Best Forex Brokers Australia 2025

For this list, we tested over 15 forex brokers with ASIC licenses operating in Australia.

We opened a real account and deposited between $4,000 and $8,000 with each broker. We placed real trades in each popular market to get the real spreads.

We also reached out to customer support to solve issues that we encountered. Finally, we withdrew our funds to see if there is any issue with the withdrawal process.

We handpick the best forex brokers based on our trading data and experience as a trader.

Australian ASIC Regulated Forex Brokers

Forex brokers must be authorized and licensed by the Australian Securities & Investment Commission (ASIC) to operate in Australia. ASIC’s website is asic.gov.au and we suggest investors and traders follow ASIC on Twitter, @ASIC_Connect to get the latest news.

ASIC-regulated brokers are safe to trade as ASIC is a good regulator with a strict measure to protect investors and traders. It has imposed millions of dollars of fines to brokers for not complying with its operational guidelines. In some cases, ASIC even withdrew brokers license and banned directors from working in the industry.

ASIC allows Australian brokers to offer a maximum leverage of 30:1, and all brokers must provide negative balance protection. But the downside is that ASIC does not have any compensation scheme to protect traders if a broker goes bankrupt.

Some of the key highlights of trading with ASIC regulated brokers are:

| 🏦Regulator | Australian Securities and Investments Commission (ASIC) |

| 📊Max. Leverage | 30:1 |

| 🛡️Is It safe to trade | Yes |

| 🔒Negative Balance Protection | Yes |

| 💰Compensation Scheme | No Compensation Scheme |

Best Forex Brokers Australia

To select the best forex brokers, we have tested and reviewed over 15 forex brokers operating in Australia. We opened live accounts and deposited real money. We placed real trades to get the exact picture of the spread and commission, trading platform, deposits and withdrawals conditions, education, and customer service.

- Pepperstone – Best Overall Forex Broker in Australia

- IG – Best Forex Broker for Beginners in Australia

- GO Markets – Best MT4 Broker Australia

- CMC Markets – Best Forex Trading Platform Australia

- Admiral Markets – Lowest Spread & Trading Fees in Australia

Best Overall Australian Forex Trading Brokers

We picked Pepperstone as the overall best forex broker in Australia.

Pepperstone is an excellent broker with a full package of services. The experience of opening a new account is smooth, and it offers 9 deposit and withdrawal methods.

Pepperstone also offers competitive spreads with only 1.15 pips on EUR/USD pair. Trading conditions with the broker are also excellent with no limit in trading strategies. Furthermore, it provides great education and trading tools, including video tutorials, webinars, Autochartist, and many more. The broker also added social trading services recently through Myfxbook and DupliTrade.

Best Forex Broker for Beginners in Australia

We picked IG as the best forex brokers for beginners in Australia.

IG is one of the top global forex brokers operating in Australia with an ASIC license. It is an excellent platform to start with as it provides a ton of educational resources to guide new traders.

IG’s educational guides include detailed articles, infographics, and video explainers. The broker also offers online trading courses and has end-of-course quizzes. For hands-on practice, it offers a demo account to new traders too.

The broker offers trading services with a wide range of asset classes and good trading platforms. It provides an arsenal of market research and analytics tools.

Best MT4 Broker Australia

We picked GO Markets as the best MT4 forex brokers in Australia.

GO Markets is an Australia-headquartered broker with operations around the world. It offers trading on both MT4 and MT5 platforms, which are developed by the MetaQuotes Software.

The broker also offers three account tiers, all on both MT4 and MT5. It offers these industry-standard trading platforms on both desktop and mobile devices.

GO Markets also offers trading with several asset classes, and spreads are also attractive for forex. All in all, it is the best MT4 forex broker in Australia.

Best Online Forex Trading Platform Australia

We picked CMC Markets as the best forex trading platform in Australia.

CMC Markets offers trading with forex, stocks, indices, and other asset classes. But the platform shines even only as a forex trading platform. It offers 339 currency pairs, which is higher than most of the top forex-only platforms.

CMC Markets also offers very attractive spreads. Out testing finds that the average spread on EUR/USD pair on the broker is only 0.7 pips, which the industry average stands at 1.6 pips. It also offers fast execution.

Forex Broker with Lowest Spread and Trading Fees in Australia

We picked Admiral Markets as the Australian forex broker with the lowest spreads and fees.

When it comes to forex spreads, Admiral Markets offers some lowest in the industry. Our testing of the broker finds that the average spread on EUR/USD spread remains 0.6, which is among the lowest in the industry. Spreads on CFDs of indices, stocks, and commodities are also much lower than the industry average.

Admiral Markets charges a trading commission on most accounts, but there is no trading fee on two basic account types. Overall, Admiral Markets is the best lowest spreads and fees broker in Australia.

Australian Forex Brokers List & Review

Besides our best picks above, we also put together a complete list of 16 Australian forex brokers along with our reviews.

| Forex Broker | ASIC Regulated | About Our Test | Our Review |

|---|---|---|---|

| eToro | Yes | Deposit Amount: Over $6,000 Total Trade: 18 trades | eToro Review |

| AvaTrade | Yes | Deposit Amount: Over €4,000 Total Trade: 21 trades | AvaTrade Review |

| Plus500 | Yes | Deposit Amount: Over €6,000 Total Trade: 18 trades | Plus500 Review |

| AXI (AxiTrader) | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | AXI Review |

| XM | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | XM Review |

| Admiral Markets | Yes | Deposit Amount: Over €4,500 Total Trade: 12 trades | Admiral Markets Review |

| FP Markets | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | FP Markets Review |

| FxPro | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | FxPro Review |

| Pepperstone | Yes | Deposit Amount: Over €6,000 Total Trade: 12 trades | Pepperstone Review |

| CMC Markets | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | CMC Markets Review |

| IC Markets | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | IC Markets Review |

| Markets.com | Yes | Deposit Amount: Over €4,500 Total Trade: 12 trades | Markets.com Review |

| Vantage FX | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | Vantage FX Review |

| ThinkMarkets | Yes | Deposit Amount: Over €5,000 Total Trade: 15 trades | ThinkMarkets Review |

| GO Markets | Yes | Deposit Amount: Over €4,500 Total Trade: 12 trades | GO Markets Review |

| Fortrade | Yes | Deposit Amount: Over €5,000 Total Trade: 12 trades | Fortrade Review |

FAQ & More on Australian Brokers

Traders usually have many questions related to trading generic trading-related queries. We tried to pick and answer some of the most important queries related to Australian brokers.

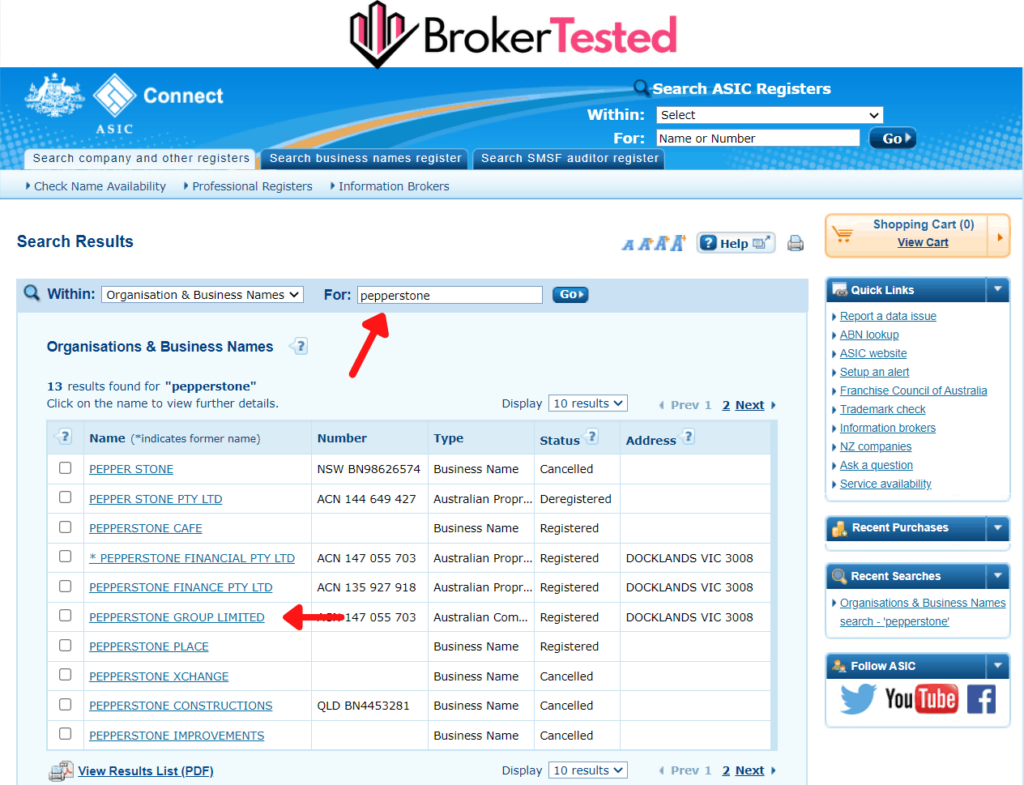

How to Verify an ASIC-Regulated Broker?

The registration details of any ASIC-regulated can be checked on the online registry of the regulator.

Go to https://connectonline.asic.gov.au/ and select the search type from the dropdown menu and type the name of the broker. A list of all the name matches will appear with the relevant licensing details.

How to Compare Australian Forex Brokers?

All Australian forex brokers can be compared using the standard trading metrics like regulatory license, products offered, spreads and fees, deposit and withdrawal options, and a few other parameters.

We have tested several ASIC-regulated brokers based on these parameters and concluded that Pepperstone is the best overall forex broker in Australia.

ECN Forex Brokers in Australia

ECN brokers offer traders direct market access and do not take any positions against the traders. These brokers are often preferred by expert traders for zero or tight spreads and fast execution.

Some of the best Australian ECN traders are:

- Pepperstone

- IG

- IC Markets

- GO Markets

- FP Markets

MT4 Forex Brokers in Australia

MT4 is the industry standard forex and CFD trading platform. It is preferred by both brokers and traders and dominates the trading industry, in terms of trade volume execution.

Though many brokers started to offer an alternate trading platform, MT4 remains the primary one for most of them.

Some of the MT4 Top Australian Forex Brokers are:

- GO Markets

- XM

- Markets.com

- ThinkMarkets

- IC Markets

High Leverage Forex Brokers in Australia

From March 2021, ASIC set maximum leverage of 30:1 on CFDs for all regulated brokers. To access trading high leverage trading like 400:1 or 500:1, Australian traders need to be eligible to apply as professional traders or trade with a broker from New Zealand, like BlackBull Markets.

Lowest Spread Forex Broker in Australia

Spreads charged by the brokers remain the making or breaking factor to get clients. If the brokers charge too high spreads, traders will go to other platforms, and if the spreads are too low, along with no commission, then it would be hard to sustain the business.

Some of the Australian brokers with the lowest spreads are:

- Admiral Markets

- CMC Markets

- AvaTrade

- Plus500

- Markets.com

Australian Forex Brokers Offer Micro/Cent Account

Micro/Cent account generally means the brokers calculate the trading account balance instead of dollars. Though most of the brokers do not promote themselves as micro/cent account brokers, they usually offer such services for standard retail clients.

Swap Free Forex Brokers in Australia

Swap-free is the option of offering trading services without any fees. These accounts are considered Halal under Islamic Sharia Law as traders are not trading on commission-basis or paying any roll-over charges.

Some of the ASIC-regulated brokers offering swap-free accounts are:

- IC Markets

- ThinkMarkets

- VantageFX

- Pepperstone

- AXI (AxiTrader)

Australian Regulated CFD Brokers

CFDs are described as agreements between buyers and sellers of financial derivatives settled in cash upon closing. CFDs traders only bet on the price movements; they never own assets.

Australian financial markets require CFD brokers to be properly regulated and licensed. Actually, the market is on the rise and at the moment it has over 710,000 active traders. Due to ASIC, CFD traders are mostly protected from losses by stringent regulations.

The most popular Australian regulated CFD brokers are:

- IC Markets

- Plus500

Tax in Australia for Forex Trading

In Australia, forex trading is a legitimate income source. Consequently, profits gained from forex trading are subject to taxation. The tax amount in Australia generally depends on how much was the overall gain of the year. Taxes usually comprise 23% of the gains. However, the taxes are applied if the trader proved to be profitable within the tax year.

Traders should remember, that it is their responsibility to pay taxes. Any avoidance or delay in paying can lead to fines. So, forex traders are recommended to follow all the rules and regulations on taxation.

Author of this review

By George Rossi

Author of this review

I am a well-rounded financial services professional experienced in fundamental and technical analysis, global macroeconomic research, foreign exchange and commodity markets and an independent trader.

Now I am passionate about reviewing and comparing forex brokers.

Everything you find on BrokerTested is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology