For this Libertex review, we have opened a standard account with the broker and deposited over €5,000.

We traded the popular instrument in each market to get the real spreads and commissions, and placed a total of 15 trades.

We also reached out to customer support to solve the issues we faced.

Finally, we withdrew our funds to see if there are any issues with the withdrawal process.

What is Libertex?

Libertex is a Cyprus-headquartered forex and contracts for difference (CFDs) broker brand. It was established in 1997.

The broker operates globally with its license from Cyprus, South Africa, and Belarus. Its offerings include forex, indices, commodities, cryptocurrencies, and stocks CFDs.

Some of the highlights of Libertex are:

| 🗺️ Authorised & Regulated in | Cyprus, South Africa, Belarus |

| 🛡️ Is Libertex safe | Yes |

| 💰 EUR/USD Spread | Zero Spread |

| 💳 Minimum deposit | €100 or $10 |

| 💰 Withdrawal fee | Depends on the withdrawal method |

| 🖥️ Trading Platform | MT4, Libertex platform |

| 📈 Markets offered | Forex, Indices, Stocks, Commodities, Cryptocurrencies |

| 📉 Number of Products | 271 (depends on the jurisdiction) |

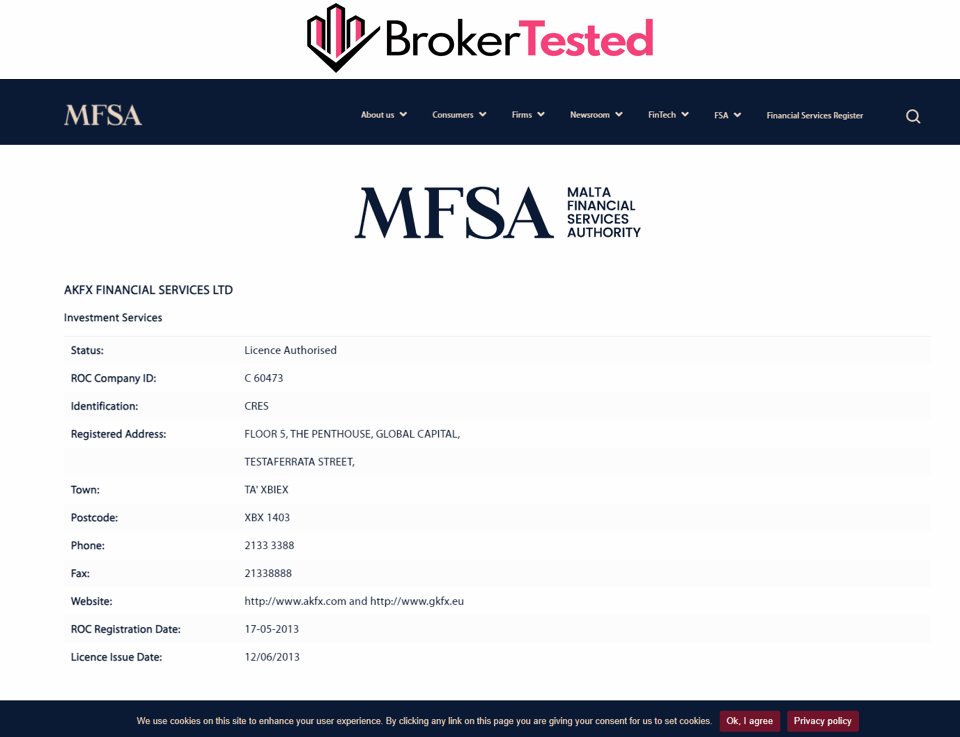

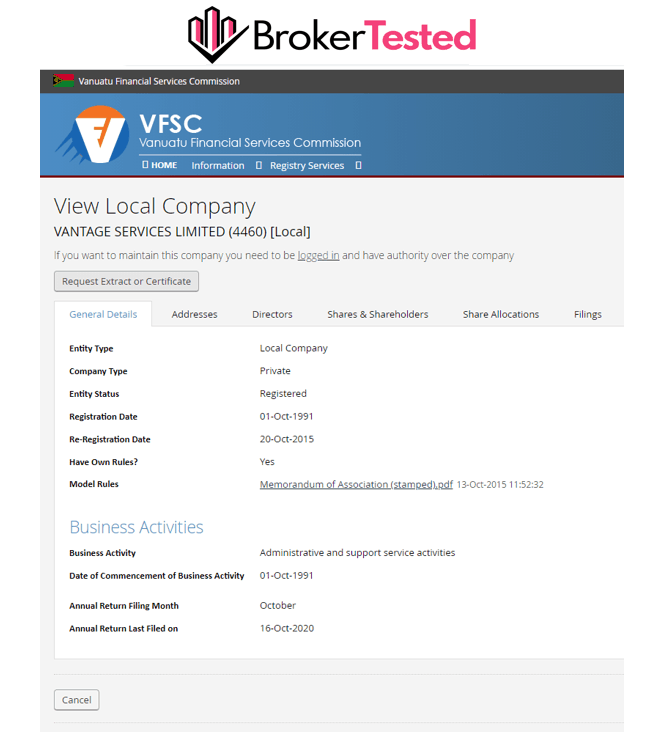

Licenses and Regulations

Libertex holds licenses 3 regulatory licenses.

The broker is regulated in Cyprus, South Africa, Belarus. Being operational for more than two decades, the broker also has a good reputation in the market.

The full list of Libertex licenses is below:

| Legal entity | Registered in | Regulator | License number | Accepting clients from | Compensation scheme amount |

|---|---|---|---|---|---|

| Indication Investments Ltd | Cyprus | Cyprus Securities and Exchange Commission (CySEC) | 164/12 | European Union | €20,000 |

| Libertex (pty) ltd | South Africa | Financial Sector Conduct Authority (FSCA) | 47381 | South Africa | No compensation scheme |

| LLC Financial Company Forex Club | Belarus | National Bank of the Republic of Belarus (NBRB) | 192580558 | Belarus | No compensation scheme |

| Libertex International Company Limited | St.Vincent & the Grenadines | NA | NA | Global | NA |

Libertex International Company Limited is accepting non-EU clients, but the broker told us that it does not need any license from local regulators for operations.

Is Libertex Safe

Yes, Libertex is a safe broker for trading.

The broker is well-regulated with a total of 3 licenses. The clients under CySEC also receive a compensation scheme of €20,000 for the protection of their funds.

For our tests, we opened a Libertex Account with Indication Investments Ltd, which is regulated by Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

Fees and Commissions

Libertex generally charges trading fees, but there are some spreads for some instruments as well.

Spread Charged in Our Trades

For our tests, we have chosen popular instruments in each market. We placed 3 trades for each instrument to get a picture of the average trading fees.

Our test is based on the Libertex account. The broker only charged commissions on our traders with zero spreads.

Details of our trades are shown below the table.

| Markets | Instruments | 1st trade margin adjusted commission | 1st trade trading commission | 2nd trade margin adjusted commission | 2nd trade trading commission | 3rd trade margin adjustment commission | 3rd trade trading commission |

|---|---|---|---|---|---|---|---|

| Forex | EUR/USD | €6 | €0 | €6 | €0 | €6 | €0 |

| Indices | FTSE 100 | €4.66 | €3 | €2.33 | €1.50 | €2.33 | €1.50 |

| Stocks | Apple | €1.93 | €1.50 | €1.93 | €1.50 | €1.93 | €1.50 |

| Commodities | Gold | €3 | €0.66 | €3 | €0.66 | €3 | €0.77 |

| Cryptocurrency | Bitcoin | €5.52 | €1.50 | €5.59 | €1.50 | €2.26 | €0.60 |

| Markets | Instruments | Multiplier | Volume |

|---|---|---|---|

| Forex | EUR/USD | 30 | €2,000 |

| Indices | FTSE 100 | 20 | €1000 for 1st trade, €500 for 2nd and 3rd trade |

| Stocks | Apple | 5 | €500 |

| Commodities | Gold | 20 | €1,000 |

| Cryptocurrency | Bitcoin | 2 | €500 for 1st trade and 2nd trade €200 for 3rd trade |

Other Fees

Libertex does not charge any deposit fees (only with one exception). The broker, however, charges withdrawal fees for most of the methods.

Libertex also collects a $5 monthly inactivity fee from the accounts without any trading activity for 180 days, holding a balance of less than $10,000.

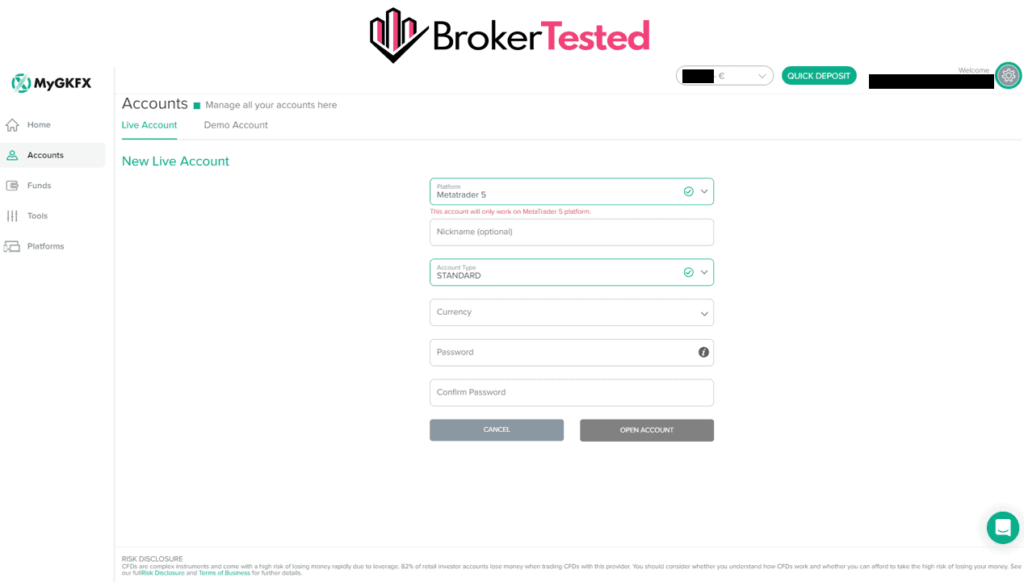

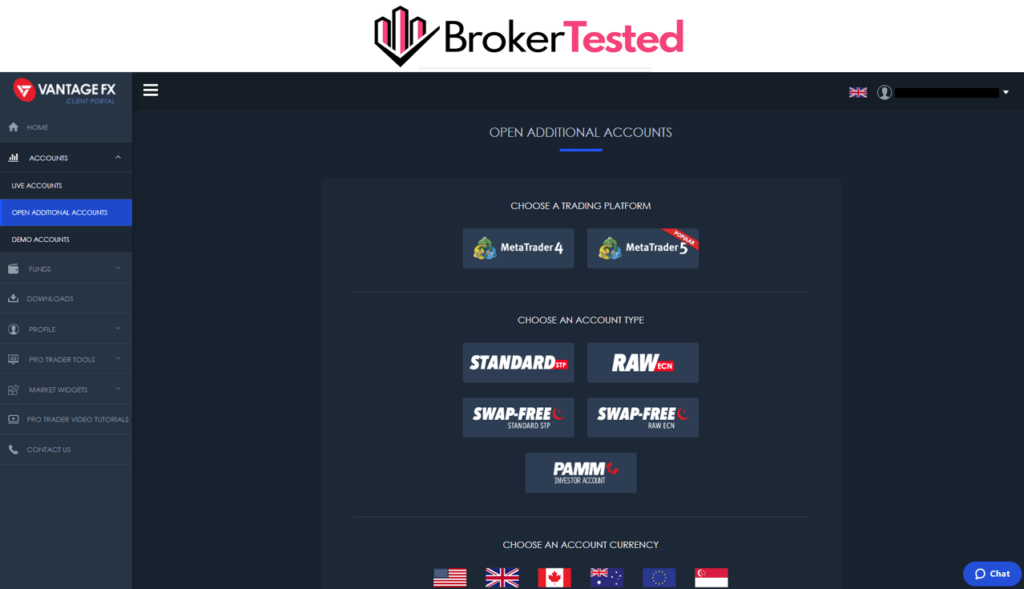

Account Types

Libertex offers three types of accounts: Libertex account, MetaTrader 4 account, and MetaTrader 5 account (available only to customers outside the EU).

Details of all account types under Indication Investments Ltd (for EU clients):

| Libertex Account | MT4 Account | |

|---|---|---|

| Trading Platforms | Libertex Platform | MetaTrader 4 |

| Account Currency | USD, EUR, GBP, PLN, CHF | USD, EUR, GBP, PLN, CHF |

| Minimum deposit | €100 | €100 |

| Commission | From 0.03% | From €0.04 |

| Order execution | Market Execution | Market Execution |

| Spread | From 0 | From 0 |

Details of all account types under Libertex International Company Limited (for global clients):

| Libertex Account | MT4 Account | MT5 Account (Market) | MT5 Account (Instant) | |

|---|---|---|---|---|

| Trading Platforms | Libertex Platform | MetaTrader 4 | MetaTrader 5 | MetaTrader 5 |

| Account Currency | USD | USD | USD | USD |

| Minimum deposit | $10 | $10 | $10 | $10 |

| Commission | From 0% | From $0.06 | From $0.07 | From $0 |

| Order execution | Market Execution | Market Execution | Market Execution | Instant Execution |

| Spread | From 0.00003 | From 0 | From 0 | From 0.6 |

Libertex Login

Our overall experience of opening a new account with Libertex was smooth and fast.

We opened a Libertex Account for our tests under the Cyprus-regulated entity.

The process of registration of a new Libertex account:

- Enter email and password in the initial registration form.

- Go to profile management and verify email and fill in details like name, date of birth, country, city, and passport.

Traders need to provide additional details and summit verification details during the first deposit.

We have to provide the following details while making the first deposit:

- Enter details on the level of education, employment status, annual income level, source of wealth, and anticipated yearly investment.

- Answers a few questions on trading experience and knowledge.

- Enter residential address and nationality.

We submitted the following documents to verify our Libertex account:

- Copy of national identification (both front and back)

- Copy of our bank statement

The registration process took around 5 minutes. Our account was verified in 2 working days.

Our account was registered on April 2, 2023, and approved on April 6, 2023.

Our overall account opening experience was smooth and without any issues from registration to verification.

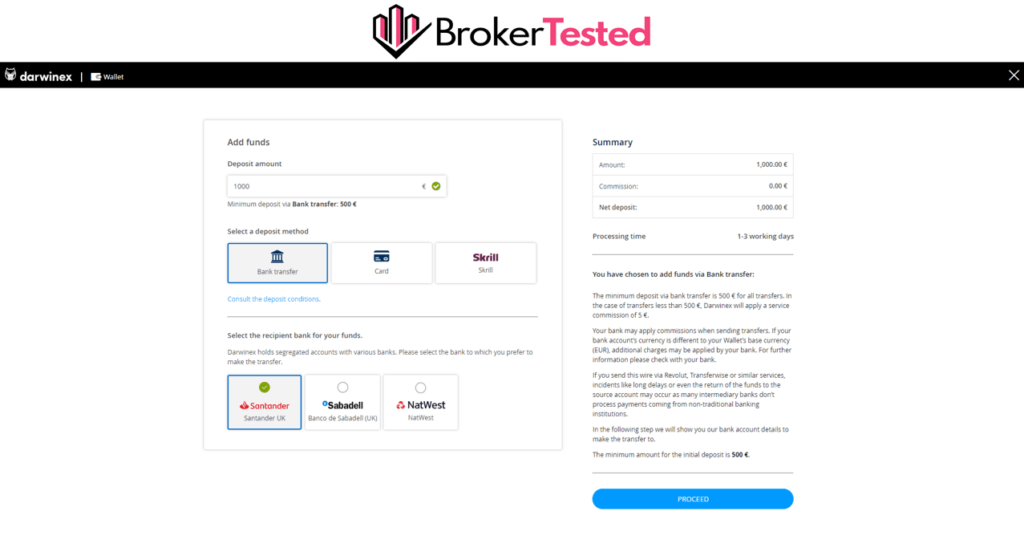

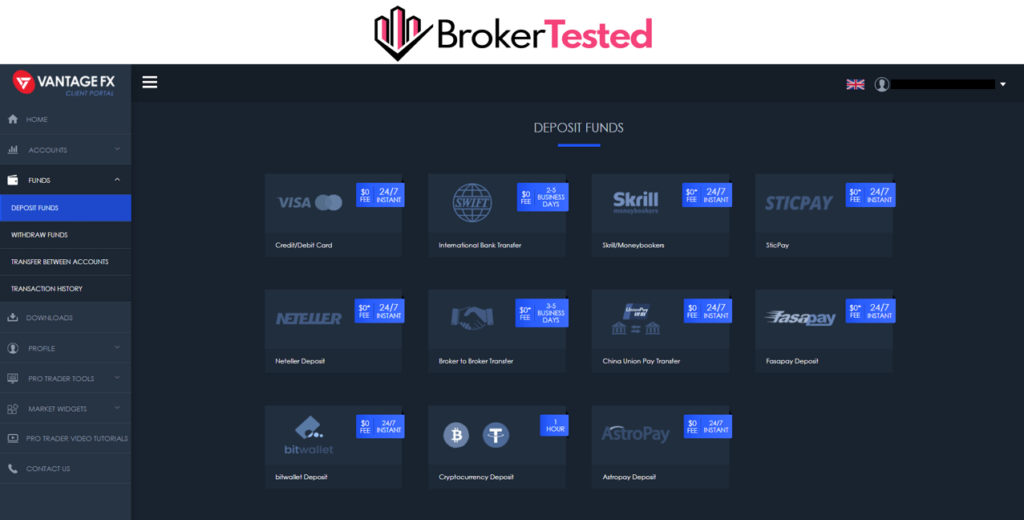

Deposit and Withdrawal

Deposits on Libertex are easy and fast, but we faced additional and tiresome scrutiny while making withdrawals.

The broker does not charge any fees for most of the deposit and withdrawal methods but there are some exceptions.

Deposit and withdrawals fee details on Indication Investments Ltd:

| Method | Deposit Fee | Withdrawal Fee |

|---|---|---|

| Bank transfer | None | 0.5% (Min €2, max €10) |

| Credit/ debit card | None | €1 |

| Skrill | 1.9% | None |

| Neteller | None | 1% |

Deposit and withdrawals fee details on Libertex International Company Limited:

| Method | Deposit Fee | Withdrawal Fee |

|---|---|---|

| Bank transfer | None | $29 |

| Credit/ debit card | 2.5% (Min $0.5) | NA |

| Skrill | 1.9% (Min $0.5) | 1% (Min $0.5) |

| Neteller | 4% | NA |

Libertex did not charge any fee on our Skrill deposit

Minimum Deposit

The minimum deposit on Libertex depends on the entity under which the account is opened.

- Indication Investments Ltd: €100

- Libertex International Company Limited: $10.

Traders only need to invest a minimum of $10 on every investment on Libertex International Company Limited.

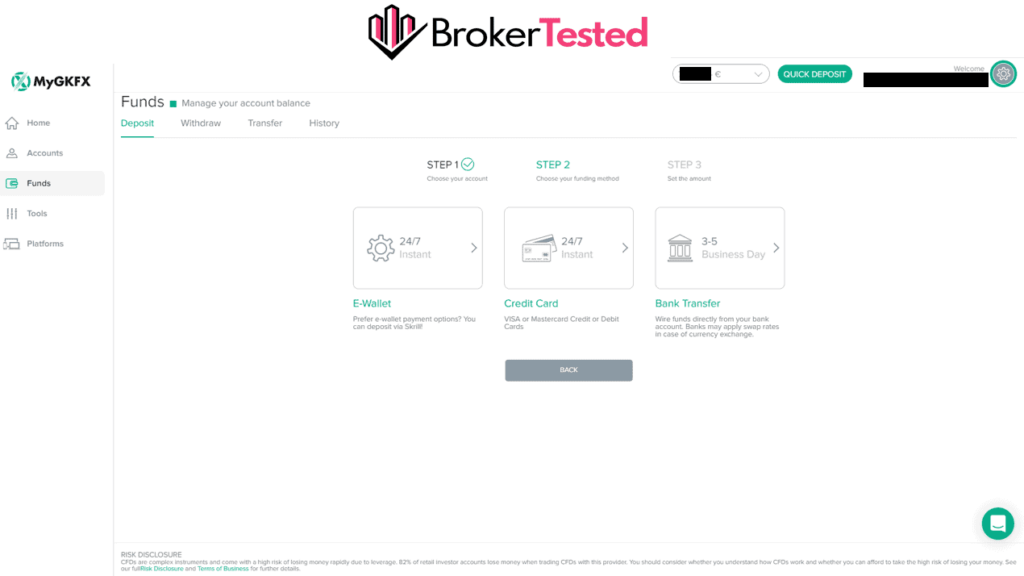

Deposit

Libertex supports deposits with bank transfers, credit and debit cards, and popular e-wallets like Neteller and Skrill. The broker also accepts funds through other regional payment platforms like Sofort (Germany, Spain, Italy, Austria), Ideal (Netherlands), GiroPay (Germany), and a few more.

The broker mostly does not charge any fees for deposits for EU clients but charges heavy fees for non-EU clients.

The deposit methods also depend on the account jurisdiction.

We tested the deposit process on Libertex using a credit card, Neteller, Skrill, and PayPal.

Details of our fund deposits are shown in the below table.

| Payment Method | Submitted Date | Funded Account Date | Funding Time | Fee |

|---|---|---|---|---|

| Credit card | 2023-04-08 | 2023-04-08 | Instant | 0 |

| Skrill | 2023-04-08 | 2023-04-08 | Instant | 0 |

| Neteller | 2023-04-08 | 2023-04-08 | Instant | 0 |

| PayPal | 2023-04-08 | 2023-04-08 | Instant | 0 |

Libertex mentions on its website that there is a 1.9% deposit fee on Skrill, but the broker did not charge us anything on our Skrill deposit.

After depositing €5,000, we received a notice from Libertex saying that we became a VIP client and will receive a Libertex platform trading commission discount of 30%, along with Premium support.

Withdrawal

Libertex allows withdrawals with bank transfers, credit and debit cards, and online wallets like Neteller and Skrill.

Though the Libertex website mentions that there are withdrawal fees for most of the deposit methods, it did not charge any fee for most of our withdrawals.

Overall, our experience with the Libertex withdrawal process was not smooth.

Details of our withdrawal requests are in the table below.

| Payment Method | Submitted Date | Fund Released Date | Fund Arrived Date | Withdrawal Time | Fee |

|---|---|---|---|---|---|

| Credit card | 2023-04-09 | NA | NA | NA | NA |

| Credit card | 2023-04-14 | NA | NA | NA | NA |

| Neteller | 2023-04-12 | 2023-04-14 | 2023-04-14 | 2 working day | 1% |

| Skrill | 2023-04-12 | 2023-04-14 | 2023-04-14 | 2 working day | 0 |

| PayPal | 2023-04-08 | 2023-04-14 | 2023-04-14 | 4 working day | 0 |

| Skrill | 2023-04-15 | 2023-04-15 | 2023-04-15 | Instant | 0 |

Our experience with Libertex withdrawal was not smooth with quite a bit back and forth.

After submitting the withdrawal request, Libertex requested proof of identity (selfie with ID and image of front/backside of credit card) from us. Additionally, the requirements state that the selfie with ID must be a color photo clearly showing the trader’s face, the trader’s entire arm holding the ID, and all the information from the front side of the ID.

We provided a clear photo selfie with ID but Libertex said our ID was not clear enough and we needed to take another photo to make it more visible. Finally, we received the withdrawal fund on April 14.

We submitted twice withdrawal requests with a credit card twice, but both failed. Libertex said it was due to our bank issue and we had to withdraw the rest of the fund using Skrill at last.

Libertex Markets and Products

Libertex offers CFDs trading services with forex, indices, stocks, commodities, and cryptocurrencies instruments.

The complete list of Libertex offerings are:

| Markets | Instruments |

|---|---|

| Forex | 51 |

| Indices | 21 |

| Stocks and ETFs | 129 |

| Commodities | 18 |

| Cryptocurrency | 52 |

The markets and the number of offered instruments will depend on the account jurisdiction.

Trading Conditions

Trading conditions on Libertex are decent. The broker allows hedging and scalping strategies but traders cannot change leverage levels.

Though scalping is allowed, traders cannot open more than 1 position within a minute.

| Trading Method | Allowed |

|---|---|

| Hedging | Yes |

| Scalping | Yes (Traders cannot open more than 1 position in a minute) |

| Change Leverage | No |

Leverage

Leverages offered by the various entities of Libertex are detailed below:

| Markets | Indication Investments Ltd | LLC Financial Company Forex Club | Libertex International Company Limited |

|---|---|---|---|

| Major Currency Pairs | 30:1 | 100:1 | 999:1 |

| Non-Major Currency Pairs | 20:1 | 100:1 | 200:1 |

| Gold | 20:1 | 100:1 | 300:1 |

| Other Commodities (except Gold) | 10:1 | 100:1 | 200:1 |

| Indices | 20:1 | 100:1 | 500:1 |

| Stocks | 5:1 | 5:1 | 20:1 |

| Cryptocurrencies | 2:1 | 5:1 | 200:1 |

Trading Platform

Libertex offers trading services on its proprietary Libertex platform and industry-standard MetaTrader 4 and MetaTrader 5 (only for non-EU clients) platforms.

We executed all our trades on the Libertex trading platform.

Bonus

Libertex International Company Limited offers a 100% welcome bonus to all new traders. The minimum deposit amount to receive the Welcome Bonus is $100. The maximum bonus amount is $10,000.

Research and Tools

Libertex offers decent market research and analysis tools.

Tools offered by the broker include:

- Good charting tools

- Economic calendar

- Signals

- Trading automation

- Newsfeed

Education

Libertex offers poor educational resources.

The broker’s educational materials only include:

- Some guides on trading

- Webinars

- Demo account

Customer Service

Libertex has decent customer support.

Traders can contact the broker via:

- Live chat

- Phone

The support staff is available only on weekdays.

Our experience with Libertex customer support was mixed.

The support staff on both live chat and email was quick enough with the response, but could not provide answers to all our queries.

| Question | Response Time | Quality of reply | |

|---|---|---|---|

| Live Chat | Asked about minimum deposit and withdrawal fees | 1 minute | Clear and accurate |

| Asked about the offered leverage under Belarus license | 1 minute | Could not provide any answer | |

| Asked about account currencies | 1 working day | Clear and direct |

Libertex Forex Club

The broker also has a detailed FAQ section for frequently faced issues.

Conclusion

Our overall experience with Libertex was decent.

The broker offers fast execution without any spreads. It charges a commission on trades, which is higher than the industry average. The broker charged a 0.3% margin adjustment fee on all instruments.

Account opening and deposits were smooth and fast, but withdrawals on the broker were frustrating. We had to provide identity proof and selfies with harsh requirements for withdrawals.

Our experience with customer support was mixed as some of the responses were fast, clear, and detailed, while they could not answer one. We recommend traders to contact the broker via Live chat.

On the positive side, Libertex allows traders to run hedging and scalping, but they cannot change leverage levels.

We recommend Libertex to traders who are taking long-term positions.

We recommend Libertex for traders who are

- Experienced traders

- Swing traders

- Trading currency pairs

- Using Metatrader

- EA trader

- Day trader

- Commission based Trading

Libertex might not be a fit if you are

- Beginners in trading