For this FirstECN review, we opened a live account and deposited over $3,000.

We traded the popular instrument in each market to identify the actual spreads and placed a total of 10 trades.

We reached out to the broker’s client support team to resolve the challenges we faced.

Finally, we withdrew our funds to evaluate whether the withdrawal process was smooth.

What is FirstECN

FirstECN is a Forex and CFD broker that positions itself as an ECN-style trading platform, offering clients access to the financial markets with tight spreads and fast execution.

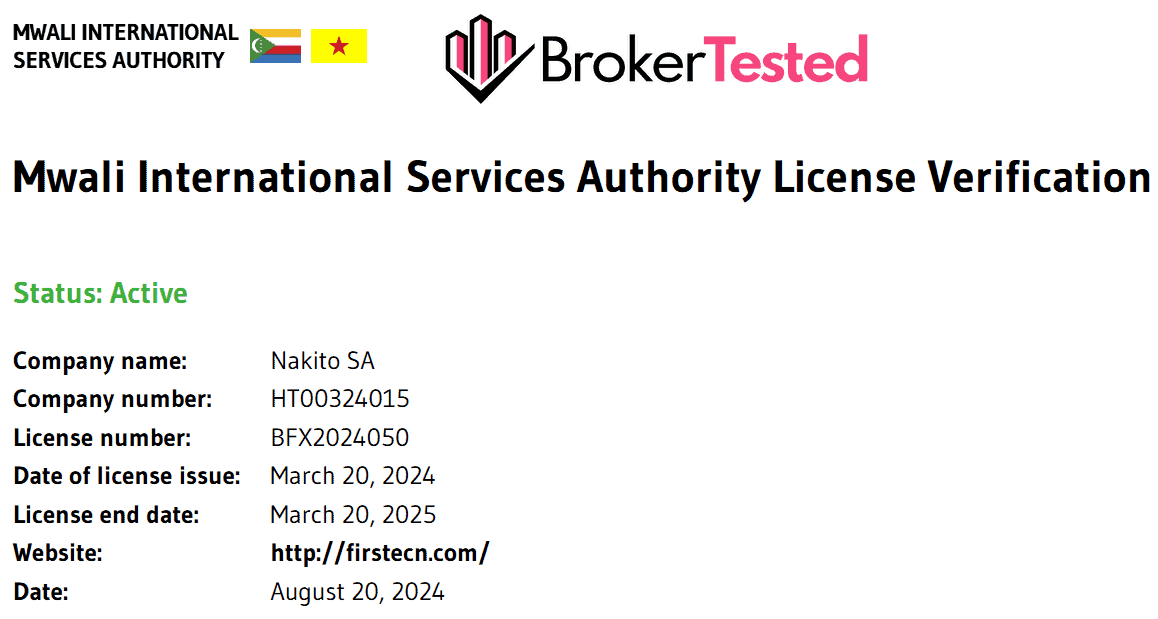

The company is registered in the Comoros Islands and is regulated by the Mwali International Services Authority (MISA) under license number BFX2024050.

FirstECN offers access to a range of popular trading instruments, including CFDs on Forex, cryptocurrencies, metals, stocks, commodities, and indices.

However, users should carefully review the company’s regulatory status, available account types, fees, and overall credibility before opening an account or depositing funds.

Some of the highlights of FirstECN are:

| 🗺️ Authorized & Regulated in | Comoros |

| 🛡️ Is FirstECN safe | Yes |

| 💰 EUR/USD Spread | 0.2 |

| 💳 Minimum deposit | $250 |

| 💰 Withdrawal fee | Depends on the payment provider |

| 🖥️ Trading Platform | FirstECN WebTrader, Mobile App, TradingView |

| 📈 Markets offered | CFDs on Forex, cryptocurrencies, metals, stocks, commodities, and indices. |

| 📉 Number of Products | 300 |

Licenses and Regulations

FirstECN is operated by Nakito SA, a company registered in the Union of the Comoros. It holds a brokerage license from the Mwali International Services Authority (MISA) under license number BFX2024050.

While this gives the broker a formal regulatory standing, MISA is considered a relatively less stringent offshore regulator.

The license also lacks the robust investor protections and prudential oversight typically found in major financial jurisdictions governed by regulators such as the FCA, ASIC, or CySEC.

Here are the details of FirstECN’s sole license:

| Legal entity | Registered in | Regulator | License number | Accepting clients from | Compensation scheme amount |

| Nakito SA | Comoros | MISA | BFX2024050 | Many countries globally | No compensation scheme |

Is FirstECN Safe

FirstECN offers basic security measures such as KYC/AML verification, encrypted data transmission, and internal controls that allow the broker to restrict account access in case of suspicious activity.

However, since the MISA is an offshore regulator, users should be cautious and verify all details before investing.

We had a smooth experience when trading with FirstECN.

For our tests, we opened Silver account with Nakito SA, which is regulated by the MISA in Comoros.

However, we recommend you conduct thorough research before opening a live account with FirstECN.

Fees and Commissions

Fees on FirstECN are built into spreads. There is no commission account or commission charges, since all fees are included in the spread that depends on the account type you select.

Spreads on trading instruments were on average with industry benchmark.

Spread Charged in our Trades

For our tests, we have chosen popular instruments in each market. We placed 3 trades for each instrument to get a picture of the average spread.

Our test is based on FirstECN Silver account. The spreads for our trades in all asset classes remained stable with minor variations.

Details of our trades are shown below the table.

| Markets | Instruments | 1st trade | 2nd trade | 3rd trade | Avg. Spread |

|---|---|---|---|---|---|

| Forex | EUR/USD | 0.2 | 0.3 | 0.2 | 0.2 |

| Indices | FTSE 100 | 1.5 | 1 | 1 | 1 |

| Stocks | Apple | 0.8 | 0.75 | 0.8 | 0.8 |

| Commodities | Gold | 3.5 | 3 | 3 | 3 |

We executed all our trades via the FirstECN iOS App on our iPhone.

Our testing finds that FirstECN’s spreads across all assets are lower than or in line with the industry average.

| Markets | Instruments | Avg. Spread Charged | Industry Avg. Spread |

|---|---|---|---|

| Forex | EUR/USD | 0.2 | 1.2 |

| Indices | FTSE 100 | 1 | 1.65 |

| Stocks | Apple | 0.8 | 1.75 |

| Commodities | Gold | 3 | 3.53 |

Other fees

FirstECN does not apply any deposit fees, but third-party charges may still occur. Banks, e-wallets, payment processors, or other external providers may impose their own fees, and the client is responsible for covering those costs.

There are no hidden charges, and all applicable fees are reported to clients, enabling users to plan their expenses effectively and avoid unexpected costs.

Account Types

FirstECN offers 3 main account types: Silver Account, Gold Account, and Platinum Account.

Details of the Account types and differences are outlined below:

| Silver | Gold | Platinum | |

|---|---|---|---|

| Trading Platforms | FirstECN WebTrader, Mobile App, TradingView | FirstECN WebTrader, Mobile App, TradingView | FirstECN WebTrader, Mobile App, TradingView |

| Account Currency | USD, EUR, GBP | USD, EUR, GBP | USD, EUR, GBP |

| Minimum Deposit | $250 | $250 | $250 |

| Commission | Zero | Zero | Zero |

| Order Execution | Market Execution | Market Execution | Market Execution |

| Spread | From 0.2 | From 0.1 | From 0.1 |

| Note | – | Spread Discount 50% | Spread Discount 75% |

FirstECN also offers a Demo Account, allowing beginners to practice and professional traders to test strategies in a risk-free environment using real-time market conditions.

For our tests, we chose to open Silver Account.

FirstECN Account Opening

FirstECN account opening was quite easy to follow. We went through the entire registration process and completed it online.

The process of registration of a new FirstECN account:

- Visit the official FirstECN website.

- Navigate to the Sign Up section on the homepage.

- Fill out the registration form with your basic details, such as name, phone number, and preferred account settings.

- Choose between Silver, Gold, or Platinum accounts based on your trading experience and goals.

- Upload a government-issued ID (passport or national ID) and a recent proof of address (e.g., utility bill or bank statement).

- Choose your desired platform for the live account.

- Submit the form and verify your email if required.

- Once registered, download the selected trading platform or access the WebTrader directly through your browser.

- Log in using the account credentials provided.

- Once your account is approved and funded, you can access the trading platform and begin trading.

The registration process took about 15 minutes, and our account was approved on the same day.

We opened Silver account with Nakito SA, which is regulated by the MISA in Comoros for this test.

Deposit and Withdrawal

Deposits and withdrawals on FirstECN are easy and fast. A range of funding methods is supported, and all our requests were completed without any issues.

FirstECN Minimum Deposit

The minimum deposit to open a FirstECN account is $250, which applies to all account types.

Traders only need to maintain the minimum deposit balance in their accounts.

FirstECN Deposit

FirstECN offers a variety of payment options, including bank transfers, credit/debit cards, and more, allowing users to choose the method that best suits them.

The broker does not charge any deposit fees, and processed our deposit quickly.

FirstECN Withdrawal

FirstECN allows clients to make withdrawals using the same payment methods as available for deposits.

The broker does not charge withdrawal fees. However, similar to deposits, third-party providers such as banks, wallets, and payment systems may impose their own fees, which are the responsibility of the client.

We did not face any challenges when withdrawing funds.

Markets and Products

FirstECN offers over 300 trading instruments across various asset classes, including CFDs on Forex, cryptocurrencies, metals, stocks, commodities, and indices.

Here’s the complete list of FirstECN’s product offering:

| Markets | Instruments |

|---|---|

| Forex | 70+ |

| Indices | 30 |

| Metals | 20 |

| Commodities | 5 |

| Cryptocurrencies | 5 |

| Stocks | 200 |

The broker offers a standard range of trading instruments; however, it is below industry leaders, who provide thousands of products.

Trading Conditions

The trading conditions at FirstECN are rather good. The broker allows hedging and scalping strategies, and clients can also request to change their leverage by contacting support.

| Trading Method | Allowed |

|---|---|

| Hedging | Yes |

| Scalping | Yes |

| Change Leverage | Yes |

Leverage

FirstECN offers traders various leverage levels depending on the instrument, with a maximum of 1:200 considered high leverage.

Traders can also change their account’s leverage levels after registration.

The table below shows the different leverage levels available:

| Markets | DXA Seychelles Limited |

|---|---|

| Major Currency Pairs | 200:1 |

| Commodities | 100:1 |

| Indices | 100:1 |

| Stocks | 10:1 |

| Cryptocurrencies | 10:1 |

Bonus

FirstECN’s Gold and Platinum account holders can benefit from reduced spreads and swap discounts.

Gold account holders receive a 40% swap discount and a 50% spread discount, while Platinum account holders enjoy a 60% swap discount and a 75% spread discount.

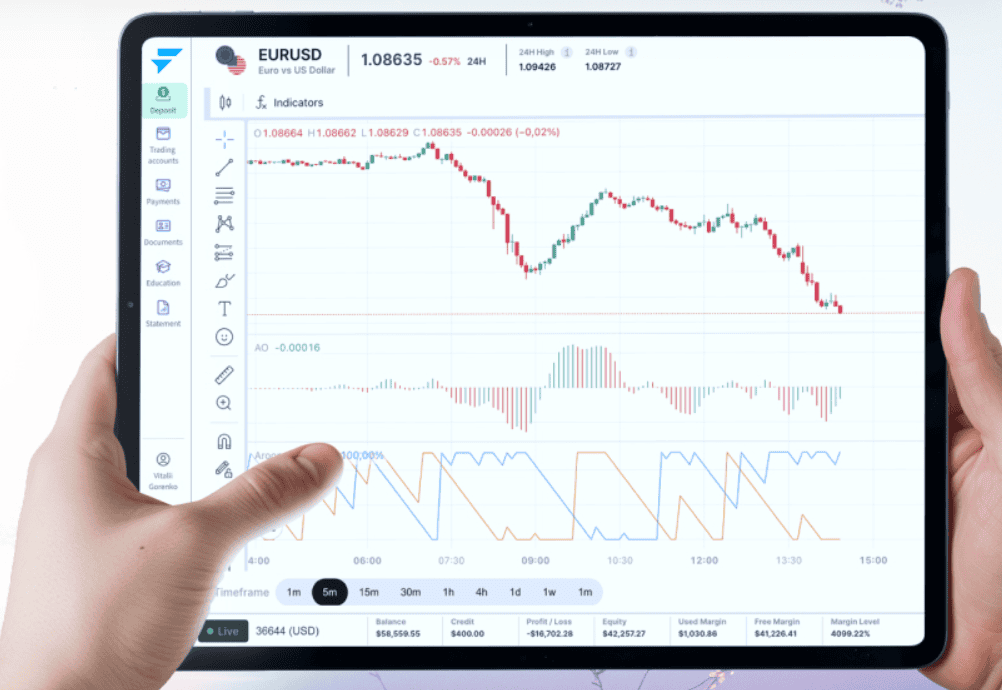

FirstECN Platform

FirstECN offers trading services on its proprietary web and mobile platforms, as well as through integration with the TradingView platform.

- FirstECN WebTrader

- FirstECN Mobile App

- TradingView

We found the platforms offer a user-friendly experience with robust charting features and a wide range of functionalities.

Research and Tools

FirstECN offers a range of market research and analysis tools. For technical analysis, the broker integrates TradingView’s charting technology.

Some of the key tools offered by the broker are:

- Different chart views

- Trading indicators

- Economic calendar

- Trading strategies

- Multiple layouts

- Trend line tools

- Real-time data

- Newsfeed

We find FirstECN’s research offering to be quite competitive, as the broker provides users with a variety of research and analytical tools, ranging from advanced charting and real-time data to comprehensive risk management features, all accessible across multiple devices.

Education

FirstECN offers limited educational resources. The broker provides an FAQ section to address common trading questions, along with market news updates.

Based on our Test FirstECN Education is limited compared to brokers with comprehensive Education Academy or Trading Schools.

Customer Service

FirstECN provides responsive customer support.

Traders can contact the broker via:

- Contact form

The support team is available 24/5, ensuring that users can receive assistance with a range of inquiries and issues.

Our experience with FirstECN customer support was good.

We filled out the contact form and inquired about the average EUR/USD spread on the Silver account. The response we received through the contact form was accurate.

| Question | Response Time | Quality of reply | |

|---|---|---|---|

| Contact form | Asked about the EUR/USD average spread | 1-2 hours | The information was accurate. |

Conclusion

Overall, had a smooth experience with FirstECN, from the account opening to the deposit and trading process.

FirstECN BrokerTested Review found that the Broker delivers a good trading experience with popular trading instruments, and Forex spreads that are industry-standard or below average.

Our experience with account opening, deposits, and withdrawals was also smooth and without any issues.

The broker also offers multiple trading platforms, including its proprietary WebTrader, mobile apps, and TradingView integration, giving clients flexibility and access to advanced charting tools.

We recommend FirstECN to Forex traders looking for competitive fess, a flexible trading environment with multiple platform options, as well as access to a variety of popular assets.

We recommend FirstECN for traders who are

- International traders

- Beginners

- Experienced traders

- Run Hedging

- Scalping

- Need a broker with good research tools

- Prefer flexible account types

FirstECN might not be a fit if you are

- Real Stock / Futures Trading

- Looking for a wider instrument range

- Prefer other platforms like MT4, MT5, cTrader, NinjaTrader

- Seeking comprehensive educational resources

- Commission-based trading

- Need a regulation by a reputable financial authority