For this Capital.com review, we have opened a standard account with the broker and deposited over €3,500.

We traded the popular instrument in each market to get the real spreads and placed a total of 15 trades.

We also reached out to customer support to solve the issues we faced.

Finally, we withdrew our funds to see if there are any issues with the withdrawal process.

What is Capital.com

Capital.com is a forex and contracts for differences (CFDs) broker with headquarter in London, the United Kingdom. The broker was founded in 2016.

Offerings of Capital.com include trading services with forex, indices, commodities, cryptocurrencies, and stock CFDs. It also offers spread betting in the UK and Ireland.

The broker is well-regulated with licenses in the United Kingdom, Cyprus, and Belarus.

Some of the highlights of Capital.com are:

| 🗺️ Authorised & Regulated in | UK, Cyprus, Belarus |

| 🛡️ Is Capital.com safe | Yes |

| 💰 EUR/USD Spread | 0.8 |

| 💳 Minimum deposit | $20 |

| 💰 Withdrawal fee | 0 |

| 🖥️ Trading Platform | MT4, Mobile App |

| 📈 Markets offered | Forex, Indices, Stocks, Commodities, Cryptocurrencies |

| 📉 Number of Products | 3720(depends on the jurisdiction) |

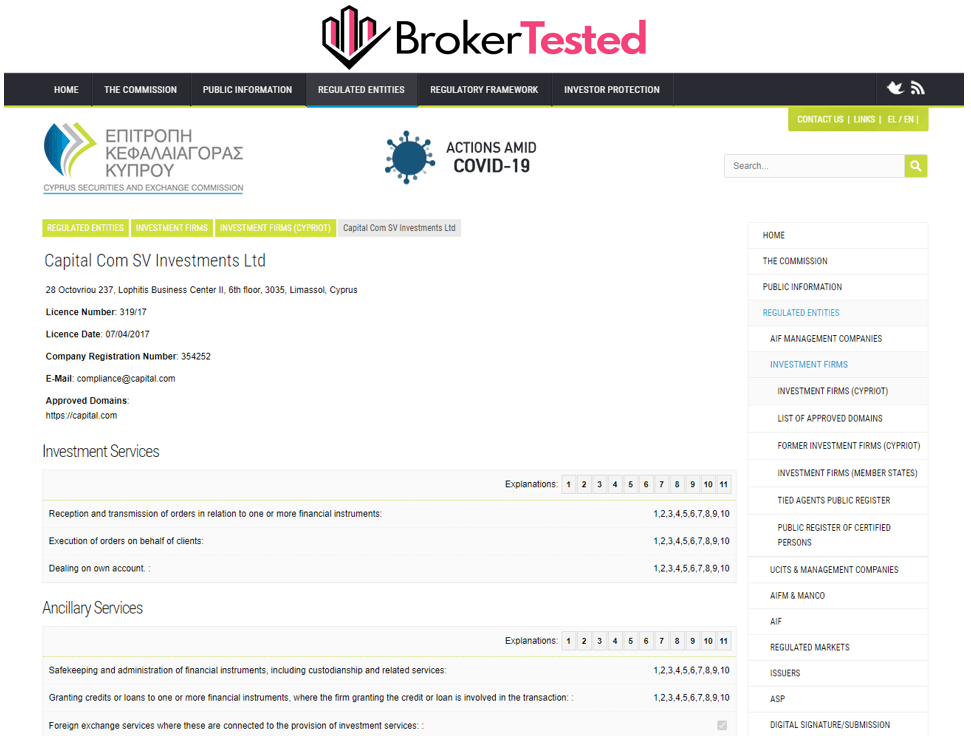

Licenses and Regulations

Capital.com holds 3 regulatory licenses.

The broker is regulated in the United Kingdom, Cyprus, and Belarus.

The full list of Capital.com’s licenses is below:

| Legal entity | Registered in | Regulator | License number | Accepting clients from | Compensation scheme amount |

|---|---|---|---|---|---|

| Capital Com (UK) Limited | United Kingdom | Financial Conduct Authority (FCA) | 793714 | United Kingdom | £85,000 |

| Capital Com SV Investments Limited | Cyprus | Cyprus Securities and Exchange Commission (CySEC) | 319/17 | European Union | €20,000 |

| Closed joint-stock company “Capital Com Bel” | Belarus | National Bank of the Republic of Belarus (NBRB) | 193225654 | Global | No compensation scheme |

Is Capital.com a scam or legit?

Yes, Capital.com is a safe broker for trading from a regulatory standpoint.

The broker is regulated in 3 jurisdictions. The UK’s FCA is one of the most reputed regulators and also offers a compensation scheme of up to £85,000. Additionally, the clients under the CySEC-regulated entity receive a compensation scheme of €20,000 for the protection of their funds.

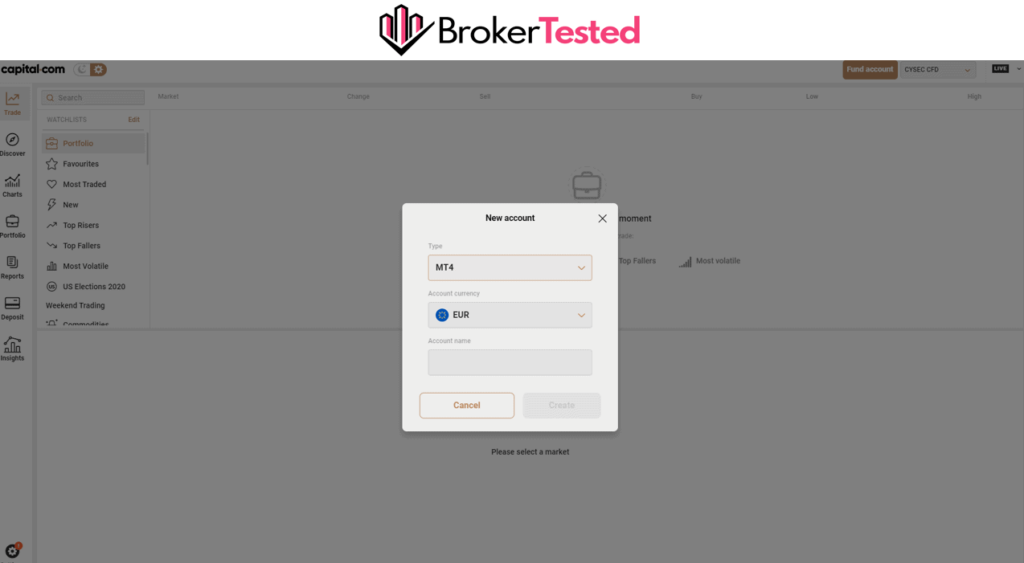

For our tests, we opened a Standard account on the MT4 platform with Capital Com SV Investments Limited which is regulated by CySEC in Cyprus.

Capital.com Fees and Commissions

Capital.com’s fees are built into spreads.

Spreads on our forex trades were much lower than the industry average benchmark. However, spreads charged for stocks and cryptocurrency trades are significantly higher than the industry benchmark.

Spread Charged in Our Trades

For our tests, we have chosen popular instruments in each market. We placed 3 trades for each instrument to get a picture of the average spread.

Spreads for our trades in all asset classes remained stable, much like fixed spreads. We only recorded variations in commodity spreads.

Details of our trades are shown below the table.

| Markets | Instruments | 1st trade | 2nd trade | 3rd trade | Avg. spread |

|---|---|---|---|---|---|

| Forex | EUR/USD | 0.8 | 0.8 | 0.8 | 0.8 |

| Indices | FTSE 100 | 1.4 | 1.4 | 1.4 | 1.4 |

| Stocks | Apple | 8.3 | 8.3 | 8.3 | 8.3 |

| Commodities | Gold | 2.8 | 3.3 | 3.25 | 3.12 |

| Cryptocurrencies | Bitcoin | 154 | 154 | 154 | 154 |

Our testing finds that forex spreads Capital.com is much lower than the industry average. Spreads on indices and gold are also on the lower side. However, spreads charges on stocks and cryptocurrency traders are too high.

| Markets | Instruments | Avg. spread charged in our trades | Industry avg. spread |

|---|---|---|---|

| Forex | EUR/USD | 0.8 | 1.16 |

| Indices | FTSE 100 | 1.4 | 1.65 |

| Stocks | Apple | 8.3 | 1.75 |

| Commodities | Gold | 3.12 | 3.53 |

| Cryptocurrencies | Bitcoin | 154 | 72.81 |

Other Fees

Capital.com has minimum non-trading fees. The broker does not charge any deposit or withdrawal fees. Further, there are no inactivity or account maintenance fees either.

Account Types

Capital.com offers three types of accounts to retail traders

| Standard Account | Plus Account | Premier Account | |

|---|---|---|---|

| Trading Platforms | MetaTrader 4, Capital.com App | MetaTrader 4, Capital.com App | MetaTrader 4, Capital.com App |

| Account Currency | USD, EUR, GBP, PLN | USD, EUR, GBP, PLN | USD, EUR, GBP, PLN |

| Minimum deposit | $20 | $3,000 | $10,000 |

| Commission | None | None | None |

| Order execution | Instant Execution | Instant Execution | Instant Execution |

| Spread | From 0 | From 0 | From 0 |

Capital.com also onboards professional clients, offering them higher leverage levels.

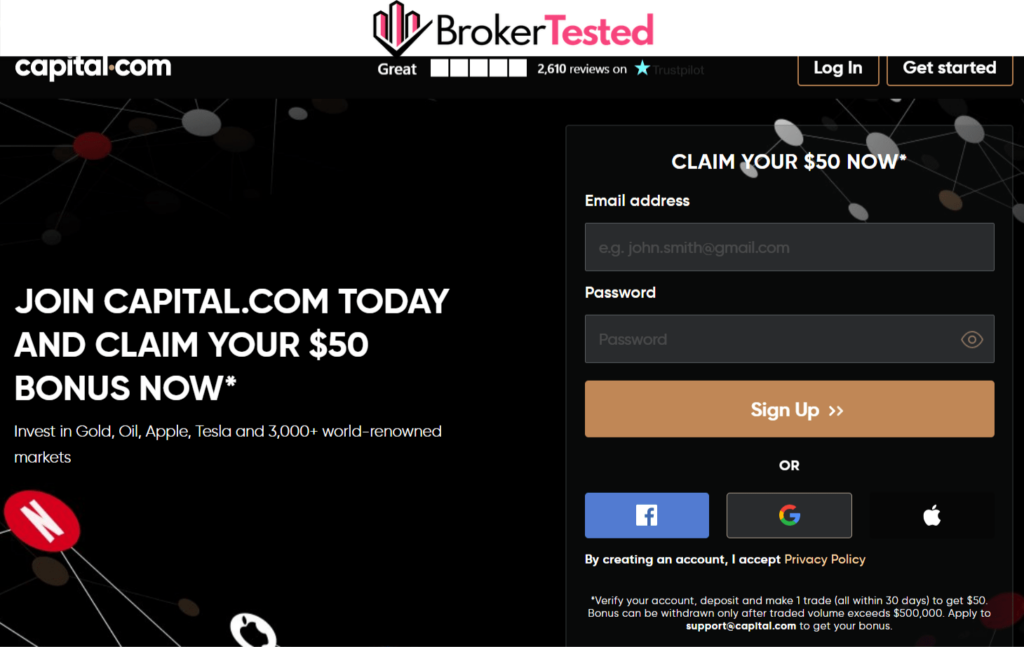

Account Opening

Our overall experience of opening a new account with Capital.com was smooth and quick.

We opened a Capital.com Standard Account for our tests under the Cyprus-regulated entity.

The process of registration of a new Capital.com account:

- Enter email and password on the initial registration page (traders can also register using Google, Facebook, or Apple account)

- Provide personal details like country of residence, nationality, and place of birth.

- Provide details on trading experiences like duration of trading and financial instruments traded, among others.

- Enter details of formal education and employment status. Also declare the annual income, source of income, wealth, and amount of annual expected investment.

- Answer a few questions on trading knowledge.

- Enter personal details like name, middle name, surname, residential address, and phone number. Also, select account currency and patent method.

We submitted the following documents to verify our Capital.com account:

- Copy of national identification (both front and back)

- Copy of passport

The registration process took around 16 minutes. Our account was verified on the same day.

Our account was registered on Februrary 17, 2023, and approved on the same day.

Our overall account opening experience was smooth and without any issues from registration to verification.

Deposit and Withdrawal

Both deposits and withdrawals on Capital.com are easy and fast.

The broker does not charge any fees on deposits and withdrawals

Minimum Deposit

Minimum deposits on Capital.com vary with the account type.

- Standard account: $20

- Plus account: $3,000

- Premier account: $10,000

For deposits via bank transfer, Capital.com requires a minimum deposit of $250.

Deposit

Capital.com supports deposits with bank transfers, credit and debit cards, and payment platforms like Sofort, iDeal, Giropay, Multibanko, Przelewy24, QIWI, Webmoney, ApplePay, Trustly, 2c2p, or AstropayTEF.

We tested the deposit process on Capital.com only using a debit card. We were disappointed with the lack of support for popular eWallets like PayPal, Skrill, or Neteller.

Details of our fund deposits are shown in the below table.

| Payment Method | Submitted Date | Funded Account Date | Funding Time | Fee |

|---|---|---|---|---|

| Debit card | 2023-02-26 | 2023-02-26 | Instant | 0 |

Capital.com Withdrawal

Capital.com allows withdrawals with bank transfers, credit and debit cards, and other methods that are supported for deposits.

Overall, our experience with the Capital.com withdrawal process was positive, but we faced an issue with our first withdrawal request.

Details of our withdrawal requests are in the table below.

| Payment Method | Submitted Date | Fund Released Date | Fund Arrived Date | Withdrawal Time | Fee |

|---|---|---|---|---|---|

| Debit card | 2023-02-27 | Declined | NA | NA | NA |

| Debit card | 2023-02-27 | 2023-02-29 | 2023-02-29 | 2 working days | 0 |

We submitted our first withdrawal request on 27th December but received an email from Capital.com saying that our withdrawal was declined.

On inquiry, the broker’s support team suggested us to try and submit a withdrawal request again or they will process the withdrawal using bank transfer.

We insisted to withdraw the funds to our debit card and initiated a second withdrawal request. Capital.com finally realeased our fund and we received it on December 29.

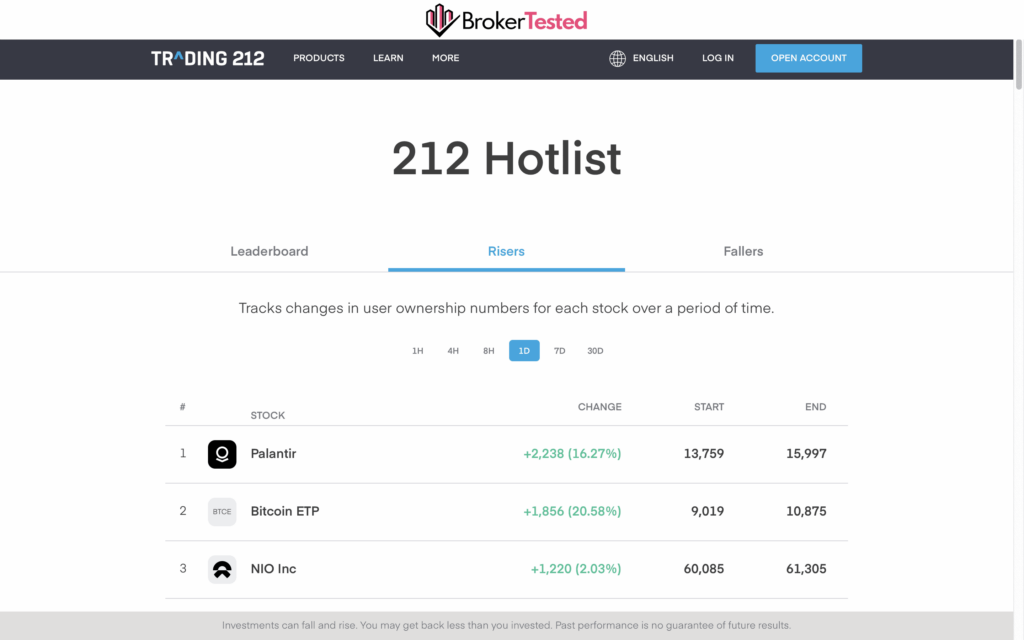

Markets and Products

Capital.com offers CFDs trading services with forex, indices, stocks, commodities, and cryptocurrencies. The FCA regulated entity does not offer cryptocurrency instruments.

The complete list of Capital.com offerings are:

| Markets | Instruments |

|---|---|

| Forex | 138 |

| Indices | 27 |

| Stocks | 3,278 |

| Commodities | 38 |

| Cryptocurrencies | 239 |

The markets and the number of offered instruments will depend on the account jurisdiction.

Trading Conditions

Capital.com offers excellent trading conditions. The broker allows hedging and scalping strategies and traders can change leverage levels as well.

| Trading Method | Allowed |

|---|---|

| Hedging | Yes |

| Scalping | Yes |

| Change Leverage | Yes |

Leverage

Leverages offered by the various entities of Capital.com are detailed below:

| Markets | Capital Com (UK) Limited | Capital Com SV Investments Limited | Closed joint-stock company “Capital Com Bel” |

|---|---|---|---|

| Major Currency Pairs | 30:1 | 30:1 | 100:1 |

| Non-Major Currency Pairs | 20:1 | 20:1 | 100:1 |

| Gold | 20:1 | 20:1 | 100:1 |

| Other Commodities (except Gold) | 10:1 | 10:1 | 100:1 |

| Indices | 5:1 | 5:1 | 100:1 |

| Stocks | 5:1 | 5:1 | 5:1 |

| Cryptocurrencies | NA | 2:1 | 5:1 |

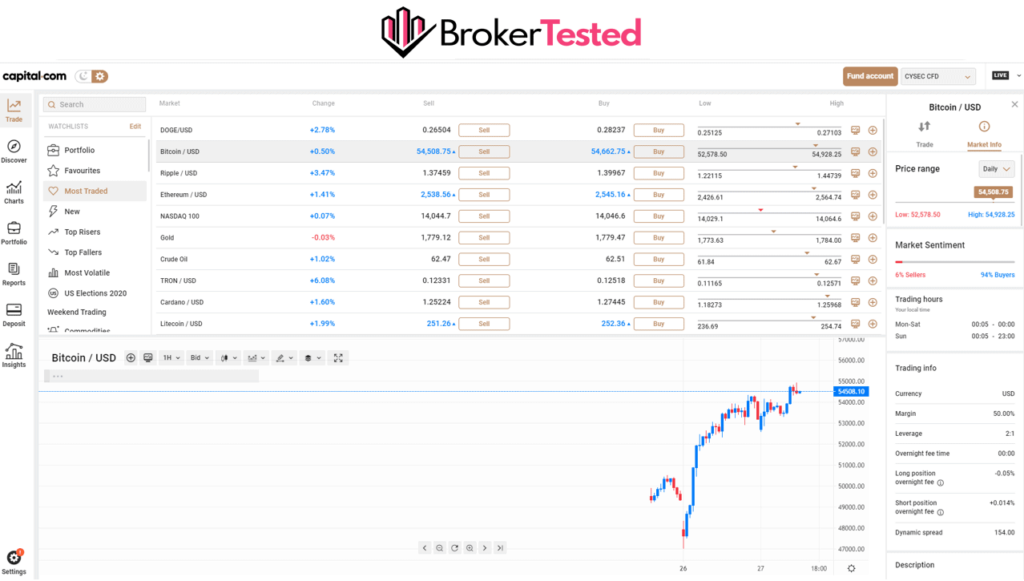

Trading Platform

Capital.com offers the two trading platforms:

- Capital.com trading app (the brokers proprietary platform)

- MetaTrader 4 (an industry-standard third-party trading platform)

MetaQuotes Software-developed MetaTrader 4 is available on desktop, web, and mobile, while Capital.com trading app is available on the web and mobile platforms.

We executed all our trades on the MetaTrader 4 trading platform.

Capital.com App Review

Capital.com Bonus

Capital.com’s Belarus-registered entity offers a $50 bonus to new traders.

| Maximum payout | $50 |

| Minimum deposit | The minimum deposit is based on account type |

| Requirements | Bonus can be withdrawn only after traded volume exceeds $500,000 |

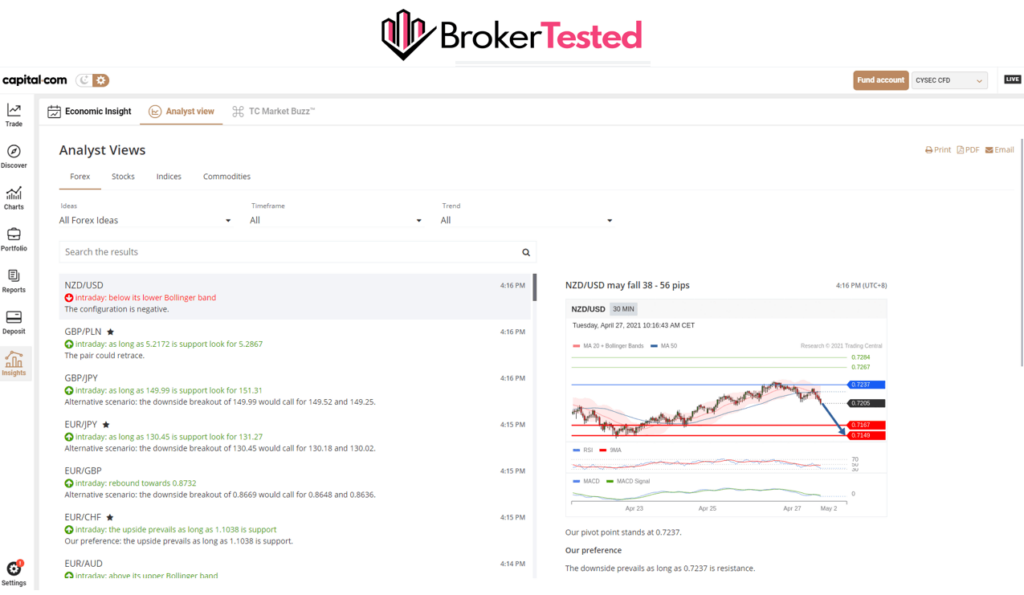

Research and Tools

Capital.com offers excellent tools for market research and analysis.

Tools offered by the broker include:

- Impressive charting tools

- Economic calendar

- Trading ideas via Trading Central

- Newsfeed

Education

Capital.com offers exceptional educational resources.

The broker’s educational materials only include:

- Detailed courses on trading

- Video guides on trading

- In-depth articles trading and platforms

- Webinars

- Glossary

- Demo account

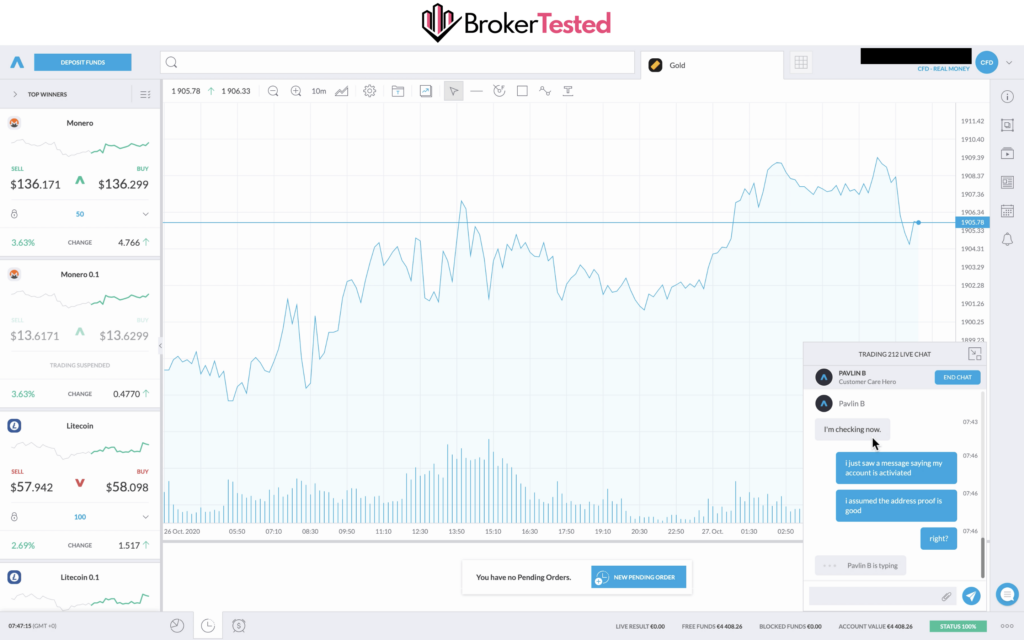

Customer Service

Capital.com offers decent customer support.

Traders can contact the broker via:

- Live chat (also on WhatsApp, Telegram, Facebook Messenger or Viber)

- Phone

The support staff is available 24/7.

Our experience with Capital.com customer support was mixed.

Though most of the time the support staff responded quickly with accurate answers, some of our questions went unanswered.

| Question | Response Time | Quality of reply | |

|---|---|---|---|

| Live Chat | Asked several questions on trading platforms, deposits, and withdrawals | 1-2 minute | Clear and accurate |

| Live Chat | We couldn’t log in to our client portal. There was a pop-up window saying we need to contact their support team. | 10 minute | Late, but accurate |

| Asked questions on withdrawal fees and also issues with our first withdrawal request | 2 hours | Clear and detailed | |

| Asked why they haven’t released our withdrawal fund even after more than 24 hours | No reply | NA |

When we first tried to withdraw funds, the withdraw button on the client portal page wasn’t clickable and our balance was showing in negative, which wasn’t correct.

We approached customer support and the glitch was fixed the next day. However, we did not receive any notification from Capital.com after the fix.

The broker also has a detailed FAQ section for frequently faced issues.

Conclusion

Our overall experience with Capital.com was positive.

The spreads charged on our forex trades were much lower than the industry average, but it was too stable. However, spreads on stocks and cryptocurrencies were high.

Capital.com allows hedging and scalping. Traders can also change the leverage levels.

The broker does not charge fees for deposits or withdrawals, but payment methods are limited. The customer support was also good and most of the responses were clear and detailed.

We recommend Capital.com to forex traders who run EA and other trading strategies.

We recommend Capital.com for traders who are

- Trading Cryptocurrency

- Trading Stocks

- Scalping trader

- MT4 Trading

- EA trader

Capital.com might not be a fit if you are

- Futures Trading

- Commission based trading