forex and CFDs of stocks, indices, and commodities, with more than 1,300 trading instruments.

Apart from the markets, XM offers impressive indicators and tools for market analysis and provides services on both MT4 and MT5. The broker also has an excellent customer support desk for helping the traders.

Best Forex Broker for Beginners in Cyprus

We picked FBS as the best forex broker for beginners in Cyprus.

FBS is, hands down, one of the best forex brokers for beginners due to the extensive educational material it offers. It provides detailed courses on trading to both beginner and advanced traders and in-depth text and video guides.

FBS conducts webinars to further help traders better understand the industry. Traders can also execute trades on demo accounts without risking real money initially. The broker offers trading with several assets, giving many choices to the traders. Its customer support is also excellent and is available around the clock.

Best MT4 Broker in Cyprus

We picked ICM Capital as the best MT4 broker in Cyprus.

Though most of the Cypriot brokers offer trading services on MT4, ICM Capital is the best MT4 forex broker for many reasons. ICM offers only MT4, meaning all its focus on concentrated on one platform. It provides some excellent indicators and technical analysis tools, all of which are integrated on the MT4 platform.

ICM also offers low-latency bridging on the MT4 platform.

The market offerings of the broker are also good with around 150 instruments of forex and CFDs of indices, stocks, and commodities.

Best Forex Trading Platform in Cyprus

We picked FxPro as the best forex trading platform in Cyprus.

With around 70 currency pairs in the offering, FxPro is the best CySEC-regulated forex trading platform. Our testing of the broker finds that the average spread on the EUR/USD pair is around 1.6, which is in line with the industry average.

FxPro supports trading on MT4, MT5, cTrader, and FxPro EDGE and has no limits on strategies. It also executes the trades with excellent speed.

Lowest Spread & Trading Fee Forex Broker in Cyprus

We picked Capital.com as the best forex broker with the lowest spread and trading fees in Cyprus.

Capital.com is headquartered in London and holds three regulatory licenses, including one in Cyprus. The broker offers extremely attractive spreads on forex pairs. According to our testing, Capital.com offers a 0.8 pips average spread on EUR/USD pair, compared to the industry average of 1.6 pips.

Capital.com does not charge any commission on trades (it only charges spreads) and has no deposit or withdrawal fees as well.

CySEC-Regulated Forex Brokers List & Review

Here is a list of the CySEC-regulated forex brokers which we have tested by opening real accounts, depositing real money, executing trades, and then withdrawing all funds:

| Cyprus Forex Broker | CySEC Regulated | About Our Test | Our Review |

|---|---|---|---|

| FBS | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | FBS Review |

| GO Markets | Yes | Deposit Amount: Over €4,500 Total Trade: 12 trades | GO Markets Review |

| Fortrade | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | Fortrade Review |

| RoboMarkets (RoboForex) | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | RoboMarkets Review |

| IC Markets | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | IC Markets Review |

| FXTM | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | FXTM Review |

| Capital.com | Yes | Deposit Amount: Over €3,500 Total Trade: 15 trades | Capital.com Review |

| FxPro | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | FxPro Review |

| Pepperstone | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | Pepperstone Review |

| Amana Capital | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | Amana Capital Review |

| FxPro | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | FxPro Review |

| XTB | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | XTB Review |

| eToro | Yes | Deposit Amount: Over $6,000 Total Trade: 18 trades | eToro Review |

| Tickmill | Yes | Deposit Amount: Over $8,000 Total Trade: 12 trades | Tickmill Review |

| Plus500 | Yes | Deposit Amount: Over €6,000 Total Trade: 18 trades | Plus500 Review |

FAQ & More on Cyprus Brokers

Traders usually have many questions related to trading generic trading-related queries. We tried to pick and answer some of the most important queries related to CySEC-regulated brokers.

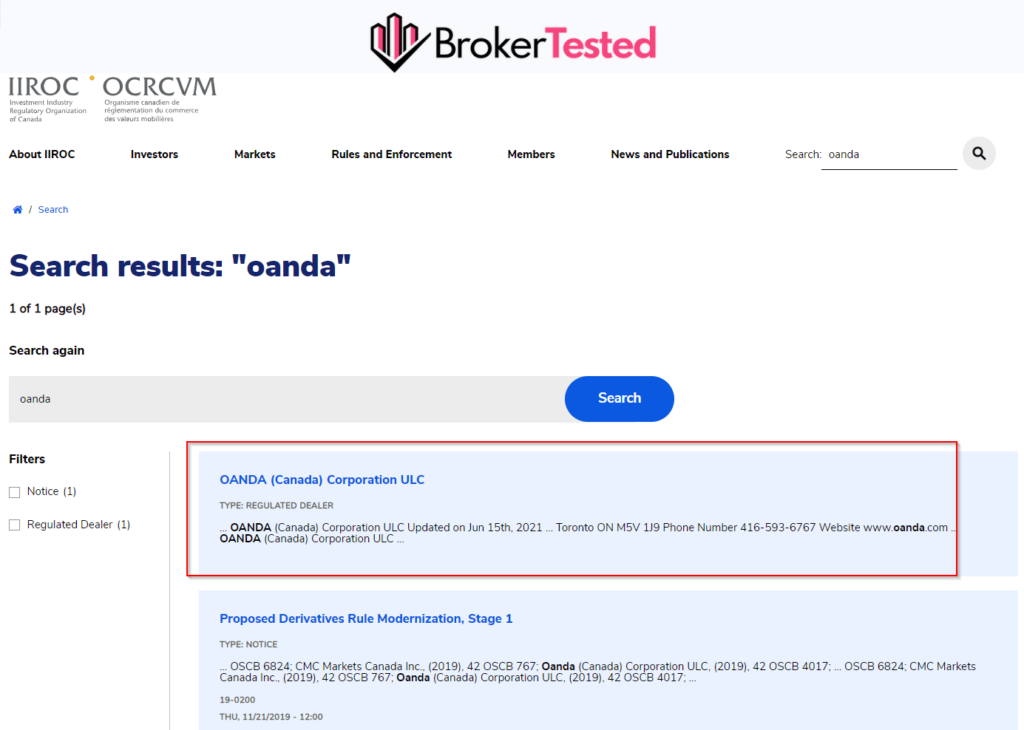

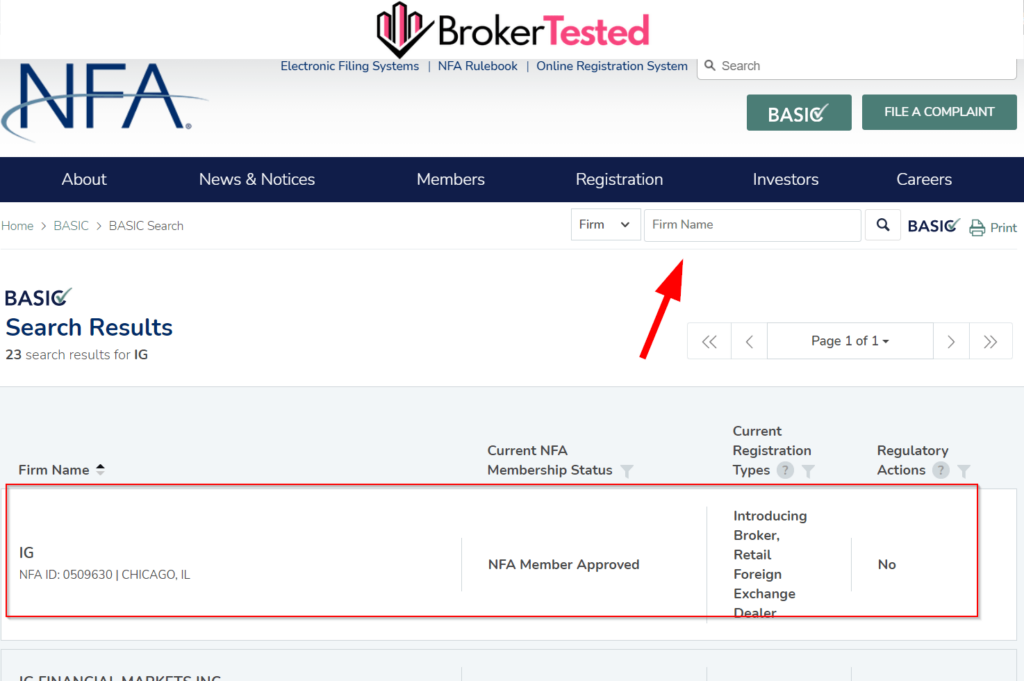

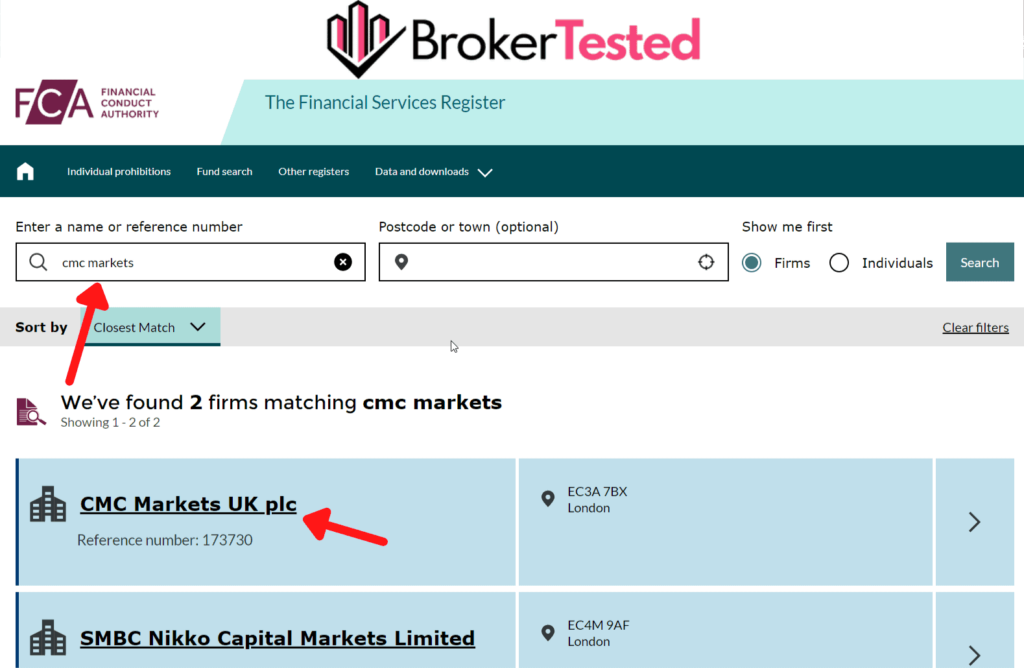

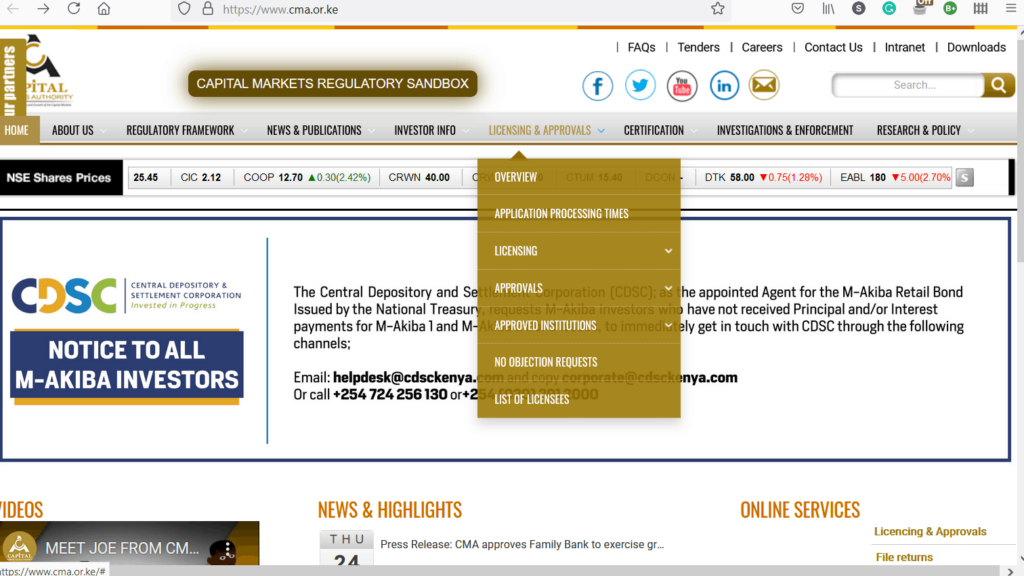

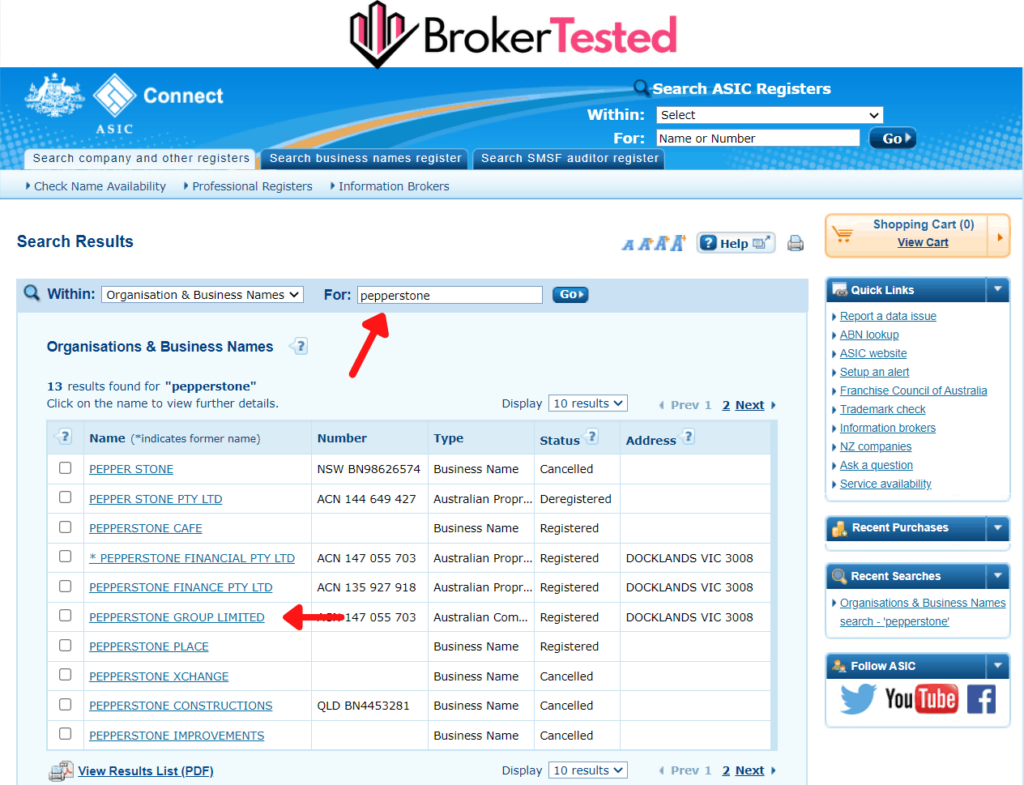

How to Verify CySEC-Regulated Brokers?

CySEC maintains an extremely detailed registry of all regulated entities, including forex brokers. It holds information on licensing and any warning or regulatory actions taken against the broker.

To check any regulated forex broker’s information, go to www.cysec.gov.cy and type the broker’s name in the search box. Then the name of the forex broker will appear, and all relevant details about it can be seen by clicking on the name.

The list of all investment firms regulated by Cyprus can be seen here.

ECN Brokers in Cyprus

ECN brokers offer traders direct market access and do not charge any spreads. They also do not take any position against the traders and make money only from trading fees.

Some ECN forex brokers in Cyprus are:

- Pepperstone

- IC Markets

- FXTM

MT4 Forex Brokers in Cyprus

MT4 is the most popular trading platform for forex trading and most of the Cyprus brokers offer training services on MT4, with or without other trading platforms. MT4 was developed by MeraQuotes Software.

Some of the top CySEC-regulated forex brokers offering trading on MT4 are:

- IC Markets

- Go Markets

- Pepperstone

- FxPro

- Tickmill

Low Spread Forex Brokers in Cyprus

Spread is the bid and ask difference on the quoted price on any trading instrument. Lower spreads offered by any broker attract more traders as they have to pay less trading fees as spreads.

Some CySEC-regulated low spread forex brokers are:

- Go Markets

- IC Markets

- Capital.com

- Pepperstone

- XTB

Swap Free Forex Brokers in Cyprus

Swap-free is the option of offering trading services without any fees. These accounts are considered Halal under Islamic Sharia Law as traders are not trading on commission-basis or paying any roll-over charges.

Some of the swap-free forex brokers in Cyprus are:

- Go Markets

- Fortrade

- RoboMarkets (RoboForex)

- IC Markets

Tax in Cyprus for Forex Trading

In the country, there is a definite difference between Capital and Income. Capital gains are not seen as just trading profits. There are rather regulated under the Law of Capital Gains, which is 20% in Cyprus. However, capital gains earned from share sales may not be subject to taxation in the country. On the other hand, income tax ranges from 20% to 35%, depending on the amount. The income becomes taxable when it exceeds €19,500 annually.

Traders should always remember that submitting tax forms to the country’s relevant institutions is their responsibility. Thus, they should be very careful if they want to avoid any complications and fines.