Trading 212 Review 2025

For this Trading 212 review, we opened a real account and made a total deposit of over EUR 5,500.

We traded the popular instrument in each market to determine the average spread charged and we placed a total of 15 trades.

We also reached out to the broker’s customer support team to resolve the issues we encountered.

Finally, we withdrew all our funds to identify if there are any delays or issues with withdrawals.

What is Trading 212

Trading 212 is a global Forex and CFD broker, founded in 2004. The broker is headquartered in London and is regulated by the UK Financial Conduct Authority (FCA) and by the Bulgarian Financial Supervision Commission (FSC).

Some of the highlighted features of Trading 212 are:

| 🗺️ Authorised & Regulated in | UK & Bulgaria |

| 🛡️ Is Trading 212 safe | Yes |

| 💰 EUR/USD Spread | 1.37 |

| 💳 Minimum deposit | US$1 |

| 💰 Withdrawal fee | US$0 |

| 🖥️ Trading Platform | Trading 212’s custom Trading Platform |

| 📈 Markets offered | Indices, Forex, Commodities, Stocks, Cryptocurrencies |

| 📉 Number of Products | 2,029 |

Licenses and Regulations

Trading 212 has 2 licenses globally including a top-tier license from the UK’s Financial Conduct Authority (FCA).

Here is the full list:

| Legal entity | Registered in | Regulator | License Number | Accepting clients from | Compensation Scheme Amount |

|---|---|---|---|---|---|

| Trading 212 UK Ltd | United Kingdom | Financial Conduct Authority (FCA) | 609146 | Globally (many countries) | £85,000 |

| Trading 212 Ltd | Bulgaria | Financial Supervision Commission (FSC) | RG-03-0237 | Globally (many countries) | €20,000 |

Is Trading 212 Safe

Yes, it is safe to trade. Trading 212 is regulated by two financial authorities globally, including a top-tier one. We did not encounter any issues in the trading and withdrawal process during our test.

FCA

For this review, we opened a CFD account with Trading 212 UK Ltd which is one of theFCA regulated forex brokers in UK in which we deposited money so as to run our tests.

We recommend that you open your account with the UK entity if it’s available to you since we consider regulation by the FCA as being the best given that it offers investor compensation of up to £85,000 in case the broker goes bankrupt.

Fees and Commissions

Trading 212’s CFD Account charges zero commissions on trades but with a spread.

Spread Charged in our Trades

We did blindly trust the spreads quoted on Trading 212’s website. The spreads listed here were actually charged on the live trades we made through our funded account.

In our test, we chose the most popular instrument in each market since we can’t test all 2,029 instruments. We placed 3 trades for each instrument to get a complete picture of the average spread. Overall, the spread is stable, as seen in our test results shown below.

Test Spread

| Markets | Instruments | 1st trade | 2nd trade | 3rd trade | Avg. spread |

|---|---|---|---|---|---|

| Forex | EUR/USD | 1.4 | 1.3 | 1.4 | 1.37 |

| Indices | FTSE 100 | 1.8 | 3.3 | 2.3 | 2.47 |

| Commodities | Gold | 10.5 | 5.4 | 6.5 | 7.47 |

| Stocks | Apple | 1.8 | 1.5 | 1.8 | 1.70 |

Comparing the spreads charged in our trades to the industry benchmark, we found the spreads for the FTSE 100 and Gold to be quite high. However, the spreads charged on FX and stock trades were in-line with industry trends, especially the spreads for stock trades which are much lower than the industry average.

| Markets | Instruments | Avg. spread | Industry avg. spread |

|---|---|---|---|

| Forex | EUR/USD | 1.37 | 1.16 |

| Indices | FTSE 100 | 2.47 | 1.65 |

| Commodities | Gold | 7.47 | 3.53 |

| Stocks | AAPL | 1.70 | 1.75 |

App Review

We traded through Trading 212’s mobile app and recorded videos of the trades. You can see this here.

Video of our trading

Other fees

Trading 212 does not charge other non-trading fees such as account inactivity fees, deposit & withdrawal fees.

Account types

Trading 212 offers 2 account types which are the Invest and CFD accounts.

Invest vs CFD Account

See the differences between the 2 accounts below

| Invest | CFD | |

|---|---|---|

| Minimum Deposit | $1 | $1 |

| Real Stocks & ETFs | 6,500+ | 0 |

| CFDs & FX Pairs | 0 | 2,029 |

| Commissions | $0 | $0 |

For our test, we chose to open a CFD Account.

Account opening

Trading 212 account opening is fully digital, fast and straightforward. Below are the 6 steps to opening a Trading 212 account:

- Enter your name, nationality, phone number, date of birth, Passport/National ID number.

- Input your residential address, the country where you pay your taxes, and tax ID,

- Choose your account type and currency.

- Answer a few questions about your annual income, the value of savings and investments, and source of your deposited funds.

- Provide your employment status, occupation and industry of business.

- Verify your identity by taking a selfie with your Passport, driver’s license or identity card.

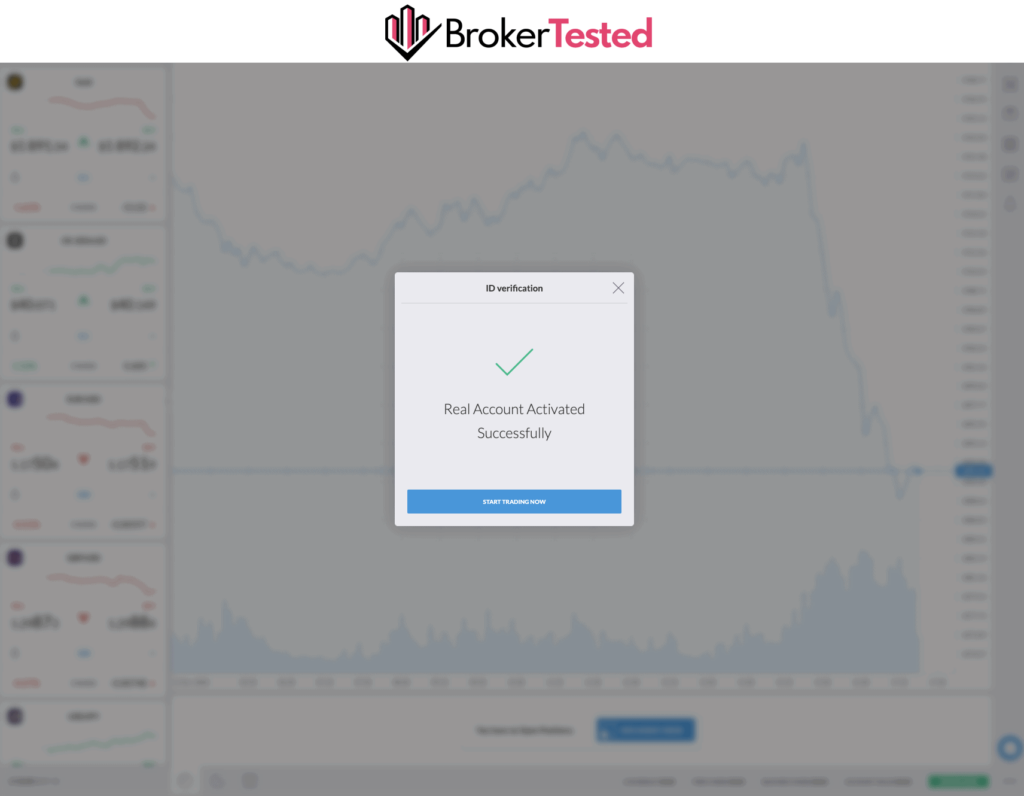

In our test, it took 2 working days to open and verify our account. The registration took only 16 mins to complete.

In the account verification, we were asked to take a selfie to compare it to our document for identity verification. Our account was verified and allowed to deposit and trade after the ID verification. However, the address proof came after we made our first deposit.

Account Verification

We video recorded our account opening. See the video below

video of our account opening

Deposit and Withdrawal

Trading 212 offers free and fast deposits and withdrawals. The broker provides multiple options for funding your account, including bank wires, credit and debit cards, as well as e-wallets such as Skrill, and PayPal.

Minimum deposit

Trading 212 requires a minimum deposit of $1 for bank transfers, credit/debit cards, Skrill and Paypal.

Deposit

In regards to the deposit, we tested 3 payment methods available to fund our account. Debit card, Skrill and Paypal deposits reflect instantly in your trading account with zero fees, which is why we recommend them. The funding times and fees are as follow

| Payment Method | Submitted Day | Funded Account Date | Funding Time | Fee |

|---|---|---|---|---|

| Skrill | 2023-01-22 | 2023-01-22 | Instant | zero |

| Credit card | 2023-01-22 | 2023-01-22 | Instant | zero |

| PayPal | 2023-01-22 | 2023-01-22 | Instant | zero |

Withdrawal Review

And about withdrawals, we made deposits via PayPal, debit card, and Skrill. However, when it came to processing our withdrawals, the broker combined our two separate withdrawals into one payment, which we received via PayPal. Hence, we were unable to test withdrawals back to our debit card.

| Payment Method | Submitted Day | Funds Released Date | Funds Arrived Date | Withdrawal Time | Fee |

|---|---|---|---|---|---|

| Skrill | |||||

| Credit card | 2023-01 -29 | 2023-02-02 | 2023-02 -22 | 3 Working days | zero |

| PayPal | 2023-01 -29 | 2023-02 -02 | 2023-02 -22 | 3 Working days | zero |

Markets and Products

Trading 212’s CFD account offers the following instruments to traders, which are indices, commodities, Forex pairs, stocks, and cryptocurrencies.

Options

Some popular asset classes, such as ETFs, mutual funds, bonds and options, also spread betting are missing.

| Markets | Instruments |

|---|---|

| Forex | 184 |

| Indices | 57 |

| Commodities | 118 |

| Stocks | 1661 |

| Cryptocurrencies | 9 |

Trading Conditions

The trading conditions at Trading 212 are okay. High-risk strategies such as scalping and using EAs are prohibited. However, hedging strategies are allowed.

| Trading Method | Allowed |

|---|---|

| Hedging | Yes |

| Scalping | No |

| Change Leverage | No |

Leverage

Trading 212 offers 1:2 to 1:30 leverage to retail clients.

| Markets | Trading 212 UK Ltd | Trading 212 Ltd |

|---|---|---|

| Major Currency Pairs | 30:1 | 30:1 |

| Non-major Currency Pairs | 20:1 | 20:1 |

| Gold | 20:1 | 20:1 |

| Major Indices | 20:1 | 20:1 |

| Non-major Equity Indices | 10:1 | 10:1 |

| Other Commodities (except Gold) | 10:1 | 10:1 |

| Stocks | 5:1 | 5:1 |

| Cryptocurrency | 2:1 | 2:1 |

You cannot change your account’s leverage level.

Trading Platform

Trading 212 offers proprietary web and mobile trading platforms as the only trading platforms. The broker does not offer the popular MetaTrader 4 & 5 (MT4 platform & MT5 platform) platforms. Therefore, traders interested in using the two platforms may have to go with a different broker.

In our tests, we placed trades via the broker’s mobile platform, which was quite intuitive.

Research and Tools

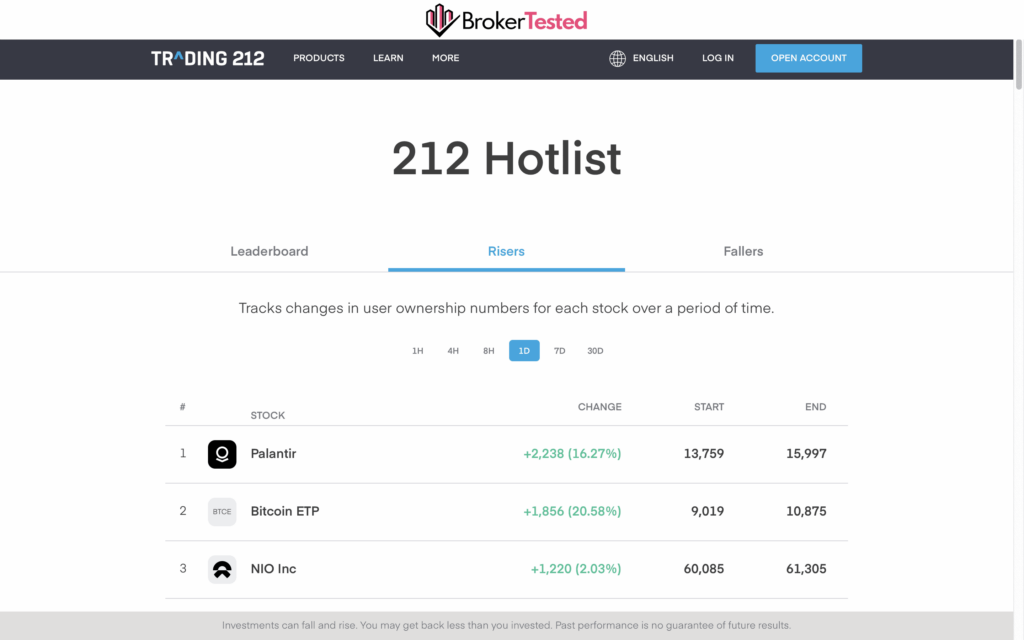

Trading 212 has excellent charts loaded with many functions that make it easy for traders to plan their trades. The broker also provides a detailed economic calendar for traders, which is a great feature. However, its market analysis and news features are not as detailed as those of its peers. The broker also provides the 212 hotlists showing how many traders own a particular stock.

- Excellent charts

- News

- Economic calendar

- Analysis

- 212 hotlist

Education

We found Trading 212’s educational resources, especially the video tutorial course, to be some of the best in the industry given the easy-to-understand format in which the material is presented.

The broker offers:

- Text and video tutorials

- Educational articles

- A demo account

Customer service

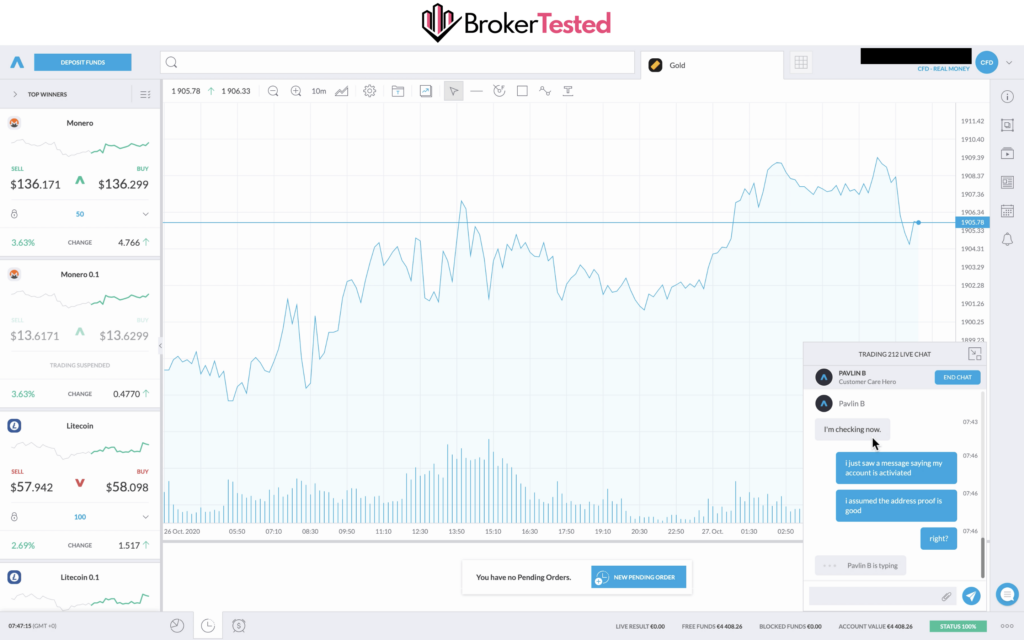

Trading 212 provides 24/7 customer service and their agents give very relevant answers. You can reach their support team via the live chat function, email and phone calls. However, our phone calls went unanswered.

You can contact Trading 212 via Email, Live Chat, and Phone calls. See our test below

| Question | Answer | Response Time | Quality of reply | |

|---|---|---|---|---|

| Live Chat | Proof of address | Resolved | Instant | Excellent |

| Change leverage | Resolved | Same day | Satisfactory |

Conclusion on Trading 212 Broker

Our overall experience with Trading 212 was smooth, and we found it safe to trade with given that the top-tier FCA regulates it.

On the plus side, we liked the broker’s educational materials, which are some of the best we have seen, especially their video tutorials. We also liked the huge selection of actual stocks available to trade combined with the low spreads on stock trades

Trading 212 has some drawbacks, though. We found the spreads on the FTSE index and Gold to be quite high, and the lack of the MetaTrader 4 & 5 platforms means that MT4 & MT5 traders might have to find another broker.

We recommend Trading 212 for traders who are

- Beginners in trading

- Experienced traders

- Trading currency pairs or CFD stocks

Trading 212 might not be a fit if you are

- Scalping trader

- EA trader

- Trading through MT4/MT5 platform only

- Trading gold or indice

Author of this review

By George Rossi

Author of this review

I am a well-rounded financial services professional experienced in fundamental and technical analysis, global macroeconomic research, foreign exchange and commodity markets and an independent trader.

Now I am passionate about reviewing and comparing forex brokers.

Everything you find on BrokerTested is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology