TradGrip Review 2025

For this TradGrip review, we opened a live account and deposited over €3,000.

We traded the popular instrument in each market to identify the actual spreads and placed a total of 10 trades.

We reached out to the broker’s customer service team to resolve the challenges we faced.

Finally, we withdrew our funds to evaluate whether the withdrawal process was smooth.

What is TradGrip

TradGrip is a Comoros-based Forex and CFDs broker founded in 2024. It is operated by Zenith Markets PLC and regulated by MISA (MWALI International Services Authority).

The broker provides access to over 250 CFDs across multiple asset classes, including Forex, cryptocurrencies, metals, stocks, commodities, and indices.

Some of the highlights of TradGrip are:

| 🗺️ Authorised & Regulated in | Fomboni, Comoros |

| 🛡️ Is TradGrip safe | Yes |

| 💰 EUR/USD Spread | 1 |

| 💳 Minimum deposit | €250 |

| 💰 Withdrawal fee | Wire Transfer: $50 |

| 🖥️ Trading Platform | WebTrader, TradGrip App |

| 📈 Markets offered | Forex, cryptocurrencies, metals, stocks, commodities, and indices. |

| 📉 Number of Products | 250 |

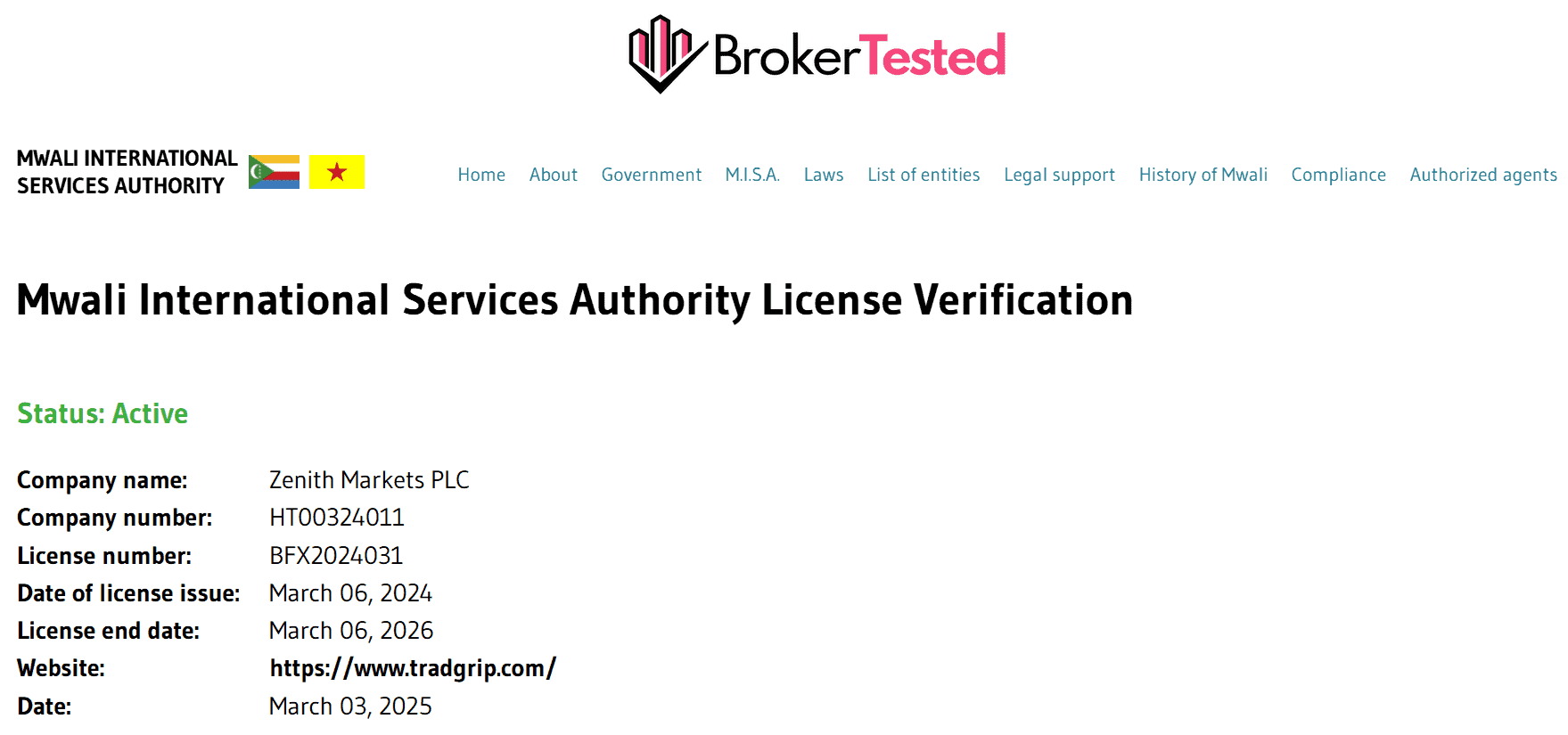

Licenses and Regulations

TradGrip is licensed by one regulator, Mwali International Services Authority (MISA), which is based on the island of Mwali, part of the Comoros Islands.

The broker operates under the brand name of Zenith Markets PLC, a company registered in the Comoros Union.

Although TradGrip holds a license from MISA, traders should be aware that this licensing may not offer the same level of regulatory oversight and consumer protection as licenses from more established financial authorities.

Here are the details of TradGrip’s sole license:

| Legal entity | Registered in | Regulator | License number | Accepting clients from | Compensation scheme amount |

| Zenith Markets PLC | Comoros | MWALI International Services Authority (MISA) | BFX2024031 | Globally many countries | No compensation scheme |

Is TradGrip Safe

TradGrip is overall considered safe to trade, however, it is also a subject that needs careful consideration.

While the broker offers access to a range of trading instruments and platforms, it is licensed by the Mwali International Services Authority, which is an offshore jurisdiction and not recognized by major global financial regulators.

Also, TradGrip is not part of any investor compensation scheme, meaning clients may not be protected in the case of broker insolvency.

We had a smooth experience when trading with TradGrip.

For our tests, we opened Silver account with Zenith Markets PLC, which is regulated by the MISA in Fomboni, Comoros.

However, we recommend you conduct thorough research before opening an account with TradGrip.

Fees and Commissions

Trading fees on TradGrip are built into spreads. There is no commission account or commission charges, since all fees are included in the spread that depends on the account type you select.

Spreads on trading instruments were on average with industry benchmark.

Spread Charged in our Trades

For our tests, we have chosen popular instruments in each market. We placed 3 trades for each instrument to get a picture of the average spread.

Our test is based on TradGrip Silver account. The spreads for our trades in all asset classes remained stable with minor variations.

Details of our trades are shown below the table.

| Markets | Instruments | 1st trade | 2nd trade | 3rd trade | Avg. Spread |

|---|---|---|---|---|---|

| Forex | EUR/USD | 1 | 1.1 | 1 | 1 |

| Indices | FTSE 100 | 1 | 1 | 1 | 1 |

| Stocks | Apple | 0.8 | 0.75 | 0.8 | 0.8 |

| Commodities | Gold | 3 | 3.15 | 3 | 3 |

We executed all our trades via the TradGrip iOS App on our iPhone.

Our testing finds that TradGrip’s spreads across all assets are lower than or in line with the industry average.

| Markets | Instruments | Avg. Spread Charged | Industry Avg. Spread |

|---|---|---|---|

| Forex | EUR/USD | 1 | 1.16 |

| Indices | FTSE 100 | 1 | 1.65 |

| Stocks | Apple | 0.8 | 1.75 |

| Commodities | Gold | 3 | 3.53 |

Other fees

TradGrip does not charge deposit or withdrawal fees for most methods, except for wire transfers, which require a minimum withdrawal amount of $50 to cover banking charges.

The broker does not charge inactivity fees, as well.

Account Types

TradGrip offers 3 main account types: Silver Account, Gold Account, and Platinum Account.

Details of the Account types and differences are outlined below:

| Silver | Gold | Platinum | |

|---|---|---|---|

| Trading Platforms | WebTrader, Apps | WebTrader, Apps | WebTrader, Apps |

| Account Currency | USD/ EUR | USD/ EUR | USD/ EUR |

| Minimum Deposit | €250 | €250 | €250 |

| Commission | Zero | Zero | Zero |

| Order Execution | Market Execution | Market Execution | Market Execution |

| Spread | From 1 | From 0.5 | From 0.25 |

| Note | – | Spread Discount 50% | Spread Discount 75% |

TradGrip also offers swap-free Islamic accounts available for all account types.

For our tests, we chose to open Silver Account.

TradGrip Account Opening

TradGrip account opening was quick and easy to follow. We went through the entire registration process and completed it online.

The process of registration of a new TradGrip account:

- Enter first name, last name, email, mobile number, and password.

- Enter the verification code sent to the provided email.

- Enter the country of residence, account currency, date of birth, and address.

- Choose the desired trading platform.

- Provide financial details like employment status, annual income, and value of savings and investments.

- Answer questionnaires on trading experience.

The registration process took 15 minutes only, and our account was approved on the same day.

We opened Silver account with Zenith Markets PLC, which is regulated by the MISA, Comoros for this test.

Deposit and Withdrawal

Deposits and withdrawals on TradGrip are easy and fast. A range of methods is supported, and all our funding requests were completed without any issues.

TradGrip Minimum Deposit

TradGrip requires a minimum deposit of €250 or equivalent in other base currencies.

Traders only need to maintain the minimum deposit balance in their accounts.

TradGrip Deposit

TradGrip supports a range of payment options, including credit cards and wire transfers, allowing you to choose the method that best suits you.

The broker does not charge any deposit fees, and processed our deposit quickly.

TradGrip Withdrawal

TradGrip allows clients to make withdrawals using the same payment methods as available for deposits.

There are no fees for withdrawal requests; however, for wire transfers, a minimum withdrawal limit may apply due to associated transaction fees, with a minimum amount set at $50.

We did not face any challenges when withdrawing funds.

Markets and Products

TradGrip offers over 250 CFD instruments across various asset classes, including Forex, cryptocurrencies, stocks, commodities, and indices.

Here’s the complete list of TradGrip’s product offering:

| Markets | Instruments |

|---|---|

| Forex | 60 |

| Indices | 20 |

| Stocks | 120 |

| Commodities | 25 |

| Cryptocurrencies | 10 |

The broker offers a standard range of trading instruments, however, it is below industry leaders, who offer thousands of products.

Trading Conditions

The trading conditions at TradGrip are rather good. The broker allows hedging and scalping strategies, and traders can also request to change their leverage via the client area or by contacting support.

| Trading Method | Allowed |

|---|---|

| Hedging | Yes |

| Scalping | Yes |

| Change Leverage | Yes |

Leverage

TradGrip offers traders various leverage levels depending on the instrument, with a maximum of 1:200 considered high leverage.

Traders can also change their account’s leverage levels after registration.

The table below shows the different leverage levels available:

| Markets | Zenith Markets PLC |

|---|---|

| Major Currency Pairs | 200:1 |

| Commodities | 50:1 |

| Indices | 50:1 |

| Stocks | 5:1 |

| Cryptocurrencies | 5:1 |

Bonus

TradGrip’s Gold and Platinum account holders can benefit from reduced spreads and swap discounts.

Gold account holders receive a 40% swap discount and a 50% spread discount, while Platinum account holders enjoy a 60% swap discount and a 75% spread discount.

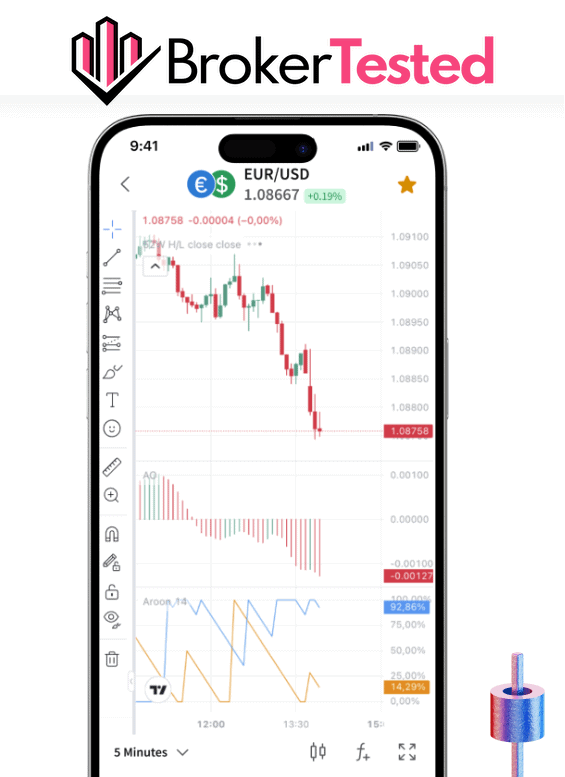

TradGrip Platform

TradGrip offers trading services on its proprietary trading platform available on the web, desktop, and mobile:

- TradGrip WebTrader

- TradGrip App

We found the WebTrader and TradGrip App offer a user-friendly experience with robust charting features and a wide range of functionalities.

Research and Tools

TradGrip offers a range of market research and analysis tools. For technical analysis, the broker integrates TradingView’s charting technology.

Some of the key tools offered by the broker are:

- Good charting tools

- Economic calendar

- Newsfeed

- Trading signals

- Trading indicators

- Drawing tools

- Market analysis

TradGrip broker’s research offering we find relatively limited in our test, but covers most important tools

Education

TradGrip offers a modest educational section. The broker provides an FAQ section to address common trading questions, along with market news updates.

Based on our Test TradGrip Education is limited compared to brokers with comprehensive Education Academy or Trading Schools

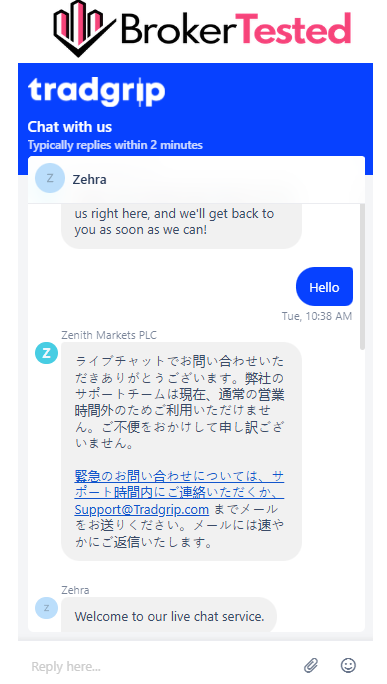

Customer Service

TradGrip provides responsive customer support.

Traders can contact the broker via:

- Live chat

- Phone

- Contact form

The support team is available 24/5, offering assistance in English, Japanese, Hindi, and Portuguese.

Our experience with TradGrip customer support was good.

The chat starts with an automated bot, followed quickly by a live support representative.

| Question | Response Time | Quality of reply | |

|---|---|---|---|

| Live chat | Asked about Forex spreads for the Silver Account | 1-2 minutes | It was fast and accurate. |

Conclusion

Overall, had a decent experience with TradGrip, from the account opening to the deposit and trading process.

TradGrip BrokerTested Review found that the Broker delivers a good trading experience with popular trading instruments, and Forex spreads that are industry-standard or below average.

Our experience with account opening, deposits, and withdrawals was also smooth and without any issues. We got fast responses to our queries via the live chat, so we recommend you approach the support team over live chat.

The only aspects where TradGrip falls below industry standards are its Education and Research quality, as well as its range of instruments, which is more limited compared to the thousands offered by market leaders.

Additionally, the broker is not regulated by a top-tier financial authority, which may be a concern for risk-conscious traders.

We recommend TradGrip to forex traders seeking competitive trading costs built into spread and to those who are comfortable using only the WebTrader platform.

We recommend TradGrip for traders who are

- Beginners

- Experienced traders

- International traders

- Run Scalping

- Hedging

- Use charting technology

TradGrip might not be a fit if you are

- Real Stock / Futures Trading

- Commission-based trading

- Looking for a wider instrument range

- Prefer other platforms like MT4, MT5, cTrader, NinjaTrader

- Seeking comprehensive educational resources

- Need a regulation by a reputable financial authority

Author of this review

By George Rossi

Author of this review

Autor de este análisis

Soy un reconocido analista profesional de los servicios financieros especializado en análisis fundamental y técnico, investigación en macroeconomía global, trader independiente en los mercados de commodities y divisas.

Me apasiona analizar, comparar y generar información y opiniones sobre brokers de Forex.

Todo lo que encuentras en BrokerTested se basa en datos confiables e información imparcial. Combinamos nuestros más de 10 años de experiencia financiera con la retroalimentación de nuestros lectores. Lea más acerca de nuestra metodología

14 replies on “TradGrip Review 2025”

I am having account with TradGrip. Not getting proper support nor getting anything after making withdrwal requests. Regrettable is that I don’t know my account manager name and number.

I am senior citizen with no source of regular income. Please help me to close the account or to seek help of any right person to continue. Thanks 🙏

How did you contact support? Cause I once had an issue with withdrawal and I waited for 2 days for their reply but after that they contacted me apologised for delay and solved my issue with verification. After that I got my withdrawal within a few hours

My experience..Custmor service too late and very los ഞാൻ 3 മാസമായി ഇതിൽ. ഇതുവരെ 7 ട്രേഡ് മാത്രമാണ് ടോട്ടൽ നടന്നത് . വളരെ മൊശം കസ്റ്റമർ സേവനം .

International fraud and Forgery fake company. Don’t believe this company Only Fraud Gangs advertisement. My money loss near Rs 18,600/=on 15-07- 2025. The various froud Gang act according this company in various language, in various STATES. Fraud company

Trade grip is a very useless platform, everyone here makes you deposit by telling lies, that is why I request everyone that if you see a face ad like mine, do not trust it. I was given 200$ by lying It has been done.. I was told that if I deposit 200$ then I will earn a profit of 10$ per day and I have deposited, it has been 3 months and I have not made even 1$ profit. And I am in loss of 200$ Very bad experience

I had a horrendous experience with Tradgrip, particularly with my account manager, Nasreen, and the head of the company, Satish. Both were impolite, unprofessional, and lacked basic customer service skills.

On July 29th, I responded to Nasreen’s email regarding my availability, but I never received any reply. Later, Satish claimed she tried calling me on July 31st—but I never got any voicemail, despite having voicemail set up.

Due to this lack of communication, my account fell 75% below margin. When I informed Satish that I no longer wanted to invest and would close my account unless Tradgrip was willing to contribute funds to recover the margin, he yelled at me, raised his voice, and said I could not blame Tradgrip.

This was not an isolated incident—Nasreen has also been consistently unresponsive and unprofessional. When I opened my account, they promised an account manager would reach out within 24 hours. In reality, it took over a month and multiple follow-ups before anyone contacted me.

Tradgrip’s staff are very friendly before you open your account, but their behaviour changes drastically afterward. Based on my experience, I strongly advise avoiding Tradgrip — their customer service is rude, dismissive, and unreliable.

Hi

Good Morning

I am having Client ID No.618969 with tradgrip. I am trading for the last two months. During this period i have invested nearly $14000 USD. Due to heavy losses incurred i have to close some trading on Brent Oil, Sweet oil due to which i have incurred nearly $ 9000 LOSS. Now My existing balance is $8207.10 as on 23.08.2025. However it is observed that abnormal Swapcharages amounting to Rs.nearly $6000 imposed on RTY cash stock and Brentoil stock. Due to which I am unable to sustain and the balance is showing a loss of $-12741.42 as on 23.08.2025. I request to kindly reduce the SWAP CHARGES to sustain from heavy loss and my free margin is drastically reducing even though most of the funds were infused into the Account.

Hence I request to reduce Or Waive the Swap Charges in my trading account. For which kind of Act, I am evergratefull to you and the management.

Looking for a positive response from your end

Thanking You

Yours faithfully

P. Damodhar

Don’t believe this advertisement. Only Fraud Gangs

நஷ்டம் ஏற்பட்டால் சந்தித்துக்கொள்ளவும் என விளம்பர கண்டிஷன் தெரிவித்துவிட்டு நாம் கட்டிய பணத்தை விழுங்கிவிடுவார்கள். No 1 டுபாக்கூர் கம்பெனி….ஃபிராடு…. எருமைமாட்டைவிடகேவலமானவர்கள். கொலை செய்ய அஞ்சாதவர்கள்.ஏமாந்து பணத்தை கட்டிவிடாதீர்கள். நுனிநாக்கில் ஆங்கிலம் பேசி நமது பாக்கெட்டை காலி செய்துவிடுவார்கள். கேனக்கூதிகள்.பரதேசிகள்.இங்கு வேலை செய்பவர்கள் அனைவரும் காசுக்காக “பீ” கூட தின்ன தயங்காதவர்கள்.என் பணம்ரூ18,600/=காலி. இழந்த நாள் 15-07-2025

These people are calling calling until you open the account and deposit the money. If they are good enough no need of calling automatically it will be populated. After seeing reviews on this page i strictly avoiding this Tradgrip platform.

Don’t invest your valuable money and time in this tradgrip platform.. all are fraud people .. they only need your money .you can’t get back single paisa .. don’t trust these people …..All are cheating persons…

Totally fraud! I lost 3000dollars by investment through tradgrip.com!The brokers are not trustable,they don’t care for investors. I suggest the so called tradgrip.com authourties to punish such persons who are decieving investors !

I’ve been trading for 2 months with this broker. I was investing with small amounts starting with $300 and after $500 and $1000. Within a month a had 10% profit on my account. Conditions are really good for me

May a/no kay hee or pasward no kay